How Does the Greek Debt Crisis Impact the Eurozone?

Greece’s debt was around 250 billion euros. It’s nearly 175% of its 2013 GDP figures. The GDP could fall more in 2016. The debt crisis started in 2010.

Dec. 28 2015, Updated 2:06 p.m. ET

Greek debt crisis

Greece’s debt was around 250 billion euros. It’s nearly 175% of its 2013 GDP (gross domestic product) figures. The 2016 estimates also indicate that the GDP could fall more. The debt crisis started in 2010. It left Greece with soaring debt and an unemployment rate in recent years. The IMF (International Monetary Fund) and the EU extended the bailout. The extension has the conditions of stiffer austerity reforms, an end of tax evasion, and a new framework to enhance business activities in Greece. Most of Greece’s bailout package will pay off international debt. So, the government has little to invest in the new economic reforms.

Grexit and the Eurozone

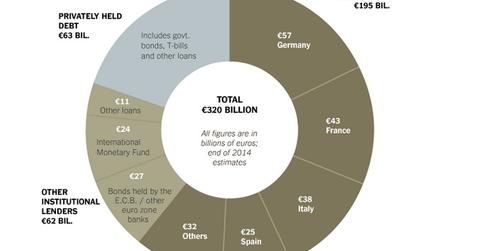

The Grexit can impact the EU’s (European Union) credibility (EZU). Experts suggest that Greece’s exit could create risk in the global financial system. The Greek debt crisis left the EU in a difficult situation. It can allow Greece to exit or it can accept Greece’s soaring debt. Moreover, member countries like Germany (EWG), France (EWQ), Italy (EWI), Spain, and others have to finance the bailout package apart from the IMF. Financial institutions like Deutsche Bank (DB), Banco Santander (SAN), and Unicredit (UNCFF) are impacted by the Greece debt crisis.

The Economist indicates that the divergence between the fiscal and monetary policy in the EU is one of the causes of the Greece debt crisis. The above graph shows the details of Greece creditors. The migrant crisis is also hitting the EU hard because of the geographical closeness to Syria.

In the next part, we’ll discuss the United Kingdom’s possible exit from the Eurozone.