Union Bankshares Inc

Latest Union Bankshares Inc News and Updates

Should You Look to European Stocks for Growth?

European stocks began the year with a lot of hope pinned on them for providing capital appreciation in the year.

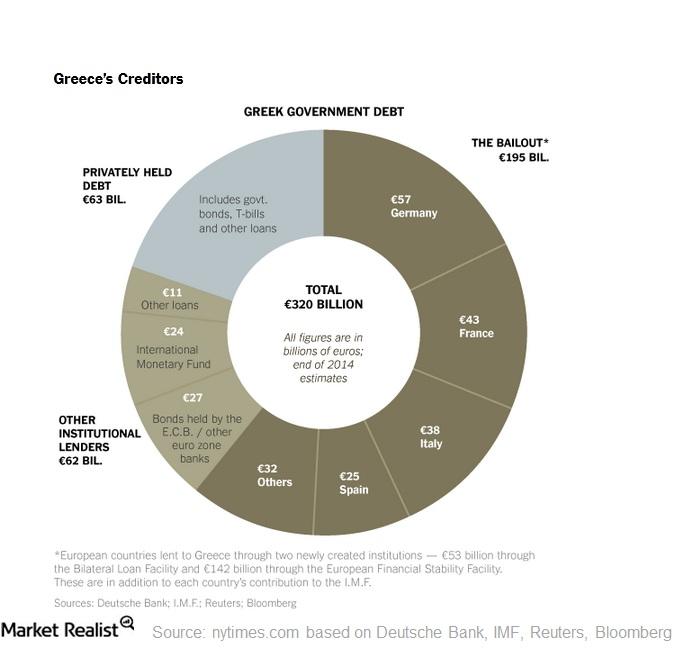

How Does the Greek Debt Crisis Impact the Eurozone?

Greece’s debt was around 250 billion euros. It’s nearly 175% of its 2013 GDP figures. The GDP could fall more in 2016. The debt crisis started in 2010.