iShares MSCI Italy ETF

Latest iShares MSCI Italy ETF News and Updates

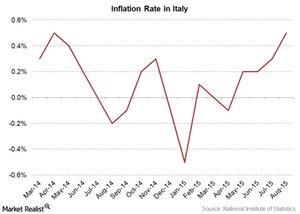

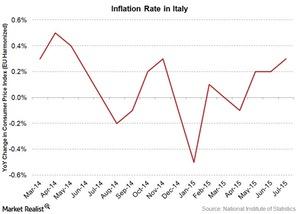

Italy’s Inflation Rate Rose in August: EWI Fell 0.40%

According to the August 31 release by the ISTAT, the EU’s harmonized inflation rate in Italy rose to an impressive 0.50% in August on a YoY (year-over-year) basis.

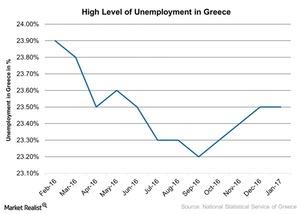

Greece’s Unemployment Falls, but Still the Highest Among Peers

Europe’s average unemployment has fallen to a four-year low of 9.8% as of 2016. Greece’s seasonally adjusted unemployment rate was 23.5% in January 2017.Financials Must-know: What caused the Greek, Irish, and Spanish debt issues?

Tourism revenues—a key revenue component for all these countries—declined substantially because foreign tourists stayed away during the aftermath of the Great Recession. Key industries were also affected—notably cyclical industries like shipping.

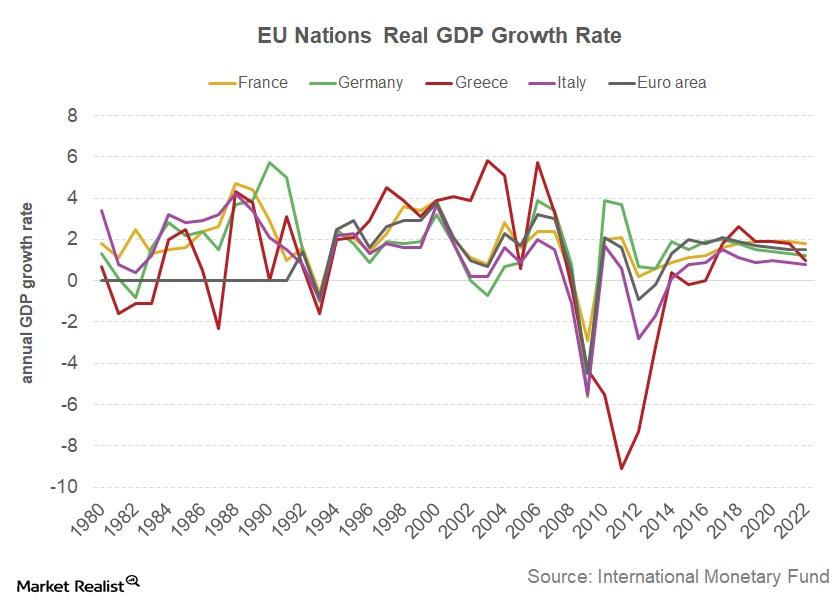

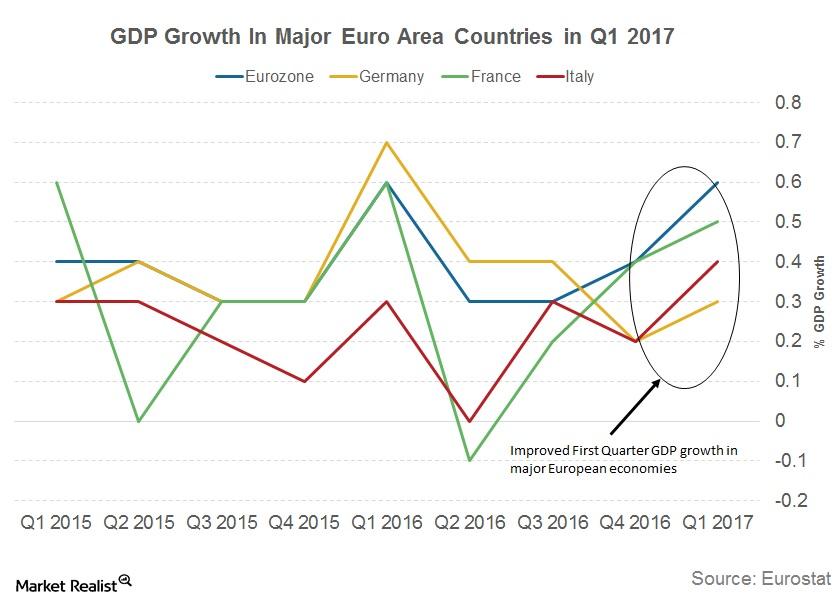

Why the IMF Upgraded Its Eurozone Growth Forecast

The International Monetary Fund (or IMF) has upgraded its growth projections for Eurozone countries, including France, Germany, Italy, and Spain.

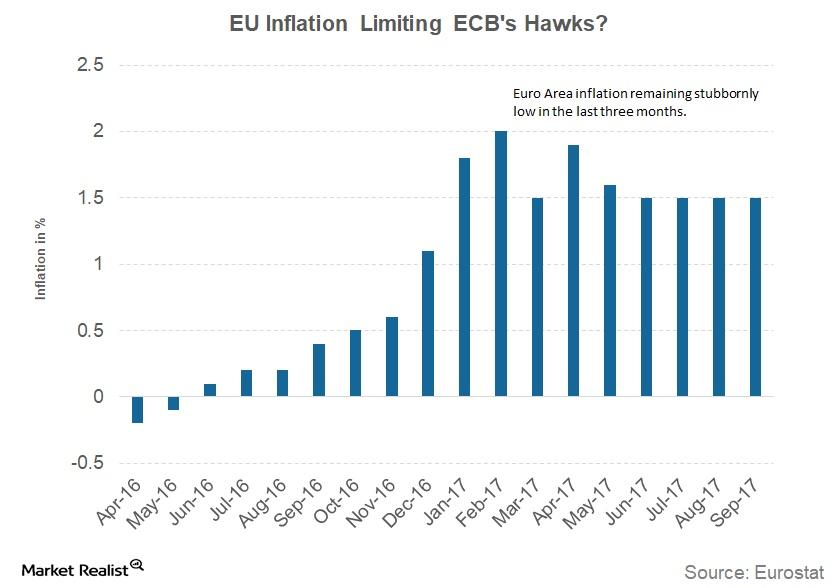

What’s behind the European Central Bank’s Normalization Plans?

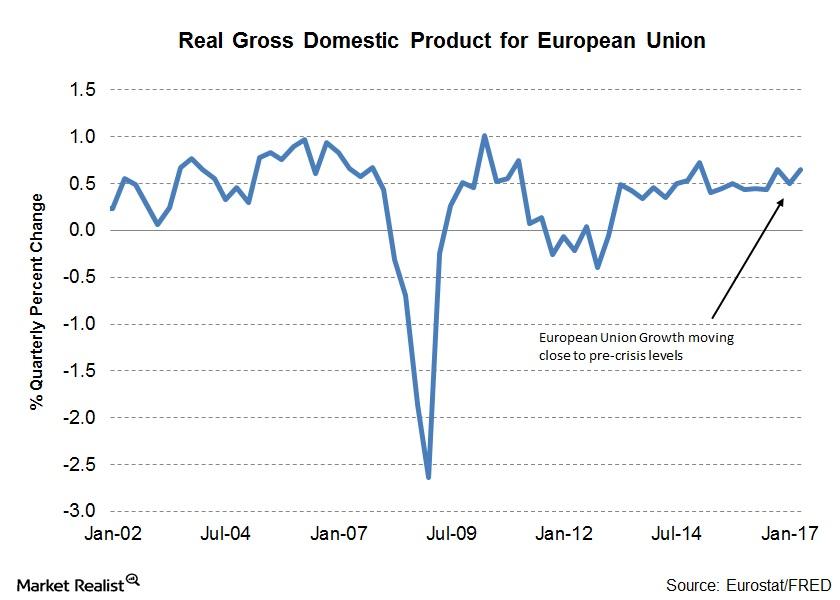

Economic growth has picked up in recent quarters. According to data from Eurostat, the European economy (VGK) grew 2.3% in the recent quarter.

Why Strong European GDP Growth Momentum Gives Confidence to the ECB

In its September 7 meeting, the ECB (European Central Bank) governing council sounded optimistic about the strong growth momentum in the EU.

Why the International Monetary Fund Expects Continued Euro Growth

Growth projections for Euro area upgraded The International Monetary Fund (or IMF) has revised its growth projections for France, Germany, Italy, and Spain. Growth projections for Germany (FGM), France (EWQ), and Italy (EWI) were upgraded by 0.2% for 2017, and 0.1% for 2018. Spain (EWP) had a higher upgrade to growth expectations, with a change of […]

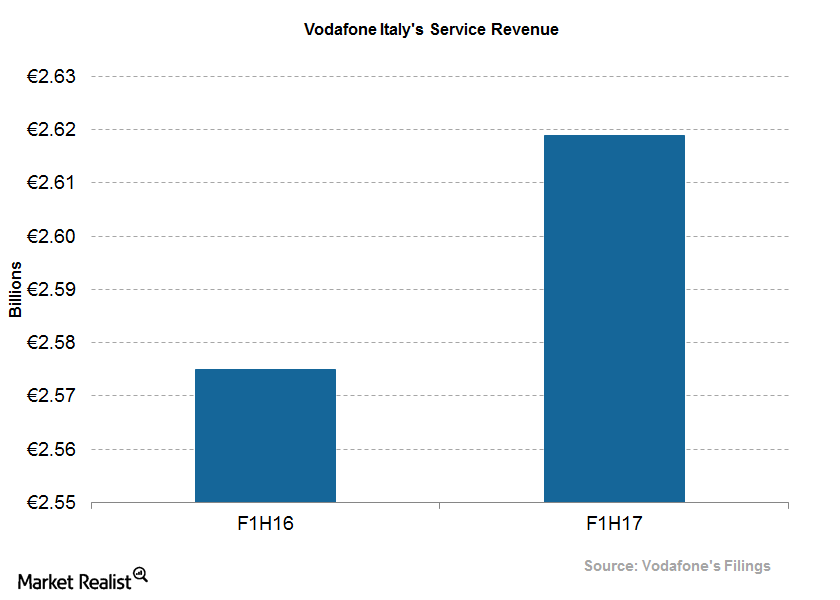

Why Vodafone Italy’s EBITDA Margin Keeps Growing

In fiscal 1H17, Vodafone Group’s (VOD) revenue in Italy (EWI) rose ~2.5% YoY (year-over-year) to ~3 billion euros (about $3.13 billion) in fiscal 1H17.

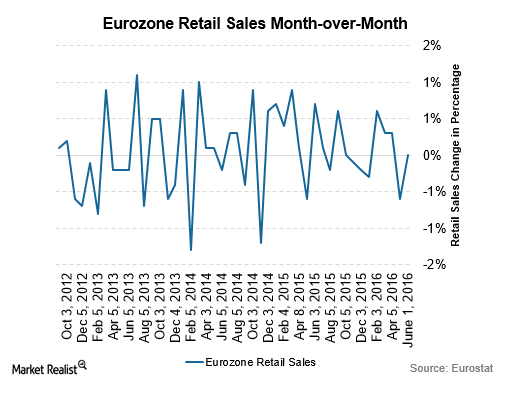

Eurozone’s Subdued Retail Sales and Services PMIs Add to Worries

The Eurostat released the Eurozone’s (DFE) retail sales data for April on June 4, 2016. Retail sales remained unchanged.

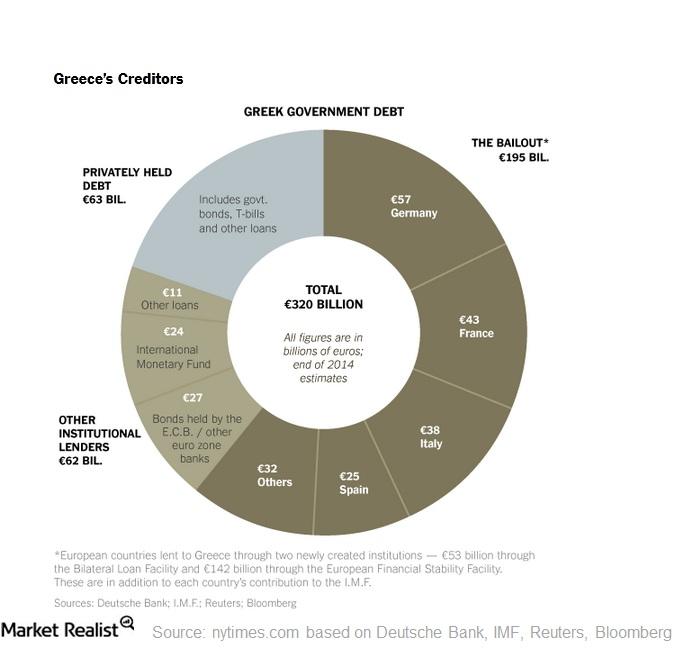

How Does the Greek Debt Crisis Impact the Eurozone?

Greece’s debt was around 250 billion euros. It’s nearly 175% of its 2013 GDP figures. The GDP could fall more in 2016. The debt crisis started in 2010.

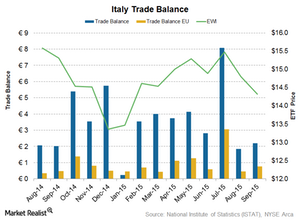

Italy’s Trade Surplus Widened with Declining Imports in September

According to the National Institute of Statistics (or ISTAT), Italy’s goods and services surplus rose to 2.2 billion euros in September 2015 compared to 2.0 billion euros a year ago.

Italy’s Inflation Rate Rose to 0.3% in July, yet EWI Fell 0.88%

The ECB’s (European Central Bank) monetary stimulus package seems to be working well for most Eurozone economies, especially Italy.