Why You Should Look Out for Gold Miners’ Commodity Exposure

It’s important to understand not only miners’ geography but also their revenue composition in terms of commodity exposure.

Dec. 28 2015, Updated 12:06 p.m. ET

Commodity exposure

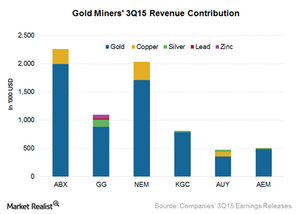

It’s important to understand not only miners’ geography but also their revenue composition in terms of commodity exposure. Product composition exposes miners to different types of commodities, which in turn impacts their revenues and profitability. So, while some produce copper, others produce silver, lead, or zinc as by-products along with gold.

Miners with copper exposure

In 3Q15, Barrick Gold (ABX) generated 12% of its revenue from copper. Barrick announced the sale of 50% of its interest in the Zaldivar copper mine in Chile to Antofagasta during 2Q15. The company also mentioned that it doesn’t plan to expand its existing copper production. Going forward, we’ll likely see a lower contribution from copper to Barrick’s revenue.

Among senior gold miners, Newmont Mining (NEM) and Yamana Gold (AUY) have some of the highest exposure to copper. For 3Q15, copper revenues contributed to 16% of overall revenues for Newmont and 18% for Yamana. Silver also contributed 7% to Yamana’s revenues.

Major exposure to gold

Agnico-Eagle Mines’ (AEM) majority of revenues is from gold. It also mines ore that contain silver, zinc, and copper. For 3Q15, 96% of its revenues were from gold, 3% from silver, and the rest from base metals.

Goldcorp (GG) is more diversified in terms of metals. While 80% of its 3Q15 revenue was from gold, 12% was from silver, 6% was from zinc, and 2% was from lead. These metals are essentially a by-product of mining gold at some of Goldcorp’s gold sites.

In contrast, Kinross Gold (KGC) has minor attributable revenues to silver, as it’s produced as a by-product at some mines. In 3Q15, silver revenues formed ~3% the company’s total revenues.

Base metals’ dynamics are quite different compared to precious metals’. While gold and silver are used as an inflation hedge and as a safe haven in times of economic and political turmoil, copper and other base metals are mainly used as a proxy for industrial growth. Copper prices have hit multi-year lows in 2015 due to demand weakness amid growth concerns in China. JPMorgan Chase (JPM) is also concerned about gold miners’ copper exposure. It warned that lower copper prices could mean trouble for miners like Barrick Gold and Newmont Mining in 2016.

Also, investors looking to hold gold miners for any of precious metals’ safe haven appeal might not want to add to their risk by holding positions in copper or other base metals.

While iShares Gold Trust (IAU) gives you exposure to gold prices, the iShares Silver Trust (SLV) provides exposure to silver prices.

Next we’ll look at gold miners’ production outlook.