Crack Spread Narrowed: Is There Less Demand for Crude Oil?

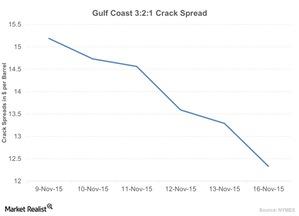

The benchmark US Gulf Coast 3:2:1 crack spread fell ~12.50% last week. It hit ~$13.28 per barrel on Friday, November 13, 2015.

Nov. 18 2015, Published 9:35 a.m. ET

Crack spread

The benchmark US Gulf Coast 3:2:1 crack spread fell ~12.50% last week. It hit ~$13.28 per barrel on Friday, November 13, 2015. On Monday, November 9, the spread was ~$15.18 per barrel. On November 16, the spread was $12.33 per barrel.

This year, the spread recorded the lowest and highest levels in January and August. It was $3.50 per barrel in January and $26 per barrel in August.

Crack spreads indicate refined products’ demand. Consumers only buy refined products because they don’t deal with crude oil. So, a narrowed crack spread signals that supply is high and demand is weak.

Because of the refinery maintenance season, more than 8 MMbpd (million barrels per day) of capacity went offline in October. The refinery margins fell across the globe due to larger-than-expected inventory builds and normal temperatures. The gasoline demand in the Atlantic Basin is healthy. However, it’s constrained by oversupply. So, refined products’ prices fell slightly. This led to a fall in the crack spreads or refiners’ margins.

What’s the impact?

Since crude oil is the input for refined products, low crude oil prices (USO) combined with high prices for refined products will make the crack spread wider. So, a wider crack spread increases the profit margins. In contrast, a narrow crack spread decreases refiners’ margins like Tesoro (TSO), Valero Energy (VLO), Western Refining (WNR), Phillips 66 (PSX), and Marathon Petroleum (MPC).

Some of the companies mentioned above are part of the Energy Select SPDR ETF (XLE) and the Vanguard Energy ETF (VDE).

A narrowed crack spread is negative for logistic operators. The production volumes will fall due to a narrowed crack spread. This results in a low transport volume. It decreases the revenue of Valero Energy Partners (VLP) and Phillips 66 Partners (PSXP).