Bristol-Myers Squibb’s Neuroscience and Immunoscience Segments

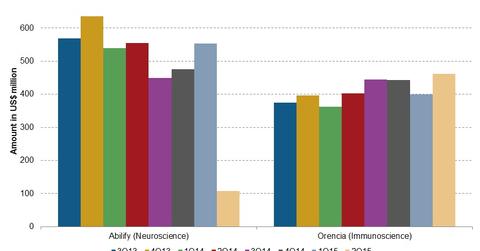

Sales for Bristol-Myers Squibb’s (BMY) neuroscience segment declined over 80% in 2Q15, while the immunoscience segment’s sales improved ~15% in 2Q15 as compared to 2Q14.

Nov. 20 2020, Updated 3:39 p.m. ET

Neuroscience and immunoscience segments

Sales for Bristol-Myers Squibb’s (BMY) neuroscience segment declined over 80% in 2Q15, while the immunoscience segment’s sales improved ~15% in 2Q15 as compared to 2Q14. The neuroscience segment represents the drug Abilify, while the immunoscience segment represents Orencia.

Abilify

Abilify is an antipsychotic agent used in the treatment of schizophrenia and major depressive disorders, and is a part of the company’s alliance with Otsuka Pharmaceutical. Abilify has contributed over $2 billion year-over-year since 2012, and US markets contributed more than 75% of total sales of Abilify.

Abilify sales fell over 80% in 2Q15 to $107 million from $555 million in 2Q14. This was due to the loss of exclusivity in the US markets. The company had lost exclusivity for Abilify in the European markets in 2014, which had impacted the sales of the drug slightly. Lower Abilify sales had a negative impact on the company’s gross margin in 2Q15.

Other drugs for schizophrenia include AstraZeneca’s (AZN) Seroquel XR, Johnson & Johnson’s (JNJ) Invega Sustenna, and Sunovion Pharmaceuticals’ (SEPR) Latuda.

Orencia

Orencia is a fusion protein used in rheumatoid arthritis and related indications. Orencia revenues increased by ~15% to $461 million in 2Q15 over 2Q14, following higher demand and higher net selling average price.

Other drugs for treatment of rheumatoid arthritis include Abbvie’s (ABBV) Humira, Amgen’s (AMGN) Enbrel, and Pfizer’s (PFE) Celebrex. Investors can consider ETFs like the Health Care Select Sector SPDR ETF (XLV), which has ~3.8% of its total investments in Bristol-Myers Squibb.