Overview of US Gulf Coast 3:2:1 Crack Spread

Crack spreads usually fall when crude oil prices (USO) increase by more than product prices, or when product prices fall more than crude oil prices.

May 3 2021, Updated 10:44 a.m. ET

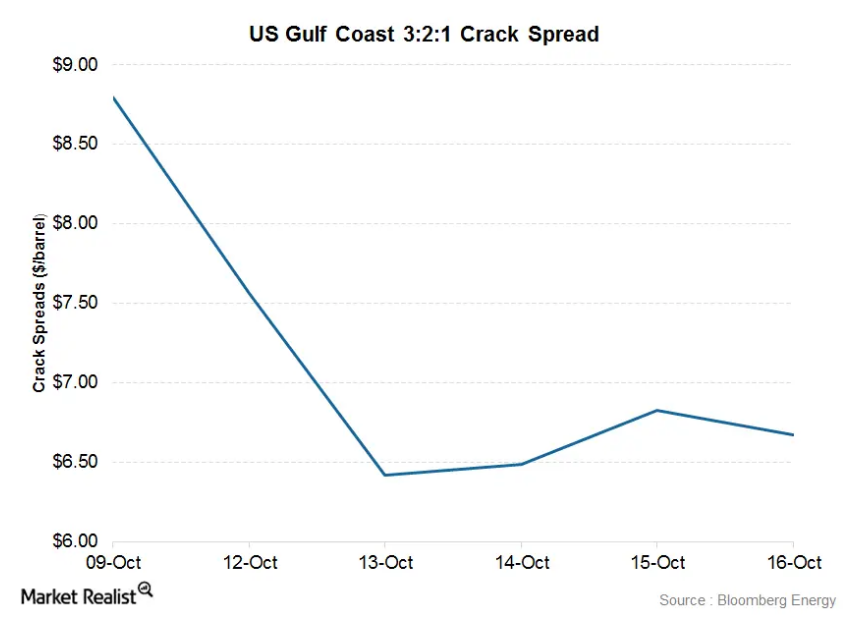

US Gulf Coast 3:2:1 crack spread

The benchmark US Gulf Coast 3:2:1 crack spread fell ~24% last week. It hit ~$6.7 per barrel on Friday, October 16. On Friday, October 9, the spread was ~$8.8 per barrel. For context, the US Gulf Coast crack spread peaked at ~$26 on August 12. The lowest crack spread levels this year reached ~$3.5 early in January.

What does it mean?

The above graph illustrates the US Gulf Coast 3:2:1 crack spread over several days. The 3:2:1 crack spread reflects a theoretical calculation of the difference between the price of two barrels of gasoline and one barrel of distillate fuel, and the cost of three barrels of crude oil where these products are assumed to be produced.

Crack spreads usually fall when crude oil prices (USO) increase by more than product prices, or when product prices fall more than crude oil prices. The latter was the case in the week ended October 16. WTI prices fell 4.7% while gasoline prices fell 6.3%, and diesel prices fell ~6%.

Why watch crack spreads?

Crack spreads represent the price difference between refiners’ revenue, derived from the sale of finished refined products, and refiners’ costs or the price of crude oil (USO). So they’re an important metric that drives refiner profitability and market valuation. This is something investors in refiner stocks should watch.

A narrower crack spread lowers the profit margins of refiners like Valero Energy (VLO), Phillips 66 (PSX), Marathon Petroleum (MPC), and Tesoro (TSO). They would have to purchase raw materials or inputs at a higher rate. Conversely, wider crack spreads tend to raise profit margins for refiners. Together, these companies account for ~12% of the Energy Select Sector SPDR ETF (XLE).

The above companies spun off some of their midstream assets to form Valero Energy Partners (VLP), Phillips 66 Partners (PSXP), MPLX (MPLX), and Tesoro Logistics (TLLP). These are all midstream MLPs. A narrower crack spread would indirectly hurt these companies. The lower volumes produced by their refining parents in response to higher input costs would mean less volume to transport. This could hurt the MLPs’ revenue. For more on crack spreads, please read Crack Spread 101.

For the latest updates on the energy sector, please visit Market Realist’s Energy and Power page.