Why PulteGroup Saw a Modest Rise in Sales Order Backlog in 2014

Sales order backlog represents homes under contract but not closed or delivered. For orders in backlog, the company receives a customer contract and deposit, which may or may not be refundable.

Aug. 13 2015, Updated 12:05 a.m. ET

Sales order backlog

Sales order backlog represents homes under contract but not closed or delivered. For orders in backlog, the company receives a customer contract and deposit, which may or may not be refundable depending on the nature of the contract. In the event of cancellation, the majority of the sales contracts stipulate that PulteGroup (PHM) has the right to retain the customer’s deposit, though the company may choose to refund deposits in certain instances.

North region has the highest backlog

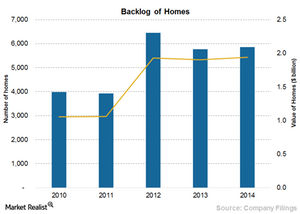

At the end of fiscal 2014, sales orders backlogs amounted to $1.94 billion, a marginal increase of 2% over the previous year. In terms of the number of homes, the sales order backlog increased by a mere 1% in fiscal 2014 to 5,850 homes from 5,772 homes in the previous year. Backlog rose to 7,624 units at the end of 1Q15. The North region had the highest backlog at 25%, or 1,462, in 2014, followed by Texas at 21.8% or 1,273 units.

Large backlog to boost revenue

Of the orders in backlog at the end of fiscal 2014, almost all are scheduled to be closed during 2015. The cancellation rate in 2014 was 15%, unchanged from 2013, and the rate is expected to be lower than this in 2015 as the economic scenario improves in the country. Large backlog and lower cancellation rates are expected to boost revenues of the company in 2015.

The average sales price of homes in backlog was $329,100 for fiscal 2014. In the next article, we’ll see how the average selling price is increasing over the years compared with industry peers like Lennar (LEN), D.R. Horton (DHI), Toll Brothers (TOL), and KB Homes (KBH).

Investors looking for diversification in the homebuilding sector can consider ETFs such as the SPDR S&P Homebuilders ETF (XHB) and the iShares Dow Jones US Home Construction Index Fund (ITB).