KB Home

Latest KB Home News and Updates

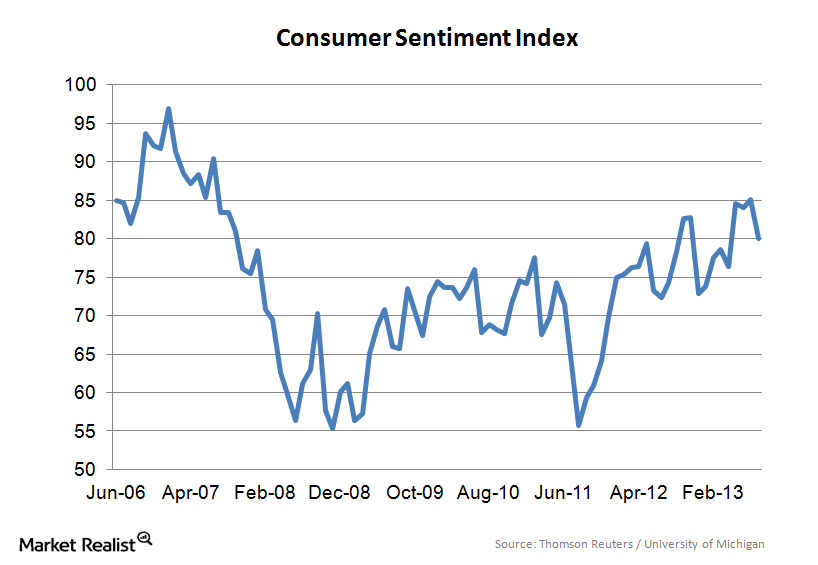

University of Michigan Consumer Confidence Index dips in August

The Thomson Reuters/University of Michigan Consumer Confidence Index is a leading indicator for the U.S. economy The Thomson Reuters/University of Michigan Consumer Confidence Index is an important indicator of the consumer’s perception of the U.S. economy. Similar to other consumer confidence measures, it asks consumers about their views on the current economic conditions and their […]

KB Home SVP Talks Smart Homes of the Future

In this interview, KB Home SVP Dan Bridleman discusses the smart home of tomorrow and how the company is making homes the center of a smart ecosystem.

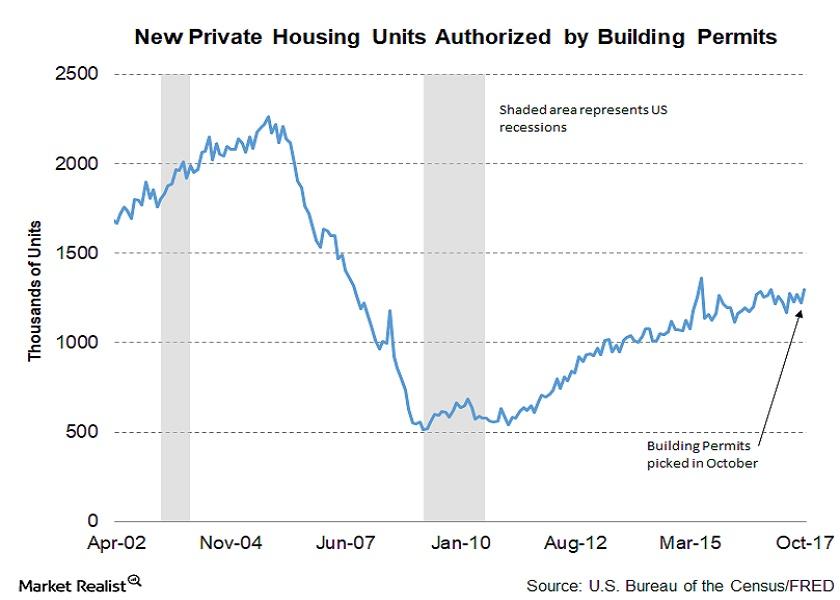

Housing Market: What a Rise in Building Permits Signals

In October 2017, building permits were at a seasonally adjusted rate of 1.297 million—an increase of 5.9% from the reading of 1.225 million in September.

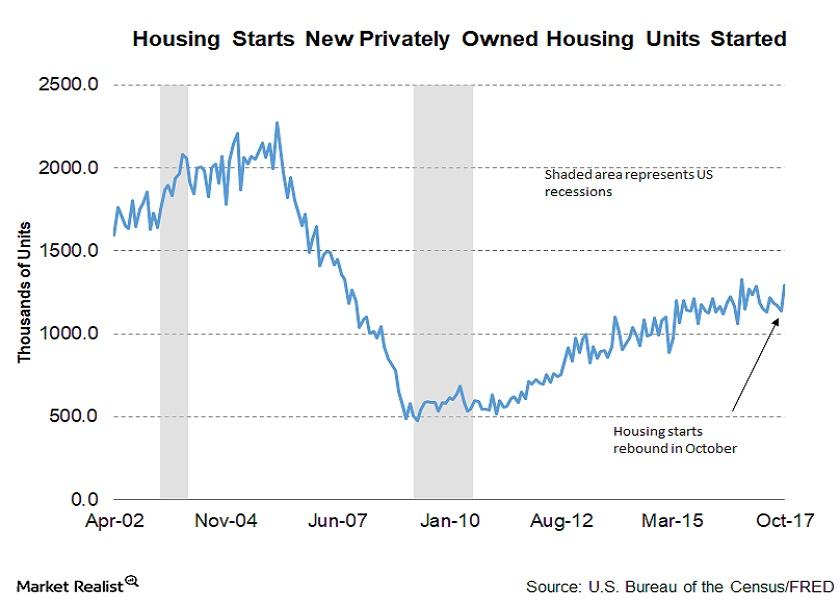

Analyzing Housing Starts in October 2017

In October 2017, housing starts rebounded sharply from the slump in September. October housing starts beat the market’s expectations.

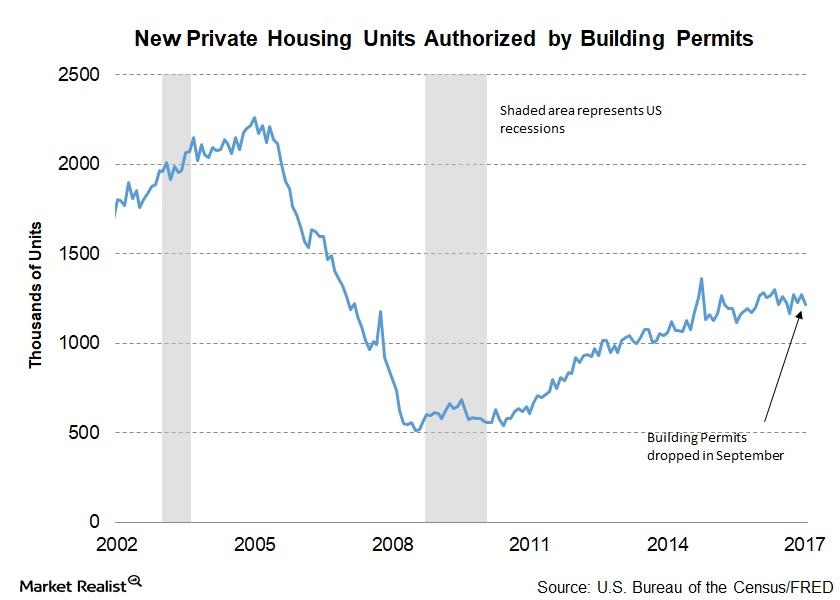

Is the Drop in September Building Permits Cause for Concern?

In September 2017, building permits were at a seasonally adjusted annual rate of 1.215 million—a fall from August’s 1.272 million and 4.3% below September 2016.

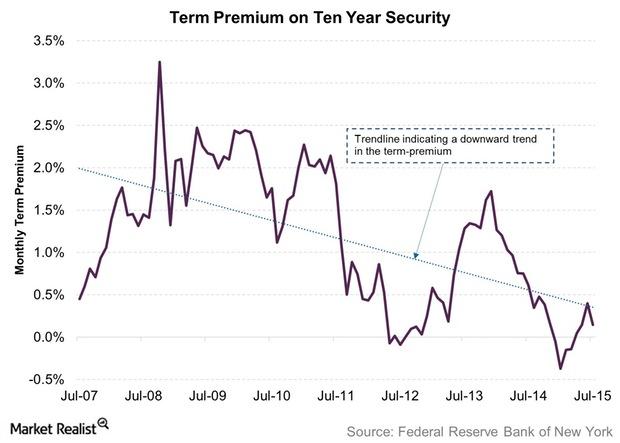

What Does US Term Premium Indicate?

Over an eight-year period, the term premium on a ten-year US security rose to 3.25% in October 2008. It saw a low of -0.37% in January 2015.

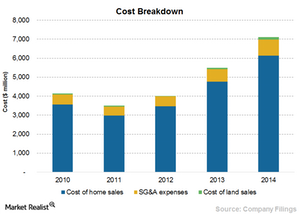

What Was D.R. Horton’s Cost Structure Breakdown in 2014?

Cost of homes sold is the highest of the company’s costs at 78.1%, followed by SG&A at 10.6%, and cost of land sold at 1.6%.

Understanding D.R. Horton’s Land Acquisition Strategy

D.R. Horton directly acquires almost all of its land and lot positions. The company has initiated few joint ventures for land acquisitions.

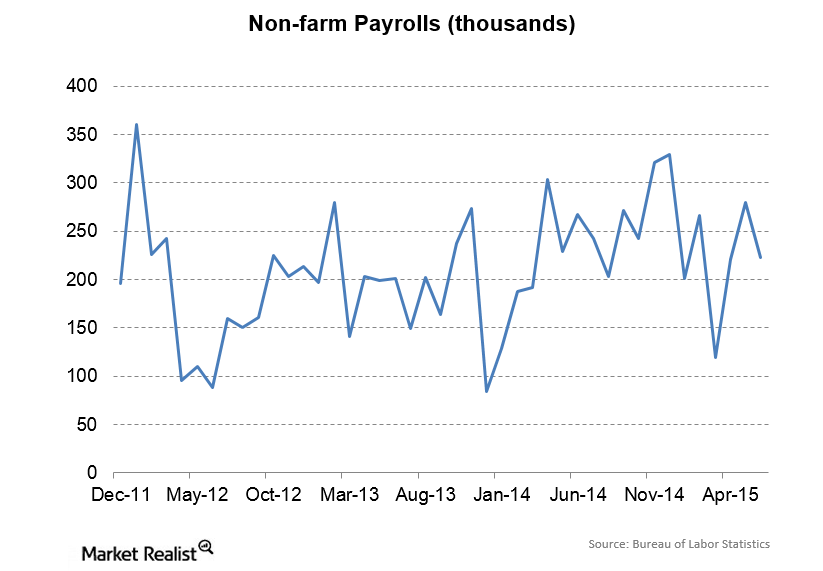

June Payrolls Increase

Private payrolls increased by 223,000 in June, while government jobs growth was flat and manufacturing employment barely increased.

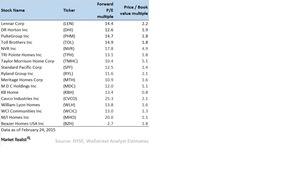

Valuing homebuilders: Buying at the right price

Homebuilders earn substantial profits buying land at a cheaper rate, allowing it to appreciate over time, constructing a house on it, and selling it.

The basics of the US homebuilding industry for investors

The US homebuilding industry comprises many large, publicly traded residential construction companies. Top homebuilders mainly focus on specific categories.

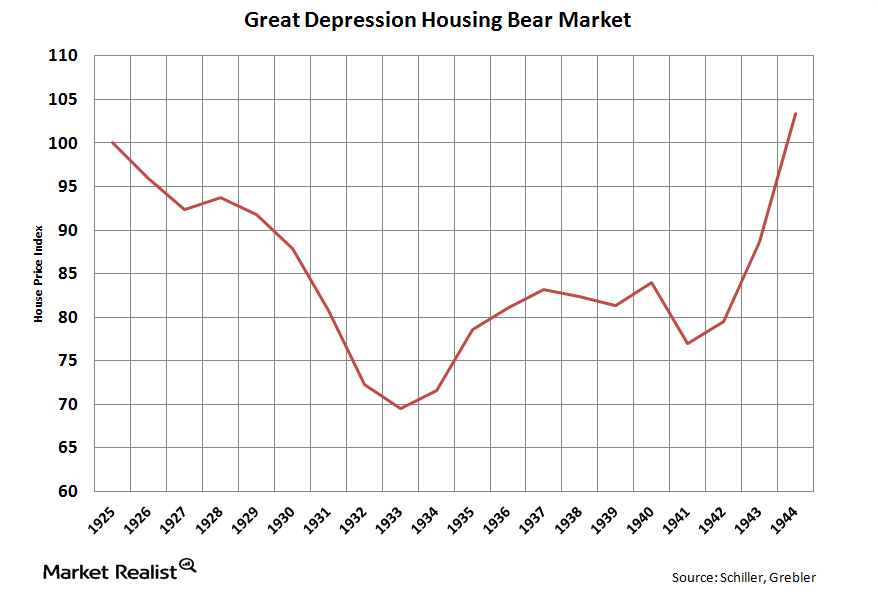

Comparing the Great Depression’s housing bear market with today’s

The real estate bubble of the 2000s was bigger than the real estate bubble of the 1920s In many ways, the dual stock market and real estate bubbles of the 1920s were a mirror image of the 2000s market collapse. The 1920s real estate boom peaked in 1925, and the stock market collapsed four years […]