Kinder Morgan’s Outlook for the Rest of 2015

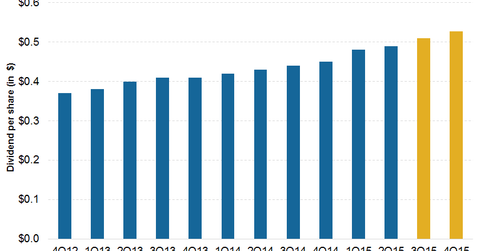

According to Wall Street analysts’ consensus outlook, Kinder Morgan’s (KMI) dividend is expected to grow by ~15.3% year-over-year by the end of 2015.

Aug. 7 2015, Updated 11:06 p.m. ET

Kinder Morgan’s dividend outlook

According to Wall Street analysts’ estimates, Kinder Morgan’s (KMI) dividend is expected to grow by ~15.3% YoY (year-over-year) by the end of 2015. Analysts’ dividend growth estimates are in line with management dividend guidance of 15% growth for the full-year 2015 over full-year 2014.

Growth drivers

YoY dividend growth of 15% in 2015 seems achievable considering the following:

- KMI’s fee-based businesses are performing well

- the addition of more fee-based projects in recent quarters

- the growth from its February 2015 Hiland Partners acquisition

- excess dividend coverage of $266 million for the first six months of 2015

Commodity exposure

Kinder Morgan (KMI) operates like a toll road or a fee-based business. It has limited commodity-price exposure. About 85% of KMI’s 2015 budgeted EBDA (earnings before depreciation and amortization) is fee-based and ~94% is fee-based or hedged. These are KMI’s businesses that are exposed to crude oil (USO) and natural gas prices (UNG):

- CO2-based enhanced crude oil recovery – KMI has hedged 81% of 2015 crude oil production volumes at $79 per barrel and 57% of its 2016 production at $76 per barrel. KMI estimates every $1 per barrel change in WTI (West Texas Intermediate) crude oil will impact its distributable cash flow by ~$10 million.

- Natural gas midstream – This business accounts for 21% of the Natural Gas Pipelines segment’s earnings. Activities include natural gas gathering and processing and treating. KMI estimates that every $0.10 per MMBtu (British thermal units in millions) change in the price of natural gas will impact its distributable cash flow by ~$3 million.

For more details on types of natural gas processing contracts, read MLPs: An Overview of the Best-Performing Energy Sector.

Energy Transfer Partners (ETP), Targa Resource Partners (NGLS), DCP Midstream Partners (DPM), MarkWest Energy Partners (MWE), and Crestwood Midstream Partners (CMLP) are among the midstream companies that have exposure to natural gas prices through their natural gas midstream assets.

ETP, NGLS, DPM, MWE, and CMLP together make up ~24.96% of the Alerian MLP ETF (AMLP). KMI alone constitutes ~4.36% of the Energy Select Sector SPDR Fund (XLE).