Crestwood Midstream Partners LP

Latest Crestwood Midstream Partners LP News and Updates

Rose Rock Midstream: Top Midstream MLP Loser on August 25

Rose Rock Midstream (RRMS) was the top loser among midstream MLPs at the end of trading on Tuesday, August 25. It fell 4.71% in a single trading session.

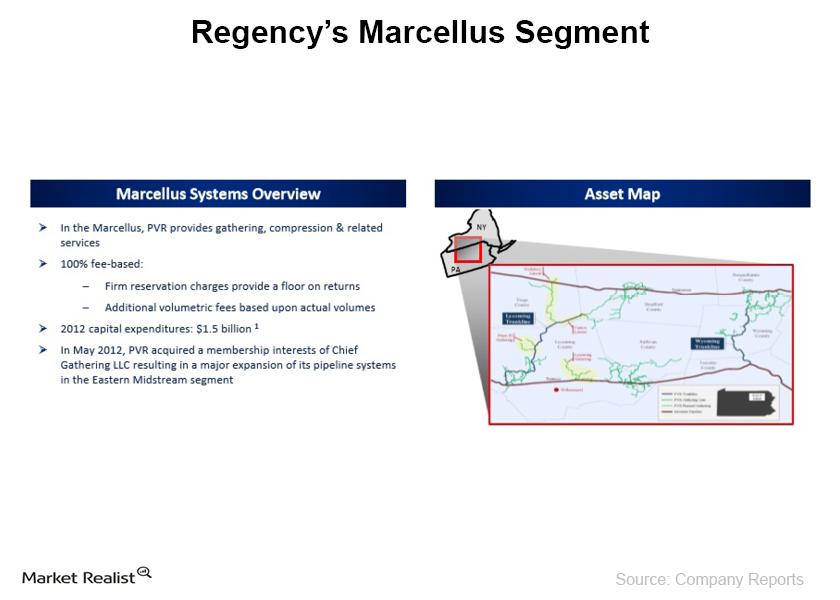

Regency’s PVR Midstream acquisition means Marcellus Shale exposure

Regency recently acquired a foothold in the Marcellus by buying PVR Partners LP in March this year in a deal worth $5.6 billion, specifically to boost its footprint in the Appalachian Basin.