The Booming Indian Stock Market: Will It Last?

Indian stocks had a strong run in the last half of 2014 through early 2015, but the ride since then hasn’t been smooth. The INDA is up only 2.6% in the one year ended June 2015.

July 3 2015, Published 11:34 a.m. ET

Indian stocks surge

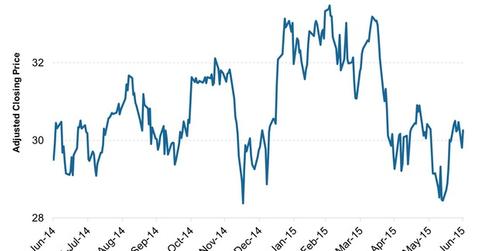

Indian stocks have witnessed gains, especially since the current government won the elections in May 2014. From the end of June 2014 to the beginning of March 2015, the iShares India 50 ETF (INDY), which tracks India’s benchmark CNX Nifty index, returned more than 15%.

ADRs (American depositary receipts) of Indian stocks like Dr. Reddy’s Laboratories (RDY), Infosys (INFY), and HDFC Bank (HDB) rose 26%, 37%, and 34%, respectively, in this period. India-focused ETFs like the WisdomTree India Earnings ETF (EPI) and the iShares MSCI India Index ETF (INDA) rose 8.6% and 13.2%, respectively.

The reason for the rally

The run-up in stocks through early March 2015 was fueled primarily by the hope of economic and social development under the leadership of Narendra Modi, who became the prime minister in May 2014. His electoral campaign focused on development. He had already succeeded in implementing his model in the Indian state of Gujarat, which he helmed from 2001–2014 as chief minister.

Indian stocks also benefited immensely from the fall in crude oil prices, which coincidentally started falling in June 2014. The Modi-led government made use of this opportunity by ending subsidies on diesel in October 2014.

Is a bust ahead?

Although Indian stocks had a strong run in the latter half of last year until earlier this year, the ride since then has not been smooth. You can gauge this from the fact that the INDA, which returned 13.2% from the end of June 2014 until early March 2015, is up only 2.6% in the one year ended June 2015. What’s impacting the performance of Indian stocks? And is a bust in the offing?

We’ll use this short series to look at factors that could either lead to or avert a bust for the Indian stock market in 2016.

Let’s begin by looking at a few of India’s macroeconomic indicators.