iShares India 50

Latest iShares India 50 News and Updates

Financials Must-know: Why did the Indian rupee free-fall in 2013?

India’s current account deficit rose to 4.8% of GDP in 2012–2013, largely financed through hot money flows, and exceeded the government’s target level of 2.5% to 3% of GDP.

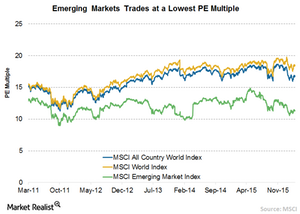

Why Emerging Markets Are Trading at a Discount to Developed Markets

With the recent fall, some of these emerging markets have certainly become very cheap compared to most of the developed markets.

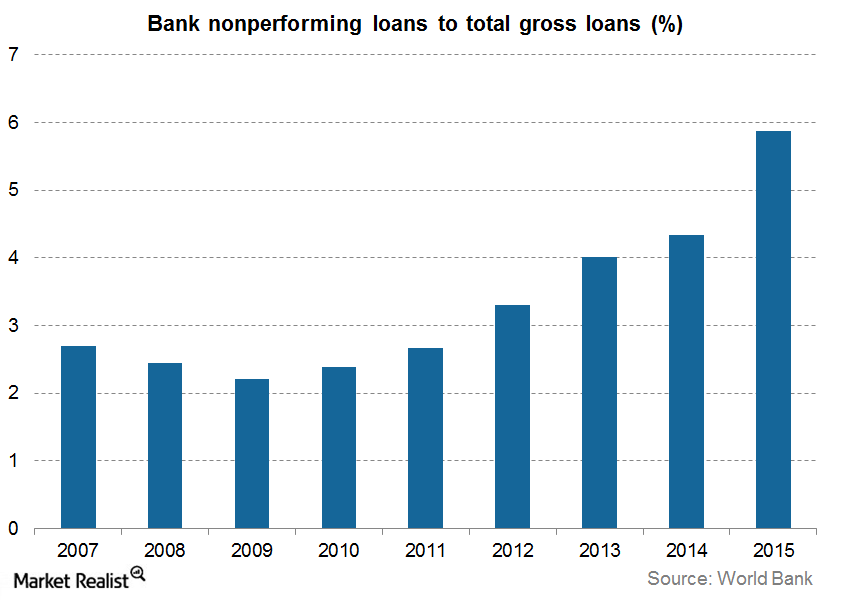

Broke Banks

“Banks are there to support businesses that have justifiable needs.” – Vijay Mallya, Indian businessman and politician, 2015 If corporate India is to thrive, it needs a healthy, functioning banking system. Socially useful projects and initiatives require capital and banks should be able to allocate this capital efficiently. While progress is being made, India’s banks […]

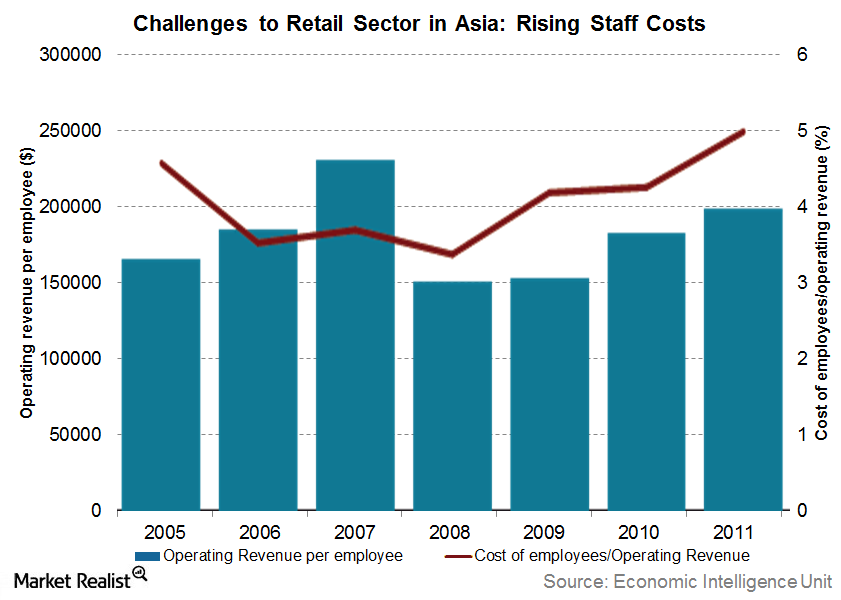

Retail Growth in Asia Faces Important Challenges

China’s retail sales growth has remained above 10% for most of the past year, and this trend isn’t likely to reverse in the near future.

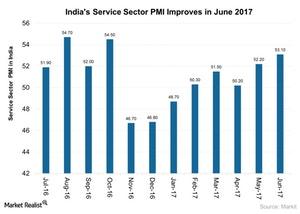

India’s Service Sector Activity Strengthened at the End of 2Q17

The service sector PMI (purchasing mangers’ index) in India (INDA) rose to 53.1 in June 2017, compared to 52.2 in May.

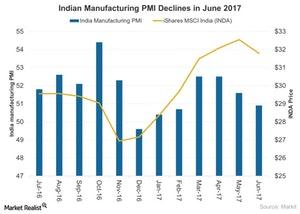

Why Manufacturing Activity in India Fell in June 2017

Uncertainty related to India’s new goods and services tax, which was implemented on July 1, 2017, seemed to affect India’s manufacturing activity in June 2017.

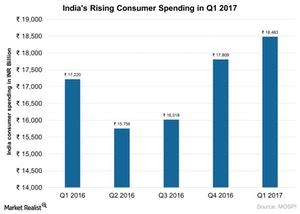

Is Consumer Spending Rising in India amid Reforms in 2017?

Consumer spending in India (INDA) is expected to grow via remonetization and other reforms undertaken by its government in 2017.

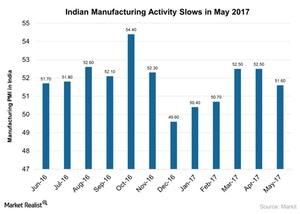

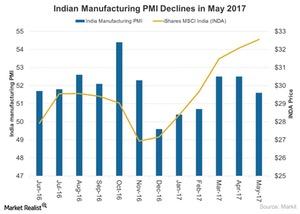

Why India’s Manufacturing Lost Momentum in May

Manufacturing activity in India lost momentum in May 2017, with the India Manufacturing PMI (purchasing managers’ index) recording a decline.

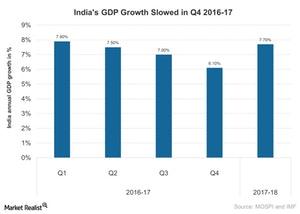

What Happened to Growth in India in Fiscal 4Q16

Economic growth in India (INDA) slowed during the country’s fiscal 4Q16 (January 2017–March 2017), revealing the impact of demonetization.

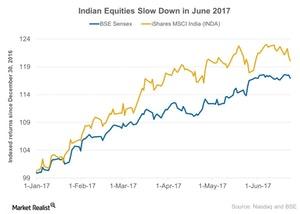

Indian Equity Markets: Waiting for the GST?

Indian equities have remained steady in June 2017, but markets remain cautious about the end of the quarter, given the impact of the GST (Goods and Services Tax).

India’s Manufacturing Activity in May 2017

The Nikkei Manufacturing PMI in India dropped to 51.6 in May 2017 compared to 52.5 in April 2017.

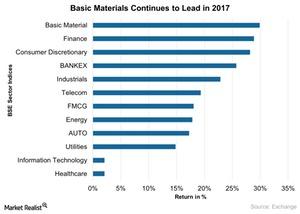

Does the Basic Materials Sector Still Lead in India in 2017?

India’s stock market performance has picked up pace since the beginning of 2017. The S&P BSE Sensex has gained about 10% year-to-date through May 18, 2017.

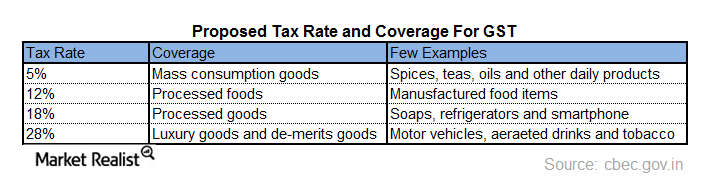

How GST Bill Could Help Investment Scenario in 2017

The implementation of the Goods and Service Tax (or GST) in India is expected to begin on July 1, 2017.

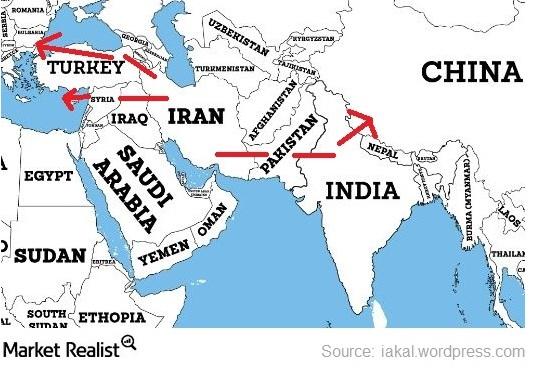

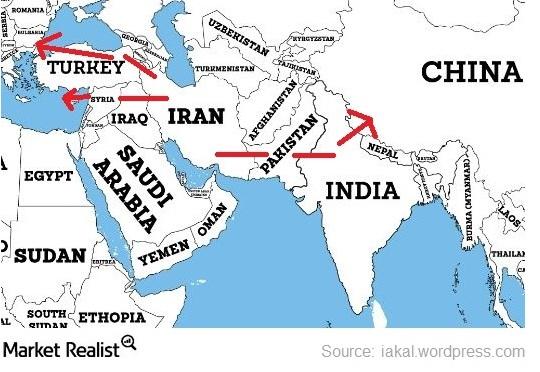

Could Iran Become a Big Gas Supplier to Europe and Asia?

Geographically, Iran is between the Europe and Asia’s gas markets. Iran could be a potential supplier to China (FXI) through Pakistan and India (INDY).

Iran Could Supply Natural Gas to Europe and Asia

Geographically, Iran is between the European and Asian gas markets. Iran could be a potential supplier to China through Pakistan and India (INDY).Macroeconomic Analysis To do or not to do business in India

Doing business has been a major concern for international businesses interested in setting up shop in India.

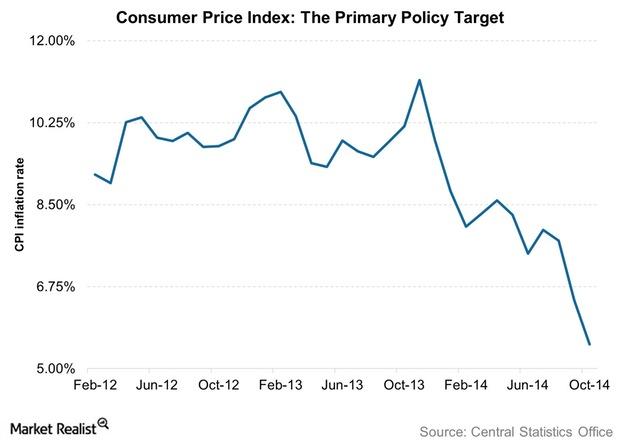

Must-know: India’s monetary policy

The RBI is India’s central bank. It used to announce its monetary policy twice in a financial year. In India, a financial year begins in April and ends in March the next year.Macroeconomic Analysis Where India spends and earns its revenues

Plan expenditure is closely associated with economic growth. It focuses on investment in order to enhance productive capacity. Non-plan expenditure is mainly obligatory in nature.Macroeconomic Analysis Understanding India’s political system—making decisions

In India, the decision-making process isn’t fast. It’s affected by the current assembly’s constitution. Slow decisions hurt a nation’s image.