XLE Is Up Even as Commodity ETFs Track Energy Prices Lower

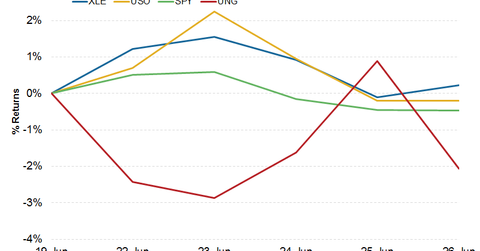

The Energy Select Sector SPDR ETF (XLE) rose 0.22% in the week to June 26. The ETF tracks a diverse group of ~45 of the largest US energy stocks.

June 30 2015, Published 3:00 p.m. ET

Energy Select Sector SPDR ETF

The Energy Select Sector SPDR ETF (XLE) rose 0.22% in the week to June 26. The ETF tracks a diverse group of ~45 of the largest US energy stocks constituting the S&P 500 Index (SPX).

In this series, we’ll see how energy-focused ETFs performed over the previous week—compared to their peers and the broader market.

Comparing performances

In comparison, the broad market SPDR S&P 500 ETF (SPY) fell ~0.5%. Negative speculation surrounding Greece’s exit, or “Grexit,” from the Eurozone weighed on SPY.

Moving to commodity ETFs, the United States Oil Fund (USO) fell 0.2% in the week to June 26. USO tracks movements in prompt WTI (West Texas Intermediate) crude oil futures prices. After rising for two consecutive weeks, the United States Natural Gas Fund (UNG) fell ~2.1% in the week to June 26. It was the biggest loser among our comparable securities for the week. UNG tracks movements in prompt Henry Hub natural gas futures.

Both crude oil and natural gas prices had a rough week, but crude oil seemed to perform better. This explains why UNG fell more than USO.

Apart from upstream energy companies, weaker crude oil and natural gas prices also don’t bode well for MLPs (master limited partnerships) like Enterprise Product Partners (EPD).

About XLE

XLE has exposure to many types of energy companies, with different exposures to energy prices. For example, XLE holds:

- upstream oil and gas companies like ConocoPhillips (COP)

- midstream energy companies like Kinder Morgan (KMI)

- downstream or refining companies like Valero Energy (VLO)

- oilfield equipment and services companies like Schlumberger (SLB)

- integrated energy companies like Chevron (CVX)

So, XLE provides safer, low-cost, and diversified exposure to energy prices.

However, investors should also note that XLE is a market-weighted index ETF. Its top five securities account for 44% of its weight. ExxonMobil (XOM) and Chevron alone account for 28%. Fortunately, they’re large integrated companies with diversified operations spanning the energy stream.