Market Paradox: Stocks Reach Record Highs Despite Headwinds

We’ll explore whether record highs signal a top for equity markets or whether there’s still some room for growth in the current bull market.

Dec. 4 2020, Updated 10:53 a.m. ET

With the U.S. stock market hitting a new record high every week, are we close to the bull market’s top? Russ and an investment strategist on his team, Kurt Reiman, weigh in.

Despite higher rates, market paradox continues to reign. U.S. stocks have scored several record highs in recent weeks.

Stocks have been posting new records despite investor concerns about slowing U.S. corporate profit growth, persistent sluggishness in the economy and Greek bailout negotiations – to name just a few of the headwinds facing equities today. Adding to the anxiety is the fact that many investors are reasonably worried over the impact of the first Federal Reserve (or Fed) tightening in nearly a decade.

Even Fed Chair Janet Yellen couldn’t help noticing in May that stock prices had become “quite high,” leading many to speculate that the U.S. central bank thought stocks had become overvalued.

However, there are several reasons why I believe we’re not yet at the peak.

Market Realist – Naysayers have been warning of a fast-approaching bear market for some time now. There’s ample reason to think US equities could fall. Some possible headwinds include the Greek debt crisis boiling over yet again, soft economic growth in the US economy, and slow growth in US corporate earnings and revenues in Q1 2015.

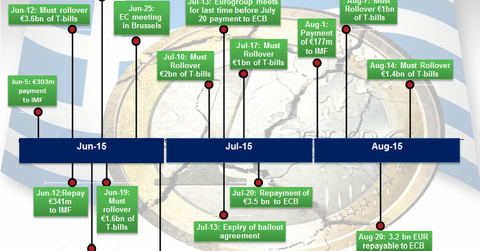

Market Realist – Greece remains a thorn in investors’ sides. Political brinksmanship and the game of cat and mouse continue to play out between Greece (GREK) and its creditors. Time is running out, as the existing bailout agreement comes to an end on July 13, 2015. Greece is thought to have enough funds to make the first loan payment repayable to the IMF on June 5, 2015. However, a default on subsequent obligations is likely in the absence of an agreement between Greece and its creditors. In this scenario, a “Grexit”[1. Greece’s exit from the European Union.] would become almost a certainty. A “Grexit” would not only affect the Eurozone (EZU) but also launch a world-wide (ACWI) contagion effect that could prove even worse than the US financial crisis (XLF) of 2008. The graph above shows the timeline of the Greek debt saga as it unfolds over the next few months.

Market Realist – The other headwind facing US stocks (VTI) is the soft economic growth in the United States. GDP growth came in at only 0.2% in Q1 2015 on account of the harsh winter weather, the West Coast Port Strike, the strength in the dollar (UUP), and the slump in the energy sector (XLE). Consumer spending hasn’t edged up despite the fall in gasoline prices, while wage growth, despite showing signs of some rebound, remains soft, at 2.2% year-over-year as of April 2015.

Market Realist – Another headwind for US equities has been the soft Q1 2015 earnings season. Earnings grew at a tepid 0.3%—the worst since Q3 2012—while revenues declined by -2.9%. You can see these trends in the graph above.

Despite these headwinds, the sense of a market paradox continues as stocks reach record highs week after week. In this series, we’ll explore whether record highs signal a top for equity markets or whether there’s still some room for growth in the current bull market.