ETFs with holdings in Nordstrom

This article discusses ETFs with holdings in Nordstrom.

Nov. 20 2020, Updated 12:30 p.m. ET

Nordstrom ETFs

Nordstrom (JWN) has been generating better results than its peers in the department store industry like Macy’s (M), Kohl’s (KSS), and Dillard’s (DDS). This article discusses ETFs with holdings in Nordstrom.

Consumer discretionary ETFs

Department stores have been facing tough times due to cautious consumer spending and the emergence of online retailers. Consumer discretionary ETFs provide exposure to companies that deal in nonessentials like apparel, consumer electronics, accessories, and footwear.

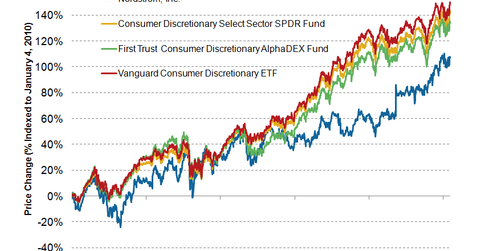

The Consumer Discretionary Select Sector SPDR Fund (XLY) is one of the most popular ETFs in its category. The fund possesses AUM (or assets under management) of $8.42 billion and a gross expense ratio of 0.15%. XLY has 0.50% holdings in Nordstrom.

The First Trust Consumer Discretionary AlphaDEX Fund (FXD) has 1.26% holdings in Nordstrom. This fund possesses $1.73 billion AUM and a gross expense ratio of 0.70%.

The Vanguard Consumer Discretionary ETF (VCR) has $1.53 billion AUM and an expense ratio of 0.12%. The VCR ETF has 0.38% holdings in Nordstrom.

Over a five-year horizon, these ETFs have outperformed Nordstrom.

Broad market ETFs

Nordstrom is also a component of several broad market ETFs like the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index. Other broad market ETFs include the iShares Dow Jones US ETF (IYY), the iShares Core S&P 500 ETF (IVV), and the iShares Russell 3000 Index (IWV). Plus, Nordstrom is part of the SPDR S&P Retail ETF (XRT), which tracks the S&P Retail Select Industry Index.

See Market Realist’s macro ETF analysis page for more information.