The bid-to-cover ratio rose at the 13-week T-bills auction

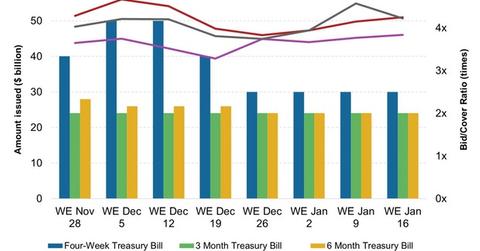

The US Department of the Treasury auctioned 13-week, or three-month, Treasury bills (BIL) (MINT), or T-bills, worth $24 billion on January 12.

Jan. 28 2015, Updated 8:06 p.m. ET

13-week T-bills auction

The US Department of the Treasury auctioned 13-week, or three-month, Treasury bills (BIL) (MINT), or T-bills, worth $24 billion on January 12. The auction amount hasn’t changed for several months. The auction demand was higher in the week. The bid-to-cover ratio rose for the third week in a row. It was 4.2x—compared to 4.1x a week ago.

Yield analysis

T-bills don’t pay a coupon. They’re offered at a discount to face value. They’re redeemable at par on maturity. The high discount rate for the January 12 auction came in at 0.025%. It was lower than 0.030% in the previous week.

Market demand rises

Market demand rose after it fell for the previous two weeks. The percentage of indirect bids rose from 13.6% to 22.8% week-over-week. Direct bids also rose from 6.9% to 9.6% in the previous week. Direct bids include domestic money managers—for example, State Street Corp. (STT).

The share of primary dealer bids fell from 79.5% to 67.5%. Primary dealers are a group of 22 broker dealers authorized by the Fed. They’re obligated to bid at US Treasury auctions and clean up the excess supply. They include firms like Goldman, Sachs & Co. (GS) and Citigroup (C). C and GS are part of the SPDR MSCI World Quality Mix ETF (QWLD) and the iShares Core S&P 500 ETF (IVV).

A decrease in the percentage of primary dealer bids shows strong fundamental market demand.