SPDR® Barclays 1-3 Month T-Bill ETF

Latest SPDR® Barclays 1-3 Month T-Bill ETF News and Updates

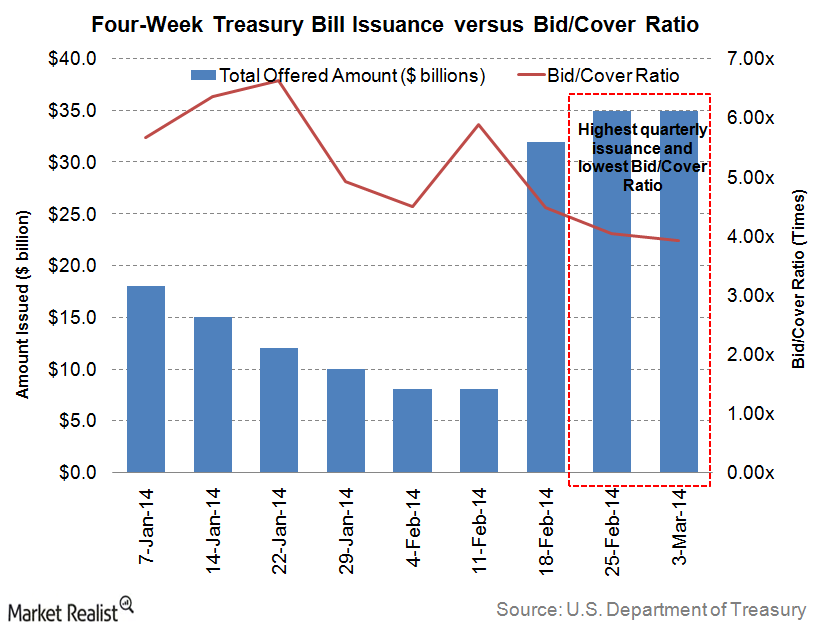

The demand for 4-week Treasury bills remained subdued last week

A considerable amount of $35 billion was offered for the weekly four-week T-bills auctioned on Tuesday, March 4, 2014.

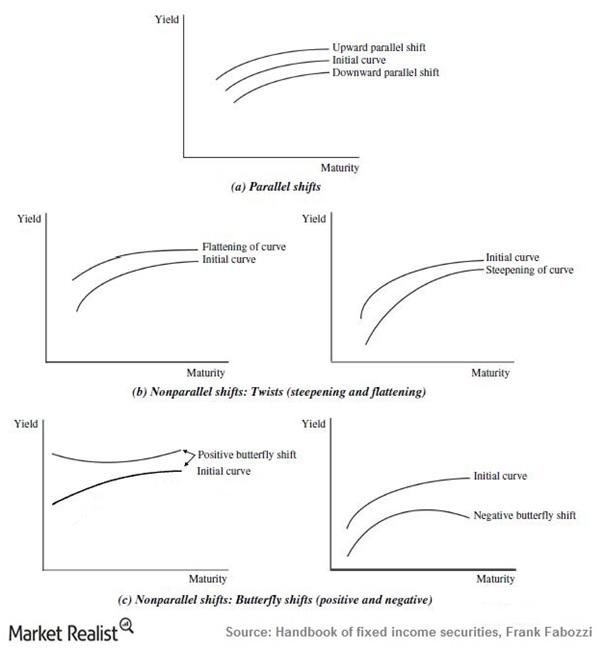

Why investors should follow shifts and twists in the yield curve

Yields on bonds don’t remain constant. When they change by the same magnitude across maturities, we call the change a “parallel shift.”Financials Key takeaways: Why is the yield curve normally upward-sloping?

In normal conditions, the yield curve is upward-sloping. As bonds pay only interest (the coupon) until maturity and pay face value at maturity, investors take longer to recover their principal.

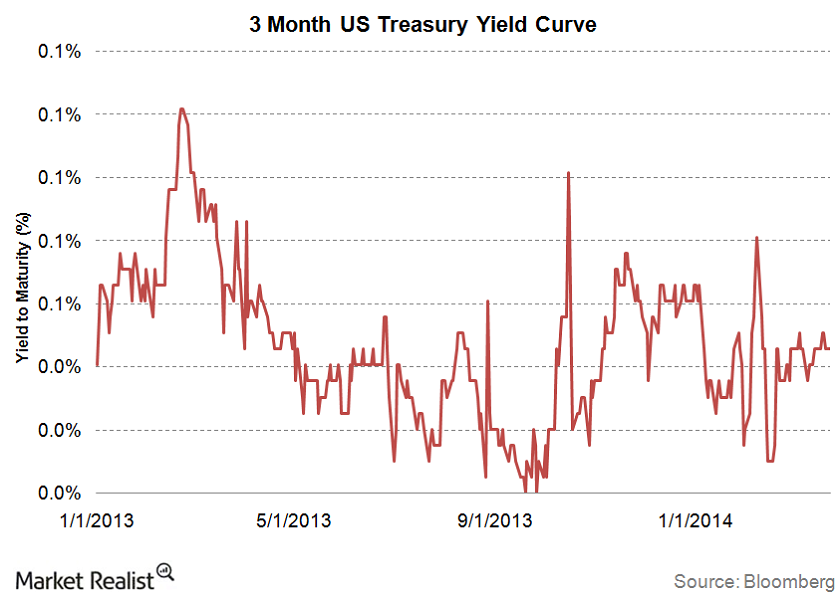

Knowing the Treasury discount rate and yields before investing

Investors can take an informed decision by knowing the rate of return on their investment.

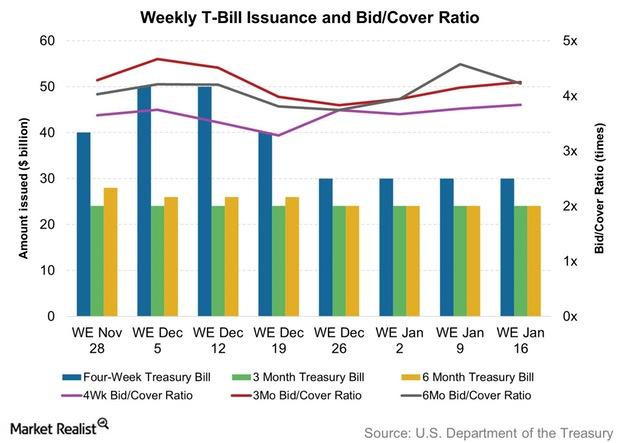

The bid-to-cover ratio rose at the 13-week T-bills auction

The US Department of the Treasury auctioned 13-week, or three-month, Treasury bills (BIL) (MINT), or T-bills, worth $24 billion on January 12.