Investing in Toll Brothers: A Must-Know Company Overview

Toll Brothers is primarily engaged in the development of attached and detached homes in luxury residential communities. It’s a dominant player in the luxury segment with very few comparable competitors.

Sept. 16 2015, Updated 5:25 p.m. ET

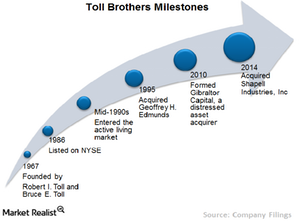

Toll Brothers’ history

Headquartered in Horsham, Pennsylvania, Toll Brothers (TOL) was founded in 1967 by Robert I. Toll and Bruce E. Toll. The company went public in 1986. Since its inception, Toll Brothers has expanded to 50 markets located throughout 19 states as well as Washington, DC.

Toll Brothers is a fortune 1000 company with a rank of 791. Two of the company’s major competitors, Lennar (LEN) and D.R. Horton (DHI), are fortune 500 companies with respective ranks of 364 and 354.

Toll Brothers’ competitors

Toll Brothers (TOL) is one of the largest homebuilding companies in the United States. The company competes with numerous homebuilders of varying sizes, ranging from local to national in scope. Some of these competitors have greater financial resources than Toll Brothers.

Major competitors of Toll Brothers (TOL) in the homebuilding space include Texas-based D.R. Horton (DHI), Miami-based Lennar (LEN), Atlanta-based PulteGroup (PHM), and Los Angeles-based KB Home (KBH).

Toll Brothers is primarily engaged in the development of attached and detached homes in luxury residential communities. Toll Brothers (TOL) is a dominant player in the luxury segment with very few comparable competitors. The other major players are primarily into single-family attached and detached homes.

ETFs to consider

Investors looking for diversification in the homebuilding sector can consider ETFs like the SPDR S&P Homebuilders ETF (XHB) and the iShares US Home Construction ETF (ITB). Toll Brothers (TOL) forms 7.78% of the iShares US Home Construction ETF (ITB) holdings.

In the next part of this series, we’ll explore Toll Brothers’ key business segments.