How The Rising Dollar Is Causing Oil Prices To Fall

A rising dollar has and will continue to put downward pressure on oil prices, causing trouble for the energy sector (XLE).

Nov. 20 2020, Updated 11:45 a.m. ET

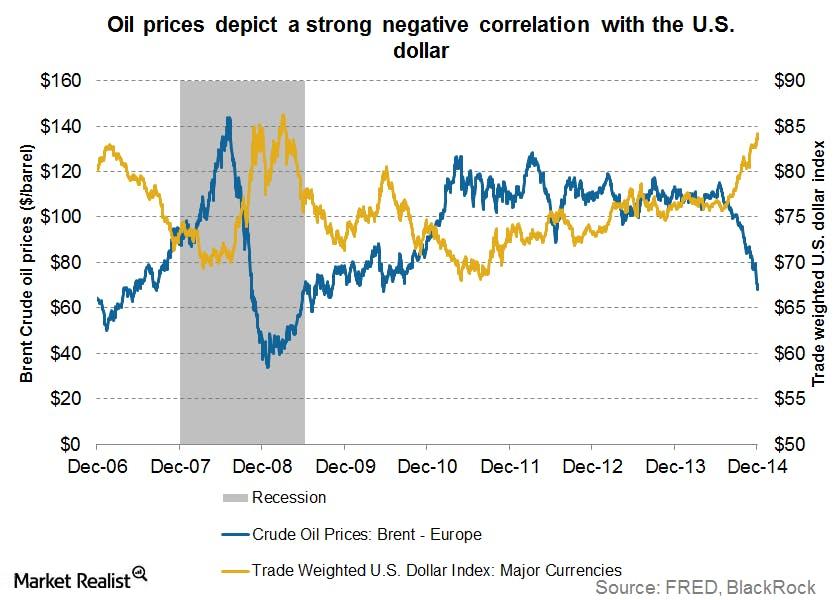

Another important relationship is that with the dollar. Commodities such as oil are dollar denominated and oil can be viewed as another store of value, much like gold or FX. With a rise in dollar, the value of oil relative to the dollar falls. The correlation between changes in the U.S. dollar and oil prices has been quite strong historically (see chart below), and indeed, the fall in crude oil prices has coincided with the strength of the dollar, strength that reflects stronger relative U.S. economic performance.

Market Realist – The US dollar (UUP) plays a pivotal role in the price movements of commodities like gold (GLD) and oil (BNO). The US economy has steadily improved, lifting itself out of the recession caused by the US financial crisis (XLF) of 2008. This has led to a strengthening in the US dollar and a rise against most other currencies. As explained above, since oil is US-dollar denominated, the rising dollar indicates a fall in the value of oil relative to the US dollar. The graph above shows the correlation between the US dollar and oil prices.

The value of the dollar is only set to increase going ahead. The Federal Reserve is likely to increase interest rates in 2015. With other central banks in Japan (EWJ), Europe (EZU), and China (FXI), pumping in liquidity, this is likely to widen interest-rate differentials. The US will continue to look like a more attractive investment opportunity. And that’s likely to support the dollar in the months ahead.

Another factor might put upward pressure on the dollar in the future. According to the Bank for International Settlements, or BIS, emerging market (EEM) firms have assumed significant dollar-denominated debts in the past few years. The fall in local currencies could affect the creditworthiness of the corporates. The rollover risks might even trigger defaults. The strain on corporates could snowball into financial strain for the entire economy. This could spur capital flight, causing a further rise in the dollar and entrapping the emerging market firms in a catch-22 situation.

A rising dollar has and will continue to put downward pressure on oil prices, causing trouble for the energy sector (XLE).

In the next part of the series, you’ll learn about the various economic implications of the drop in oil.