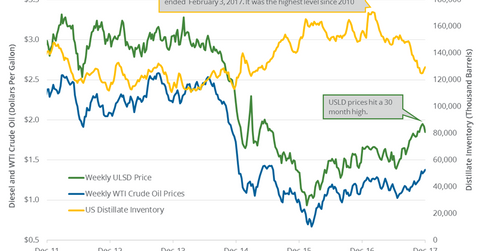

Are US Distillate Inventories Bearish for Oil Prices?

US distillate inventories rose by 1,667,000 barrels or 1.3% to 129.4 MMbbls (million barrels) on November 24–December 1, 2017.

Nov. 20 2020, Updated 1:42 p.m. ET

US distillate inventories

US distillate inventories rose by 1,667,000 barrels or 1.3% to 129.4 MMbbls (million barrels) on November 24–December 1, 2017. However, inventories fell by 27.2 MMbbls or 17.4% from the same period in 2016.

Wall Street analysts estimated that US distillate inventories would have risen by 0.9 MMbbls on November 24–December 1, 2017. A larger-than-expected rise in distillate inventories weighed on US diesel and oil (USO) (USL) prices on December 6, 2017. US diesel futures fell 2.7% to $1.86 per gallon on the same day.

Lower oil (DWT) prices are bearish for oil producers (FXN) (IEO) like Stone Energy (SGY), Chevron (CVX), Anadarko Petroleum (APC), and Denbury Resources (DNR).

Likewise, lower diesel prices are bearish for refiners (CRAK) like CVR Energy (CVI), Alon USA Energy (ALJ), and Tesoro (TSO).

US distillate production and demand

US distillate production rose by 118,000 bpd (barrels per day) or 2.2% to 5.4 MMbpd (million barrels per day) on November 24–December 1, 2017. The production also rose by 319,000 bpd or 6.3% from the same period in 2016.

US distillate demand fell by 145,000 bpd to 3.7 MMbpd on November 24–December 1, 2017. However, the demand rose by 33,000 bpd or 0.9% from the same period in 2016.

Impact

US distillate inventories rose for the third straight week. They’re also above their five-year average, which is bearish for diesel and oil (UWT) prices.

For updates on oil and gas, read Crude Oil Traders: 2 Key Indicators to Watch and Key Catalysts for US Natural Gas Prices Next Week.