Libya’s Crude Oil Production Nears 4-Year High: What’s Next?

Libya is an OPEC member but was exempt from the production cut deal due to political and economic instability.

Nov. 20 2020, Updated 2:14 p.m. ET

Crude oil futures

September WTI (or West Texas Intermediate) crude oil (RYE) (SCO) (BNO) futures contracts trading on NYMEX fell 0.73% to $48.8 per barrel in electronic trading at 2:05 AM EST on August 2, 2017. Prices fell due to the API’s (American Petroleum Institute) bearish crude oil inventory report and a rise in Libya’s crude oil production.

Lower crude oil prices have a negative impact on oil and gas producers such as Sanchez Energy (SN), ExxonMobil (XOM), Chevron (CVX), and Goodrich Petroleum (GDP).

Libya’s crude oil production

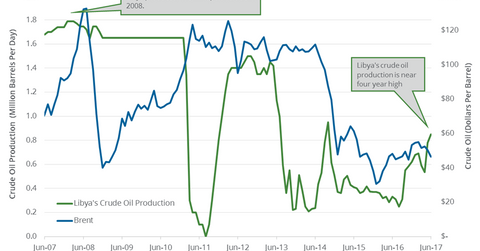

Libya is an OPEC member but was exempt from the production cut dealproduction cut deal due to political and economic instability. A Reuters survey estimates that Libya’s crude oil output rose by 180,000 bpd (barrels per day) in July 2017 compared to the previous month. Production is near a four-year high.

The EIA (U.S. Energy Information Administration) estimates that Libya’s crude oil production averaged 0.38 MMbpd in 2016. If Libya’s production averages 0.8 MMbpd in 2017, it would offset one-third of the reduced production from OPEC’s production cut dealproduction cut deal.

An OPEC and non-OPEC monitoring committee meeting was held on July 24, 2017, in Russia. Meeting participants decided to allow Libya to increase production as high as 1.25 MMbpd. Production has risen 60% since January 2017. Libya can ramp up production by 22% from current levels.

OPEC meeting

OPEC and non-OPEC producers will meet August 7 through August 9 in Abu Dhabi to discuss the faltering compliance in regards to the production cut dealproduction cut deal.

Iraq stated that it is complying 100% with the production cut dealproduction cut deal. However, secondary sources say that its production has risen. Kuwait and the UAE have since signaled they will boost compliance. Meanwhile, OPEC’s production rose in July to a 2017 high.

Next, we’ll look at API’s crude oil and gasoline inventories.