Libya’s Crude Oil Production: Bears Could Control Oil Prices

Libya’s crude oil production was at 1,030,000 bpd in July 2017. Production has risen ~60% from its levels in January 2017.

Nov. 20 2020, Updated 5:18 p.m. ET

Crude oil prices

September West Texas Intermediate crude oil (XLE) (XOP) futures contracts fell 0.3% and were trading at $49.26 per barrel in electronic trade at 1:40 AM EST on August 8, 2017. Prices are near a two-month high.

Higher crude oil (RYE) (USL) prices have a positive impact on oil and gas producers such as ExxonMobil (XOM), Northern Oil & Gas (NOG), and Triangle Petroleum (TPLM).

Libya’s crude oil production

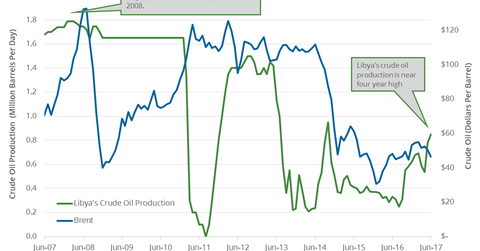

The NOC (National Oil Corporation) of Libya reported that production from Libya’s Sharara field was disrupted due to militant attacks. On August 7, 2017, the NOC reported that production from Libya’s Sharara field has returned to normal. The Sharara field produces 270,000 bpd (barrels per day) of crude oil. It’s equal to 25% of Libya’s crude oil production. Libya’s crude oil production hit almost a four-year high in July 2017.

Libya’s crude oil production was at 1,030,000 bpd in July 2017. Production has risen ~60% from its levels in January 2017. Libya was exempt from OPEC’s production cut deal due to economic and political instability.

An OPEC and non-OPEC monitoring committee meeting was held on July 24, 2017, in Russia. Meeting participants decided to allow Libya to increase production as high as 1.25 MMbpd. However, an official declaration on capping hasn’t been announced. Any rise in production in Libya could pressure crude oil prices. Lower crude oil (USO) (UCO) prices have a negative impact on oil and gas producers such as Northern Oil & Gas and Triangle Petroleum.

OPEC and non-OPEC producers’ technical committee meeting was held in Abu Dhabi on August 7–8, 2017. For more on this meeting, read the previous part of the series.

In the next part, we’ll look at how Saudi Arabia’s crude oil production and exports impact crude oil prices.