Investment Avenues during the Rise of Short-Term Interest Rates

Bill Gross thinks the central banks should implement their strategies very carefully and cautiously in this scenario.

Nov. 20 2020, Updated 11:55 a.m. ET

Bill Gross’s view on short-term interest rates

In the previous part of this series, we saw that Bill Gross is worried about both the equity (QQQ) (SPY) and bond markets (BND). He also believes that the central banks’ changes in strategy could push short-term interest rates higher than the long-term interest rate.

Gross believes this situation could lead to the next recession in the global economy (ACWI). He believes a gradual rate hike is good for the economy since zero interest rates inflated asset prices and economic growth. It’s difficult to achieve real economic growth during an ultra-low interest rate environment. He thinks the central banks should implement their strategies very carefully and cautiously. A gradual rate hike is also appropriate when economies are showing stronger movements.

Investing in high-yield bonds and short-term bond ETFs

Investors generally invest in high-yield bonds (BND) when there are expectations for higher economic growth (VFINX) (IWM). Investors could also look at short-term bond ETFs in this kind of scenario.

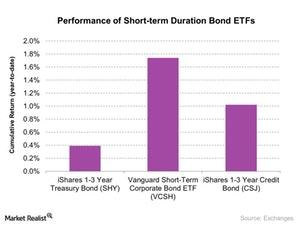

Performances of high-yield bonds and short-term bond ETFs

Some high-yield bond ETFs such as the iShares 0-5 Year High Yield Corporate Bond (SHYG), the SPDR Barclays Short Term High Yield Bond (SJNK), the PowerShares Senior Loan ETF (BKLN), and the PIMCO 0-5 Year High Yield Corporate Bond ETF (HYS) returned 3.5%, 3.5%, 0.75%, and 3.8%, respectively, on a YTD (year-to-date) basis as of July 20, 2017.

The iShares 1-3 Year Treasury Bond (SHY), which tracks the performances of short-term duration bonds, rose nearly 0.39% on a YTD basis as of July 20, 2017.

You also may be interested in reading Ray Dalio to Investors: “Keep Dancing but Closer to the Exit.”