PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund

Latest PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund News and Updates

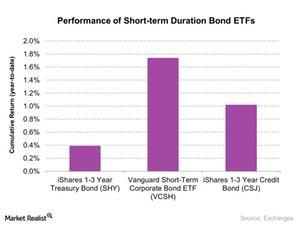

Investment Avenues during the Rise of Short-Term Interest Rates

Bill Gross thinks the central banks should implement their strategies very carefully and cautiously in this scenario.

Will Fallen Angel Bonds Continue to Capture Solid Returns?

VanEck How fallen angels may complement high yield portfolios Income investors may want to consider fallen angels as a complement to their high yield bond allocations given their higher credit quality. Fallen angels’ higher average credit quality than original-issue high yield bonds may help absorb more of the potential broader market volatility that may occur […]

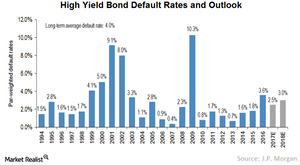

Why High-Yield Bonds Are Needed in a Portfolio

AB Summing It Up High-yield bonds present an alternative for investors at an uncertain crossroads. Equity valuations seem attractive based on some measures, but volatility has led many investors to search for ways to temper the risk in their portfolios. At the same time, bonds—a popular risk reducer—are less attractive than normal due to extremely […]

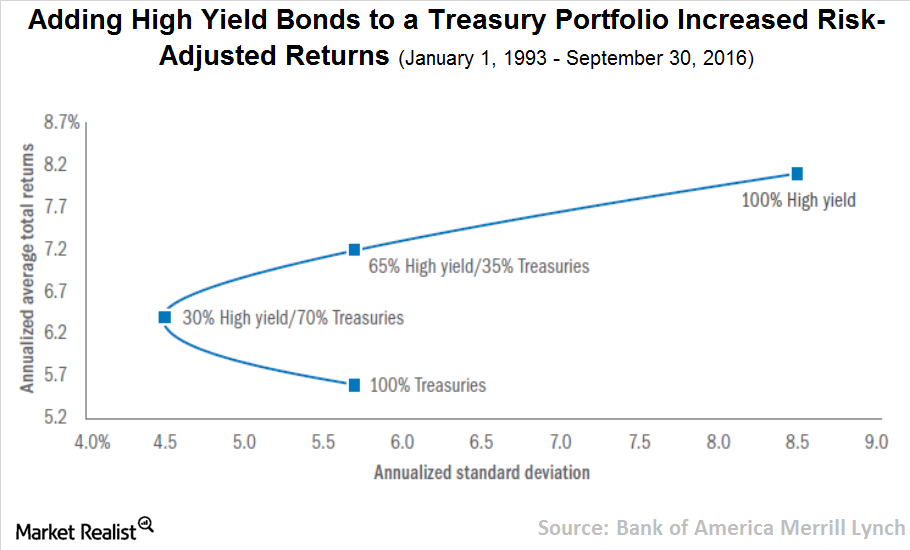

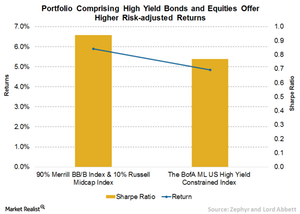

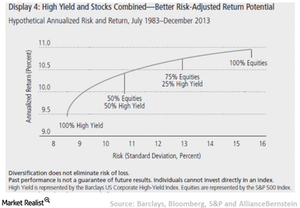

What Role Do High Yield Bonds Play in a Portfolio?

AB High Yield in the Portfolio Framework Given their higher risk levels, we’d expect that stocks would continue to outperform high yield over the long run. However, high-yield bonds have clearly demonstrated that they bring much to the table if they’re combined with stocks in a carefully designed and maintained portfolio. But not every investor […]

How Portfolio Rebalancing Boosts Overall Returns

AB Rebalancing in the Tails Because stocks have been so much more volatile than high yield, periodic portfolio rebalancing tends to occur during performance extremes—the “tails” in return distributions—when the gap between high-yield and equity returns is wide. This magnifies the “buy-low, sell-high” effect that rebalancing contributes to a portfolio’s performance. Of course, the gaps […]

How High-Yield Bonds Can Help Reduce Risk

AB A Place at the Asset-Allocation Table For investors seeking to control volatility in their equity portfolios while still maintaining return potential, high-yield bonds could represent an effective solution. A typical approach to moderating equity volatility is to reallocate assets to the greater stability of investment-grade bonds, or even cash. But this can exact a […]

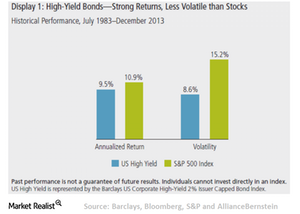

Why High Yield Bonds Are an Effective Match with Equities

AB Keeping Pace with Equity Returns over Time In fact, when we widen the lens to take in the last three decades, high-yield bonds have nearly matched equity performance. And they’ve done it with much lower volatility. Since July 1983, stocks have produced an annualized return of 10.9% (Display 1). High-yield bonds have nearly equaled […]

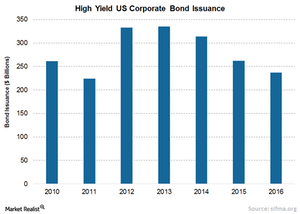

Why High Yield Bonds Are Attractive

In this series, we’ll discuss the many advantages of high yield bonds, their correlation with other asset classes, the rise of global high yield markets, and why high yield bonds should command a place in a portfolio.