Crude Oil Prices Rose above the 200-Day Moving Average

WTI (West Texas Intermediate) crude oil (USO) (UCO) (XLE) futures contracts for May delivery rose 2.4% and settled at $49.51 per barrel on March 29, 2017.

Nov. 20 2020, Updated 4:42 p.m. ET

Crude oil prices

WTI (West Texas Intermediate) crude oil (USO) (UCO) (XLE) futures contracts for May delivery rose 2.4% and settled at $49.51 per barrel on March 29, 2017. Broader markets (SPY) (SPX-INDEX) also rose 0.1% to 235.5 on March 29, 2017. Oil and gas are major parts of the energy sector. The energy sector contributed to ~6.5% of the S&P 500 as of March 24, 2017.

US crude oil prices rose to almost a three-week high due to the following factors:

- short covering from almost a four-month low

- larger-than-expected fall in gasoline and distillate inventories

- less-than-expected fall in US crude oil inventories from March 17–24, 2017

- higher compliance among OPEC producers with major producers’ production cut deal in March 2017—Reuters survey shows 95% and 94% compliance in March 2017 and February 2017 with targeted production cuts

- supply outage in Libya

- possible extension of major producers’ production cut deal

However, the recovery in crude oil prices would be short-lived due to the following data:

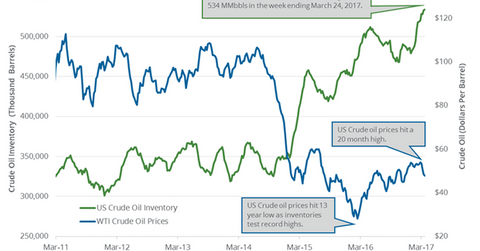

- rise in US crude oil inventories to a new record from March 17–24, 2017

- rise in weekly US crude oil production to a 13-month high

- rise in the US dollar (UUP) for the third straight day—near a 14-year high

- rise in US crude oil rigs

Crude oil volatility index and moving averages

The Crude Oil Volatility Index fell 4.6% to 28.5 on March 29, 2017. It hit 24.7 on March 1, 2017—the lowest level since October 2014. High crude oil volatility in March 2017 suggests more downfall for crude oil prices.

However, crude oil prices rose above their 20-day and 200-day moving averages of $48.5 and $49.4 per barrel as of March 29, 2017. Prices rose due to the factors mentioned above. Moves in crude oil prices can impact oil and gas producers’ earnings like Hess (HES), ExxonMobil (XOM), Matador Resources (MTDR), and SM Energy (SM).

In this series

In this series, we’ll look at US crude oil production, refinery demand, imports, and inventories. We’ll also look at gasoline inventories.

We’ll start by looking at US crude oil prices in early morning trade on March 30, 2017.