Will Demonetization in India Impact Your Loan Burden?

Banks saw a rise in term deposit accounts since the demonetization. As a result, commercial banks sharply reduced their deposit rates.

Nov. 23 2016, Updated 10:04 a.m. ET

Rates are already on the decline

After the demonetization announcement on November 8, Indian banks saw a rise in deposits. According to data from the Reserve Bank of India released on November 21, deposits crossed the 5 trillion rupee mark from November 10 until November 18. At 68.2 rupees to one US dollar, it translates to $75 billion in deposits in just eight banking days.

Banks also saw a rise in term deposit accounts since the demonetization. Due to these factors, commercial banks like State Bank of India, ICICI Bank (IBN), HDFC Bank (HDB), and Punjab National Bank, among a host of others, sharply reduced their deposit rates.

Loan burden will also fall

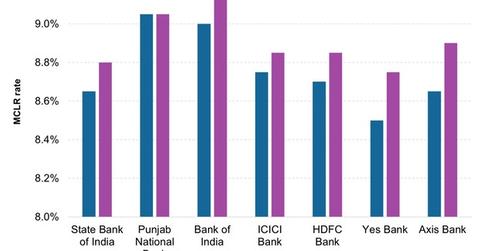

Apart from cutting deposit rates, banks reduced their lending rates as well. In India, loans sanctioned from April 1 are with reference to the MCLR (Marginal Cost of funds-based Lending Rate), instead of the Base Rate, which was used earlier.

It will translate into lower interest rates on existing floating rate loans and new loans. The reduction in lending rates is expected to stoke lending by tempting consumers to take out loans for purchasing expensive consumer discretionary items like vehicles and houses.

Demonetization can help monetary transmission

Monetary policy transmission is the translation of monetary policy actions into the financial system through banking and trading channels. The RBI (Reserve Bank of India) has been on a rate reduction cycle since January 2015. Before the January 2015 meeting, the repo rate stood at 8%. Its journey from that level to 6.3% currently includes six rate cuts totaling 175 basis points. However, banks have been slow in transmitting the benefit to consumers.

After being flush with deposits, it’s expected that banks will reduce their lending rates sizably, improve monetary transmission, and benefit consumers—both corporate (RDY) (VEDL) (WIT) and individual.

Any increase in economic activity due to more consumption on account of lower rates can be beneficial to India-focused funds (EPI) (FINGX) as well.

In the next part, let’s see how demonetization could impact India’s financial markets.