Are Commodities a Boon or a Bane for Brazil?

Brazil (EWZ) is rich in commodities. It’s among the top producers and exporters of iron ore, crude petroleum, soybeans, sugar, and meat.

Nov. 20 2020, Updated 4:22 p.m. ET

Brazil is commodity rich

Brazil (EWZ) is rich in commodities. It’s among the top producers and exporters of iron ore, crude petroleum, soybeans, sugar, and meat. Commodities have long served as the backbone of Brazil’s economic growth.

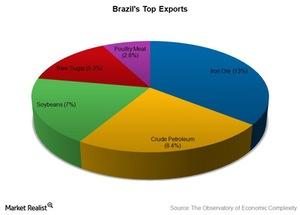

As can be seen from the above chart. Brazil’s exports are primarily dominated by commodities. Its top five exports account for 37% of its total exports. The top five exports are all commodities. Iron ore producers—like Vale (VALE), Gerdau (GGB), and Companhia Siderúrgica Nacional (SID), oil firms —like Petrobras (PBR) (PBRA), and meat producers—like BRF (BRFS) dominate the business landscape in Brazil. Given the above dependency, let’s move on to analyze commodities. Are they a boon or a bane for Brazil?

Boon

Brazil reaped the benefits from the commodity boom from 2010 to 2012. During this period, the value of commodity exports from Brazil grew substantially. There are two important points to note here:

- A major chunk of the commodity exports was destined to China. China was experiencing an industrial boom during that period with two-digit growth rates.

- Commodity prices were up and favorable. They contributed to a positive trade balance for the economy. In February 2011, iron ore was around $180 per dry metric ton, crude petroleum was at $100 per barrel, soybeans were at $500 per metric ton, and sugar was trading at $0.29 per pound.

Both of these instances caused Brazil’s current state.

Bane

- China’s growth has stalled. Its growth rate has slowed to less than 8% on an annual basis. Currently, it’s at 7%. China’s industrial boom has reversed its trend too. The industrial production growth rate averaged around 14% in 2010–2012. Now, it’s less than half that rate.

- Commodities prices have fallen. From what they were in February 2011, they have fallen a decent amount. As of August 2015, iron ore is around $55 per dry metric ton, crude petroleum is down to $45 per barrel, soybeans are being sold at around $350 per metric ton, and sugar is trading at $0.10 per pound.

Taking a look at the import side, China accounts for about 15% of Brazilian imports. With production down in China, you would expect the impact to trickle down to Brazil as well.

Also, there’s the political situation and the scandals that continue to negatively impact Brazil’s image as an appropriate investment destination.