BRF SA

Latest BRF SA News and Updates

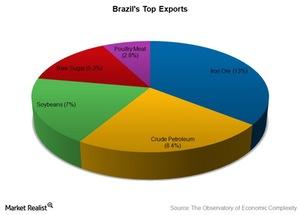

Are Commodities a Boon or a Bane for Brazil?

Brazil (EWZ) is rich in commodities. It’s among the top producers and exporters of iron ore, crude petroleum, soybeans, sugar, and meat.

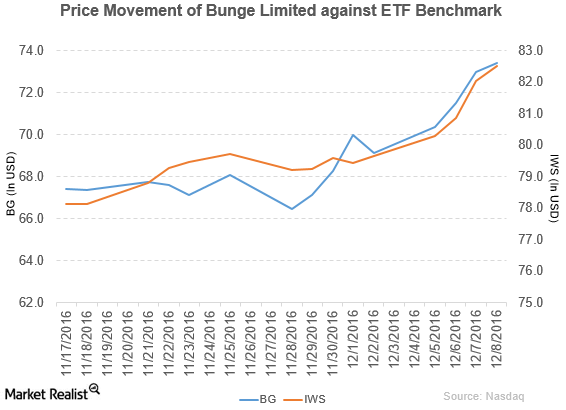

Bunge Limited Has Declared Dividends

Price movement Bunge Limited (BG) has a market cap of $10.4 billion. It rose 0.55% to close at $73.40 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.9%, 5.4%, and 10.4%, respectively, on the same day. BG is trading 7.8% above its 20-day moving average, 14.4% […]

Why Did Bunge Limited Issue Senior Notes?

Bunge Limited (BG) has declared a regular quarterly cash dividend of $0.42 per share on its common stock. The dividend will be paid on December 2, 2016, to shareholders of record on November 18, 2016.

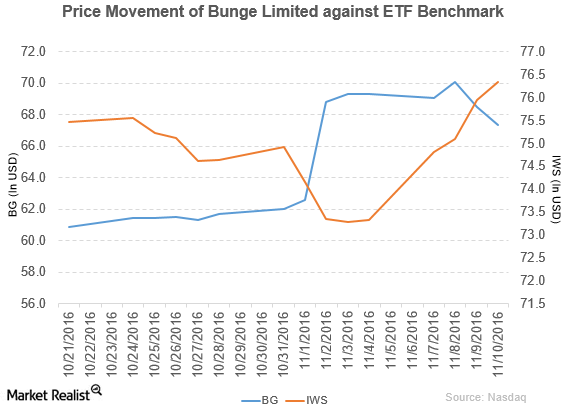

How Did Bunge Perform in 3Q16?

Bunge (BG) has a market cap of $9.6 billion. It rose 10.0% to close at $68.81 per share on November 2, 2016.

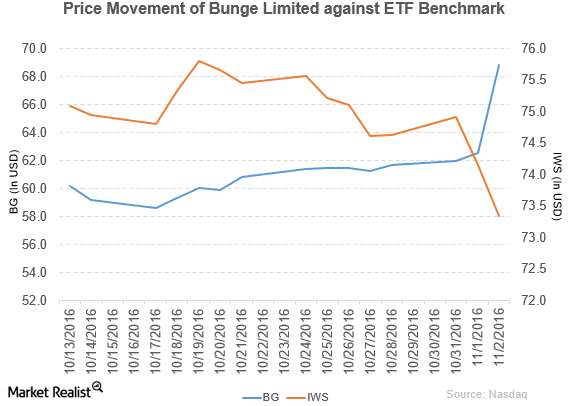

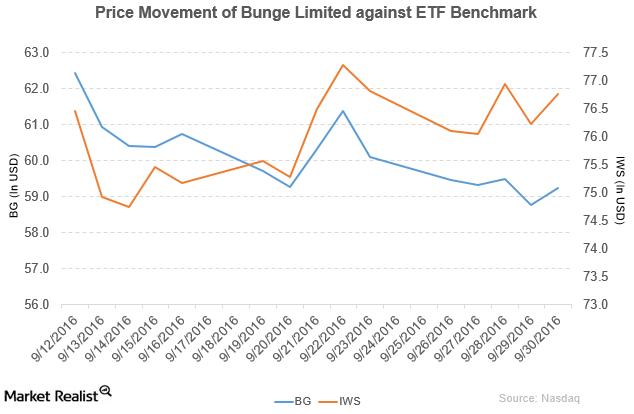

Bunge to Partner with Oleo-Fats

Bunge (BG) has a market cap of $8.3 billion. It rose 0.80% to close at $59.23 per share on September 30, 2016.

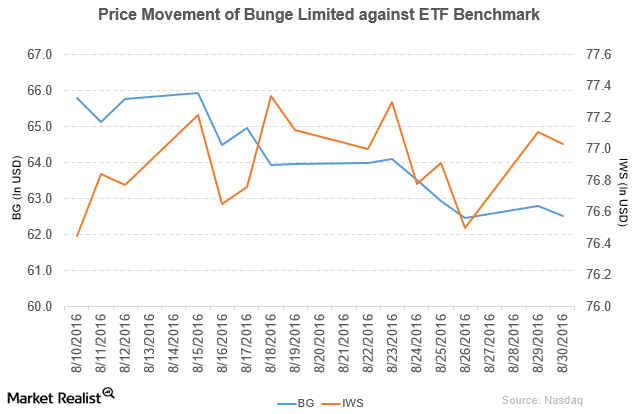

Bunge’s New Investment to Increase the Value of Its Business

Bunge (BG) has a market cap of $8.8 billion. It fell by 0.45% to close at $62.52 per share on August 30, 2016.

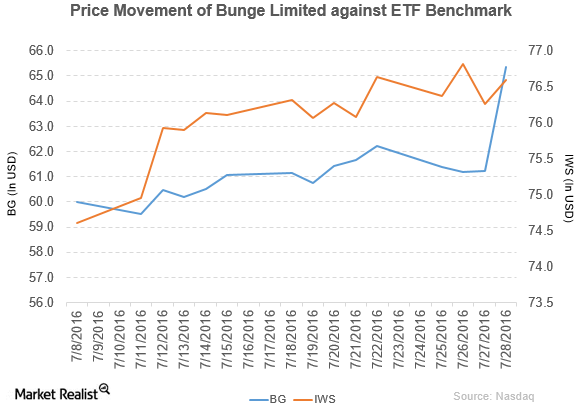

Bank of America/Merrill Lynch Upgraded Bunge Limited to a ‘Buy’

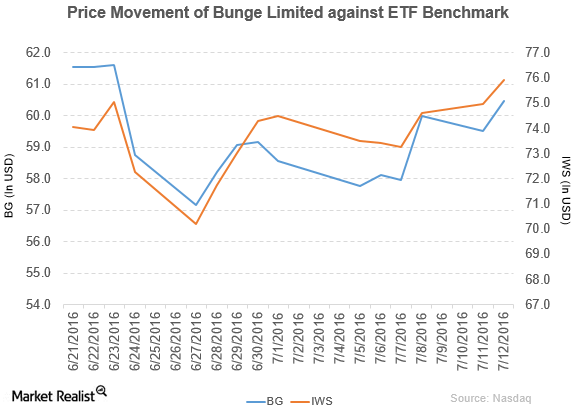

Bunge Limited (BG) has a market cap of $8.8 billion. It rose by 0.48% to close at $63.33 per share on August 2, 2016.

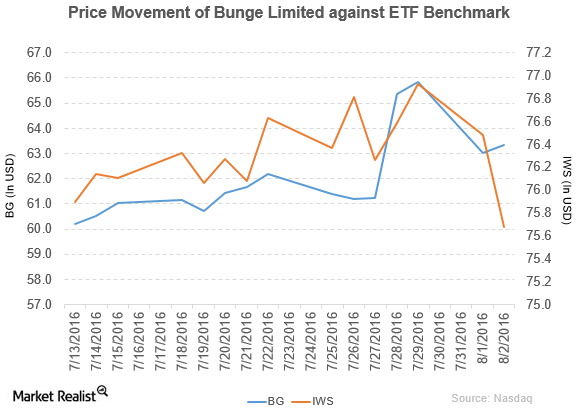

Why Bunge’s Limited Bottom Line Rose in 2Q16

Bunge Limited (BG) has a market cap of $9.1 billion. It rose by 6.7% to close at $65.35 per share on July 28, 2016.

BB&T Capital Rated Bunge a ‘Buy’

Bunge reported 1Q16 net sales of $8.9 billion, a decline of 17.5% compared to net sales of $10.8 billion in 1Q15.

Bunge and Wilmar Form Joint Venture to Increase Market Share

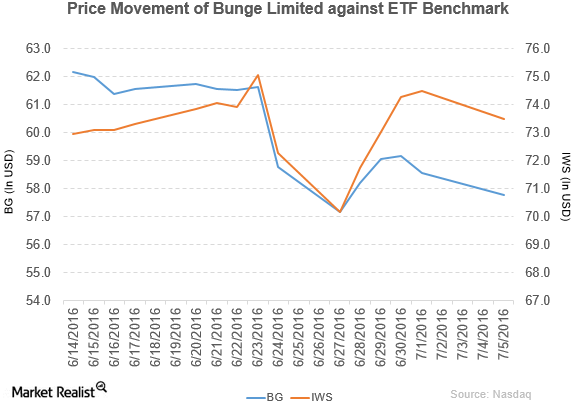

Bunge Limited (BG) has a market cap of $8.2 billion. Its stock fell by 1.4% to close at $57.76 per share on July 5, 2016.

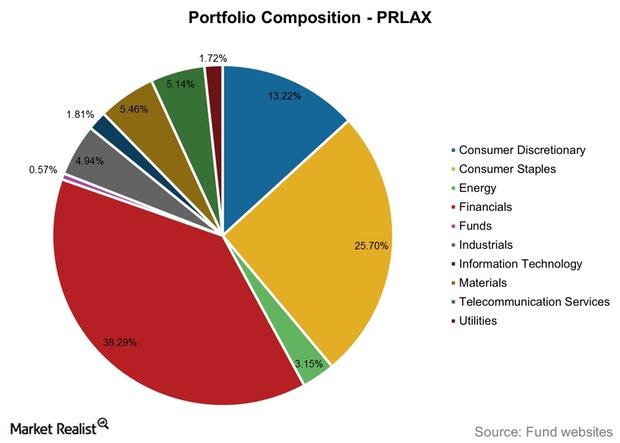

The T. Rowe Price Latin America Fund (PRLAX): Important Facts

The T. Rowe Price Latin America Fund (PRLAX) is offered by T. Rowe Price. The fund seeks long-term growth of capital.