Encana: The Effect of Declining Natural Gas Prices

In this series, we’ll take a look at the effect of declining natural gas prices on Encana. We’ll also cover its May 17 Presentation for Investors on its Montney Resource Play.

May 24 2016, Published 9:29 a.m. ET

Natural gas prices are in a downtrend

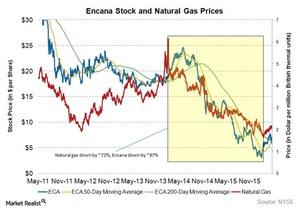

The “lower-for-longer” trend in natural gas prices over the last two years has seen the value of natural gas decline by ~72%. It has also taken its toll on natural gas producers. When natural gas prices are in decline, profit margins for natural gas producers are adversely affected. Their stock prices fall along with natural gas prices. Encana (ECA) is no exception. Its stock price has fallen ~87% since natural gas prices peaked in February 2014.

The stock of other natural gas producers also fell. Pioneer Natural Resources (PXD), EOG Resources (EOG), ConocoPhillips (COP), and Southwestern Energy (SWN) saw share prices fall ~40%, ~39%, ~51%, and ~84%, respectively, in the same period. Movements in natural gas (GASX) (UNG) prices also affect the VelocityShares 3X Long Natural Gas ETN (UGAZ) and the VelocityShares 3x Long Natural Gas ETN (DGAZ).

Encana’s downtrend

As you can see in the above chart, Encana’s stock price is in a downtrend with a clear pattern of lower highs and lower lows. When natural gas prices were in an uptrend from mid-2012 to February 2014, Encana’s stock price displayed poor relative performance and was bound in a range of $15–$24. This set the stage for a steep decline when natural gas prices started to fall in February 2014. The result was steep reductions in earnings due to lower natural gas prices.

In this series

On May 17, 2016, Encana held its Presentation for Investors on its Montney Resource Play in Canada. In this series, we’ll see what Encana’s management is thinking about Montney. We’ll also take a close look at the most interesting fundamental points outlined by Encana in its Montney presentation. Finally, we’ll see what Wall Street analysts are saying about Encana after the presentation.

Let’s start by seeing why Montney is Encana’s core resource play.