Bearish Crude Oil Market Has Put $5 Trillion at Risk

The depressed energy market has erased just over $1 trillion of market capitalization from oil and gas companies around the globe.

Dec. 29 2015, Published 7:21 a.m. ET

Crude oil market threat

US crude oil prices have fallen almost 30% in 2015 and almost 65% since the peak in June 2014. Crude oil is a big threat not only for top energy firms around the world but also for the financial market, as energy is an important sector in the broader market. The depressed energy market has erased just over $1 trillion of market capitalization from oil and gas companies around the globe. Around $2 trillion of bonds sold by oil and gas companies since 2010 have been hammered by the downturn in the energy market and are at risk of a credit rating downgrade. The possibility of default is rising. European government bonds worth more than $2 trillion have given returns of less than zero due to the turmoil in the oil market and oil-driven deflation.

Currency market

The crude oil bear market has also affected commodity-exporting giants like Russia and Brazil. The currencies of these countries have collapsed, and massive funds have flown out of emerging markets in 2015.

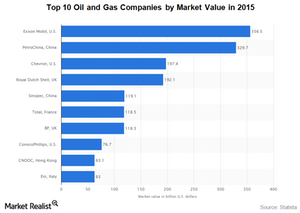

The low oil prices are affecting investments in oil and gas projects. Low oil prices and rising US interest rates in 2016 will continue to put pressure on corporate credit and emerging markets. Some of the top oil companies like ExxonMobil (XOM), PetroChina (PTR), Royal Dutch Shell (RDS.A), Eni (ENI), Total (TOT), Chevron Corporation (CVX), and BP (BP) have posted their lowest profits in many years due to the collateral damage of crude oil prices.

Bond market

The depressed oil market could curb the demand for US bonds by 30% in 2016. The market consensus suggests that around $300 billion of Treasuries will be issued in 2016. This is 50% of 2015 levels. The turmoil in the oil market could have a contagion effect in the broader market (SPY) and other assets classes in 2016.

The uncertainty in oil and gas prices also affects ETFs such as the iShares US Oil Equipment & Services ETF (IEZ), the Vanguard Energy ETF (VDE), and the First Trust Energy AlphaDEX Fund (FXN).