Nike: 5-Year Returns Targets for Shareholders

At its 2015 Investor Day held on September 14, Nike briefed the financial community on its targets for generating value for shareholders.

Nov. 20 2020, Updated 3:13 p.m. ET

Value for shareholders

At its 2015 Investor Day held on September 14, Nike (NKE) briefed the financial community on its targets for generating value for shareholders. The company is targeting returns in the top quartile of the S&P 500 Index (SPY) (VOO) (IVV) over the next five years.

Increasing returns and economic moat

Nike also expects to expand its returns and capital productivity metrics. Nike expects to see return on invested capital, or ROIC, come in at the high-twenties to low-thirties percentage, over the next five years.

Nike’s economic moat has been steadily widening over the past few years. A combination of rising returns and market share and lower cost of capital has seen the gap widen.

The economic reality has been reflected in the market as well. Nike’s major global rival Adidas (ADDYY) has seen its market share erode steadily over the years. Adidas’ sales have hardly grown since 2012. And while newer competitors like Under Armour (UA), Skechers (SKX), and Lululemon Athletica (LULU) have sprung up to challenge Nike, the latter’s dominance in footwear is unchallenged and is likely to be for some time to come.

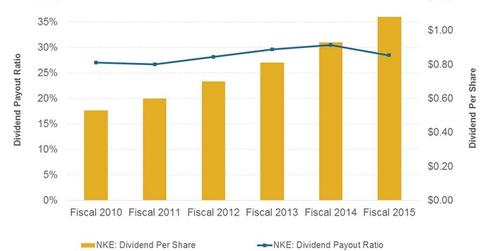

Dividend payouts

Nike is targeting a dividend payout ratio of between 25%–35% over the period from fiscal 2016–2020. The company paid out 27.6% of its earnings as dividends in the trailing-12-months, compared to 49.7% for dividend aristocrat VF Corporation (VFC).

Nike is currently providing a dividend yield of 0.86%, compared to 1.7% for VF Corporation, 1% for Columbia Sportswear (COLM), and 1.2% for Wolverine Worldwide (WWW).

Shareholder returns

Nike and most of its peers have outperformed returns on the S&P 500 Index (SPY) (IVV) (VOO) and the S&P 500 Consumer Discretionary Sector Index (XLY) (FXD) (VCR) by a wide margin over the past five years. Nike provided total average annual returns to shareholders of 27.7%, compared to[1. Returns performance computed through October 16, 2015]:

- 13.9% for the S&P 500 Index

- 18.5% for Lululemon Athletica (LULU)

- 19.7% for the S&P 500 Consumer Discretionary Sector Index

- 30.2% for VF Corporation (VFC)

- 40.4% for Skechers (SKX)

- 54.3% for Under Armour (UA)

For more sector updates and analysis, please visit our Consumer Discretionary and Retail page.