Analyzing BB&T Corporation’s 6 Operating Segments

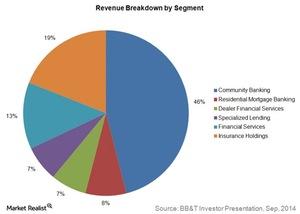

BB&T Corporation’s (BBT) operations are divided into six business segments. Community Banking contributes 46% to the total revenue.

Nov. 20 2020, Updated 2:12 p.m. ET

Operating Segments

BB&T Corporation’s (BBT) operations are divided into six business segments. Community Banking contributes 46% to the total revenue. It’s followed by Insurance Services. It contributes 19% to the total revenue. Financial Services, Residential Mortgage Banking, Dealer Financial Services, and Specialized Lending are the other segments.

Service offerings

The above graph shows the revenue breakdown by segment. Community Banking offers a variety of loan and deposit products. Apart from community and residential mortgage banking, the company offers a range of products and services.

The Dealer Financial Services segment originates loans to consumers on a prime and non-prime basis for the purchase of automobiles. It also originates loans for the purchase of boats and recreational vehicles.

The Specialized Lending segment provides specialty finance products including working capital financing, supply chain financing, export-import finance, accounts receivable management, and credit enhancement.

Insurance and other financial services

The Insurance Services segment provides property and casualty, employee benefits, and life insurance. It also provides small business and corporate services—like workers compensation and professional liability—as well as surety coverage and title insurance.

The Financial Services segment provides personal trust administration, estate planning, investment counseling, wealth management, asset management, corporate retirement services, corporate banking, and corporate trust services. It also offers clients investment alternatives, including discount brokerage services, equities, fixed-rate and variable-rate annuities, mutual funds, and governmental and municipal bonds.

Regions Financial (RF) and SunTrust Bank (STI) are other banks in the region. They also provide all of the products and services mentioned above. Together, these three banks form ~4.7% of the SPDR S&P Bank ETF (KBE) and ~2.8% of the iShares U.S. Financial Services ETF (IYG).

National banks, including the “big four” banks—Bank of America (BAC), Wells Fargo (WFC), Citigroup (C), and JPMorgan Chase (JPM)—also offer all of the services mentioned above.

Please refer our Insurance page to learn more about insurance companies.