SPDR® S&P Bank ETF

Latest SPDR® S&P Bank ETF News and Updates

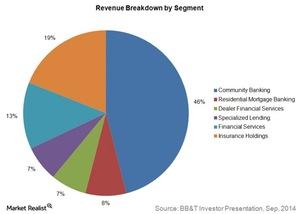

Analyzing BB&T Corporation’s 6 Operating Segments

BB&T Corporation’s (BBT) operations are divided into six business segments. Community Banking contributes 46% to the total revenue.

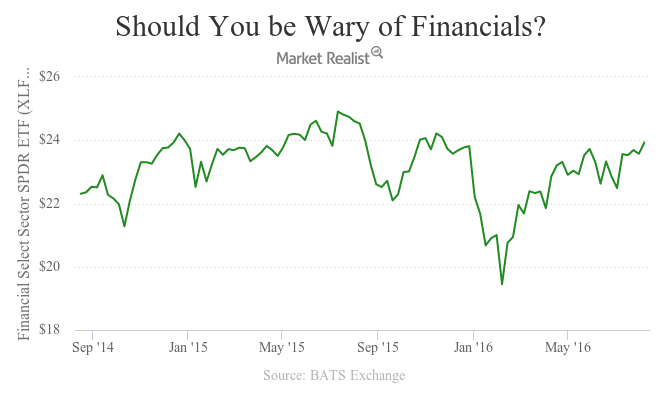

Which Sectors to Avoid if Inflation Rises

Telecom services and utilities, the traditional dividend stars, have provided a fillip to US equities in 2016.Financials Why the yield curve impacts bank profitability

Historically, a flatter yield curve had an adverse impact on the financial institutions’ returns. It lowered their net interest margins. The Fed continues to stress an accommodative monetary policy. The policy and strong overseas demand have kept yields low at the long end of the curve. As a result, the difference between 30-year and five-year Treasury yields fell to 154 basis points on September 5, 2014.

Wells Fargo: What Sets It Apart from Its Peers?

Wells Fargo (WFC) is the largest mortgage lender in the US, operating primarily as a retail and commercial bank. It is been the most profitable bank in its peer group, posting a return of 10% on shareholder’s equity and ~1.3% on assets in 2015.

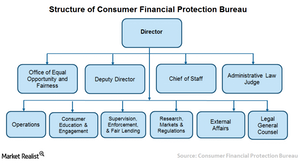

A Look at the Role of the Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau was established to protect consumers’ interests by implementing federal consumer financial laws.

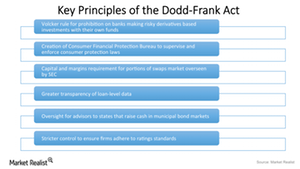

What Is the Dodd-Frank Act?

The Dodd-Frank Act is a financial reform legislation passed in an attempt to prevent events similar to the 2009 financial crisis from occurring again.

Understanding the Fed’s Financial Regulations Post-2008 Crisis

Since the financial crisis, the Fed has enforced regulations for the capital strength and liquidity of 16 systematically important financial institutions.

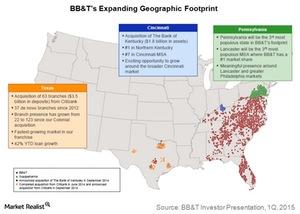

BB&T to Expand Its Footprint in Ohio and the Mid-Atlantic Region

BB&T’s Susquehanna acquisition will significantly expand BB&T’s Mid-Atlantic footprint. The deal is valued at ~$2.5 billion. It will close in the second half of 2015.