YRC Worldwide Inc

Latest YRC Worldwide Inc News and Updates

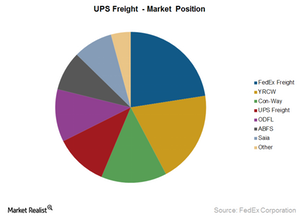

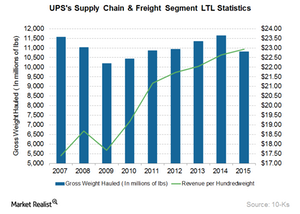

What Does UPS’s Supply Chain & Freight Segment Do?

UPS has addressed complex supply chain issues such as transportation, distribution, and international trade and brokerage services by offering a variety of services.

Who Are Old Dominion’s Biggest LTL Competitors Today?

Old Dominion’s peer group includes LTL companies that compete in the national and regional marketplace. The company also competes with some US railroads.

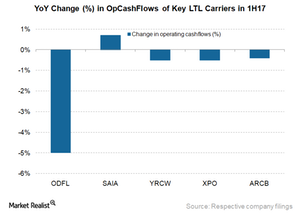

Which Less-than-Truckload Carrier Saw Highest Operating Cashflows?

In this article, we’ll analyze the operating cash flows of these LTL (less-than-truckload) carriers in 1H17.

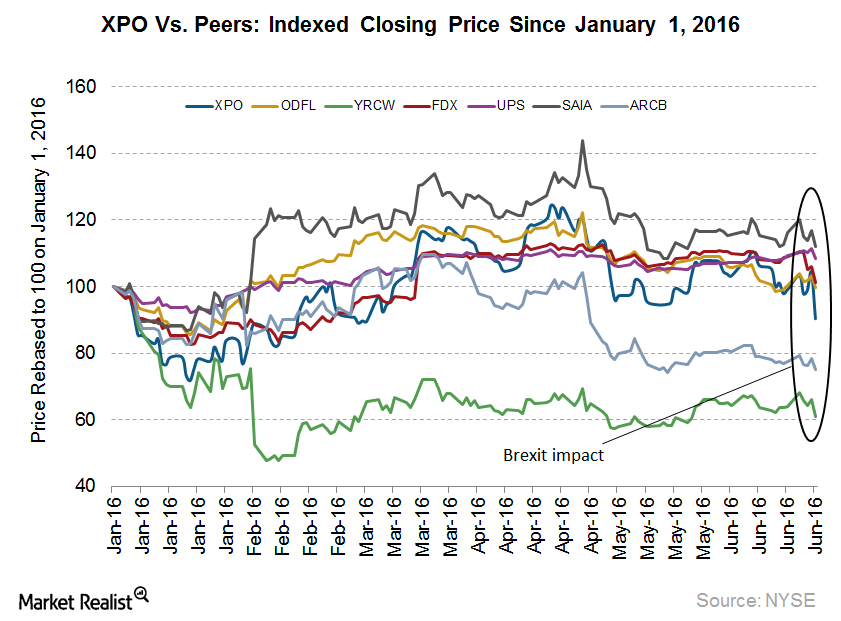

Will Brexit Continue to Impact XPO Logistics?

Following the United Kingdom’s decision to exit the European Union, XPO Logistic’s (XPO) stock fell 13.4% on June 24.

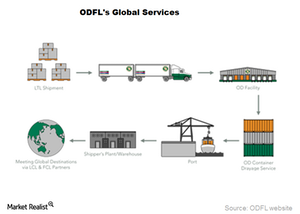

Inside Old Dominion Freight Line’s Global Services

Old Dominion unloads its less-than-truckload shipments dispatched by vendors onto an ocean container unit and onto the client’s steamship of choice.

A Deep Dive into UPS’s Supply Chain and Freight Segment

United Parcel Service’s (UPS) Supply Chain and Freight segment includes forwarding and logistics services, UPS Freight, truckload freight brokerage, and financial services through UPS Capital.

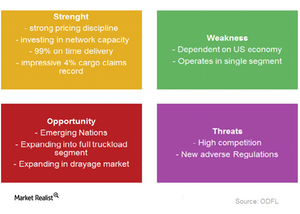

What are ODFL’s most significant strengths and weaknesses?

Old Dominion Freight Line (ODFL) has a strong pricing discipline and best-in-class service capabilities.

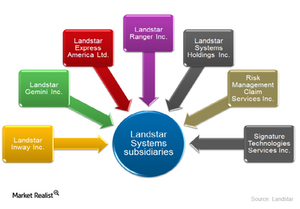

How Landstar System makes money

Landstar’s success lies in its ability to provide a complete logistics solution through various transportation modes and up-to-date technology.