Vanguard Financials ETF

Latest Vanguard Financials ETF News and Updates

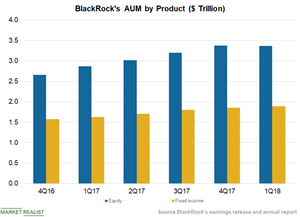

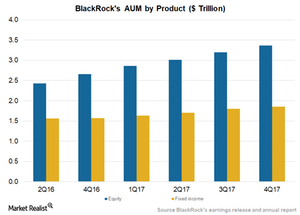

BlackRock’s Diversified Offerings Can Benefit from Rate Hikes

In the first quarter, BlackRock managed ~$1.9 trillion in fixed income offerings, up from ~$1.6 trillion in the first quarter of 2017.

Interest Rate Expectations Have Jolted Equity and Debt Alike

Asset managers (VFH) are seeking stability in order to attract funds toward either equity or debt offerings.

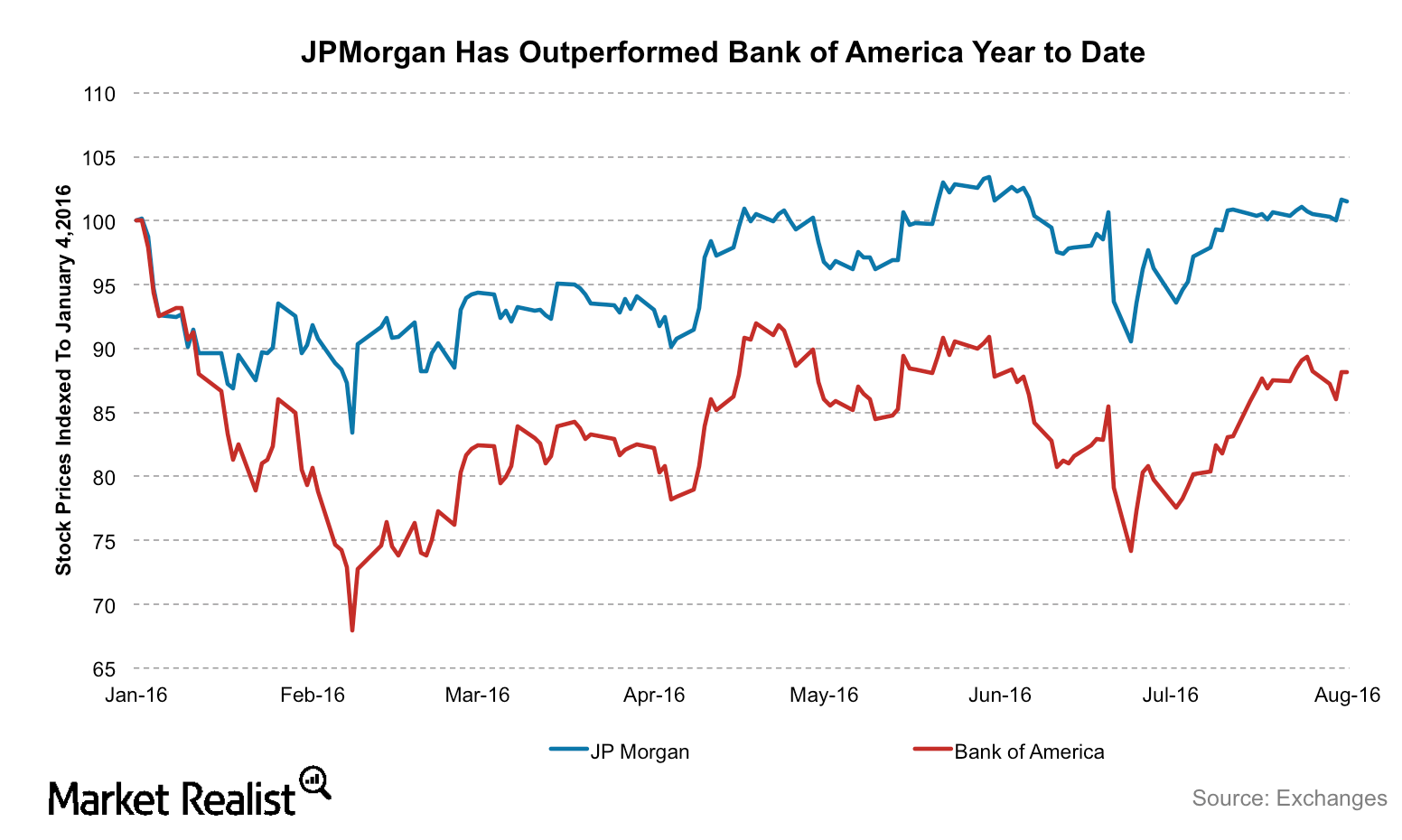

Why Deutsche Bank Prefers Bank of America over J.P. Morgan

In this series, we’ll compare Bank of America and J.P. Morgan on the basis of their 2Q earnings, profitability, cost-cutting initiatives, and interest rate sensitivities.

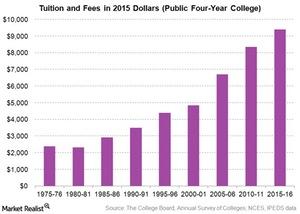

Why Is College Education So Expensive in the United States?

The rise in delinquencies on student loans in the United States (SPY) (IWM) (QQQ) can be partially attributed to the accelerated rise in college tuition and fees.

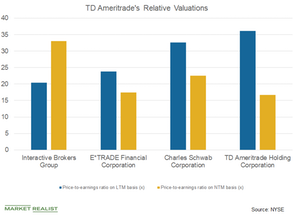

What Are TD Ameritrade’s Valuations?

TD Ameritrade’s (AMTD) PE ratio stood at 16.68x on a next 12-month basis, which implies discounted valuations.

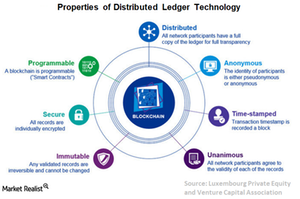

What Imparts Transparency to Digital Assets?

Digital assets based on DLT (distributed ledger technology) allows users to initiate and verify their own transactions without any central authority such as banks.

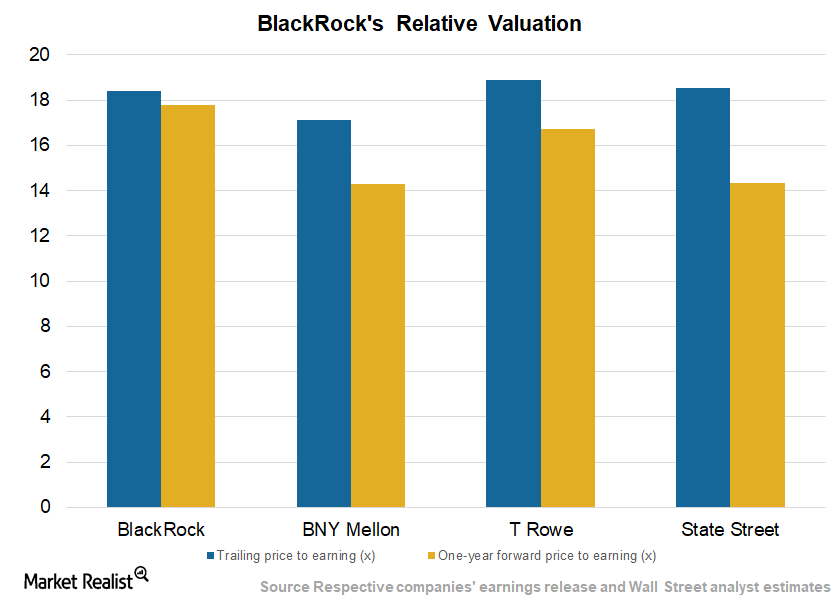

BlackRock’s Valuations Stable amid Strong Operating Performance

BlackRock is currently trading at a forward price-to-earnings ratio of 17.6x, compared with the industry average of 18.6x.

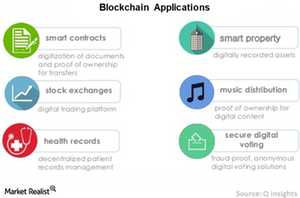

Blockchain and Bitcoin: But What Else Is Blockchain Used For?

Deutsche Bank is planning to use blockchain technology in currency settlement, trade processing, and derivative contracts.

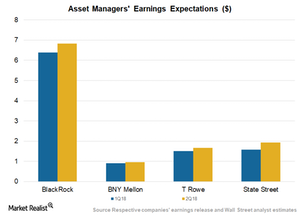

BlackRock and Competitors Look at Strong 1Q18 Numbers

Among the major asset managers, BlackRock (BLK) is expected to post sequential and year-over-year growth in earnings per share to $6.38 in 1Q18 and $6.83 in 2Q18.

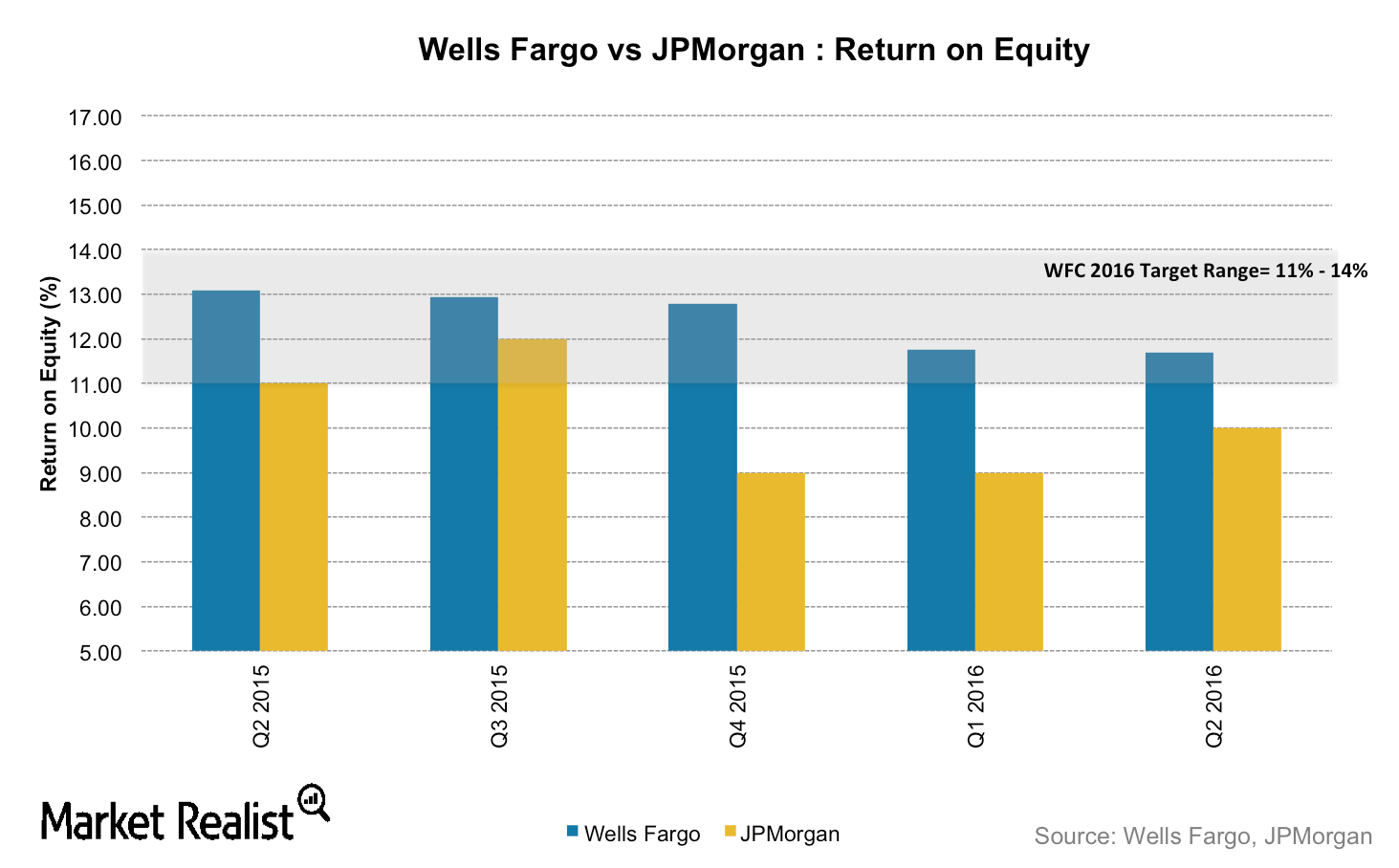

How Does Wells Fargo Compare with JPMorgan Chase on Profitability?

JPMorgan Chase (JPM) and Wells Fargo (WFC) reported profits of $6.2 billion and $5.6 billion, respectively, in the most recent quarter.

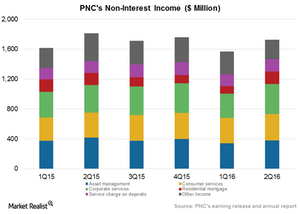

PNC Financials’ Non-Interest Income Ratio Continues to Expand

PNC Financial’s non-interest income for 2Q16 increased by 10% over the previous quarter, mainly due to higher fee income growth.

Wells Fargo: What Sets It Apart from Its Peers?

Wells Fargo (WFC) is the largest mortgage lender in the US, operating primarily as a retail and commercial bank. It is been the most profitable bank in its peer group, posting a return of 10% on shareholder’s equity and ~1.3% on assets in 2015.

Introducing Fidelity National Information Services

Headquartered in Florida, Fidelity National Information Services is a big hitter in software solutions and innovations in the financial services industry.

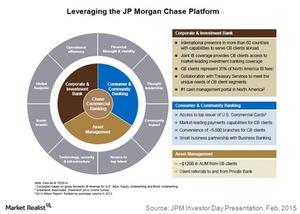

J.P. Morgan: Commercial Banking and Firm-Wide Synergies

J.P. Morgan Commercial Banking clients can access the Consumer and Community Banking segment’s commercial credit cards, payments services, and branch network.