St Jude Medical Inc

Latest St Jude Medical Inc News and Updates

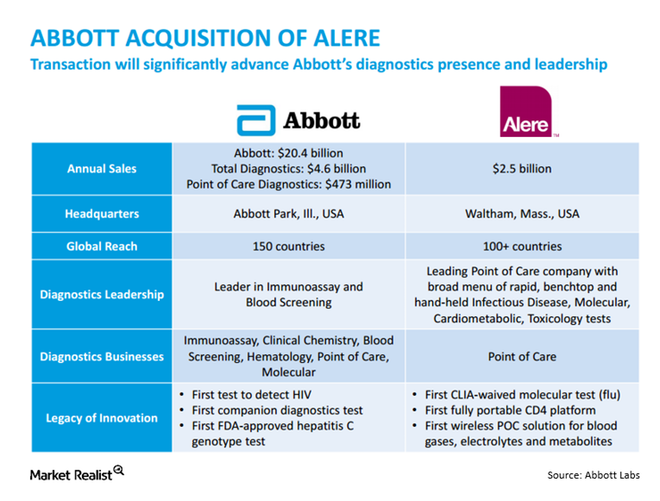

A Brief Recap of the Abbott–Alere Deal Developments

Three months after announcing a $5.8 billion deal in which Abbott Laboratories (ABT) would buy Alere (ALR), Alere rejected Abbott’s $50 million offer to end the deal. On December 7, Abbott sued Alere to terminate the deal.

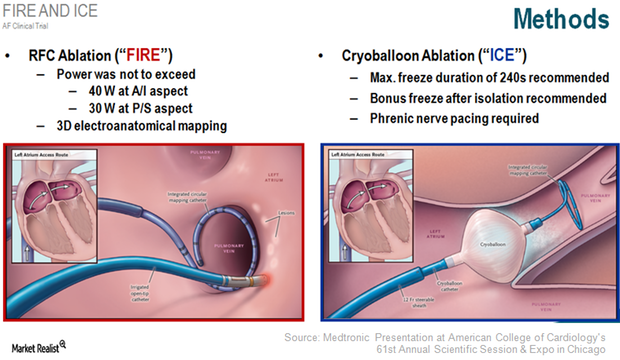

Atrial Fibrillation Ablation Could Be a Short-Term Growth Driver for MDT

More than 33 million patients suffer from AF, the most common form of heart arrhythmia. About 30% of these patients respond to antiarrhythmic drugs (or AAD).

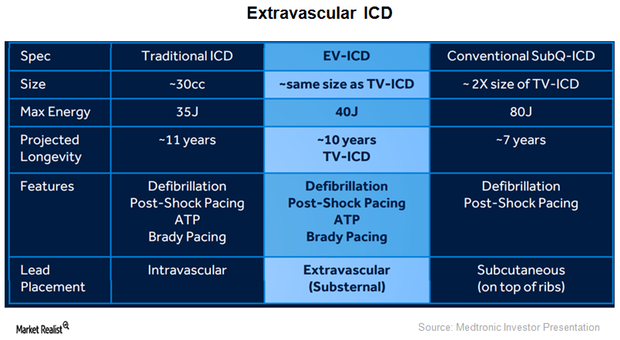

Medtronic Expands Capabilities of Implantable Cardioverter Defibrillators

On May 2, 2016, the FDA approved Medtronic’s (MDT) Visia AF and Visia AF MRI Surescan. These devices are single-chamber implantable cardioverter defibrillators (or ICDs) capable of detecting asymptomatic and undiagnosed atrial fibrillation.

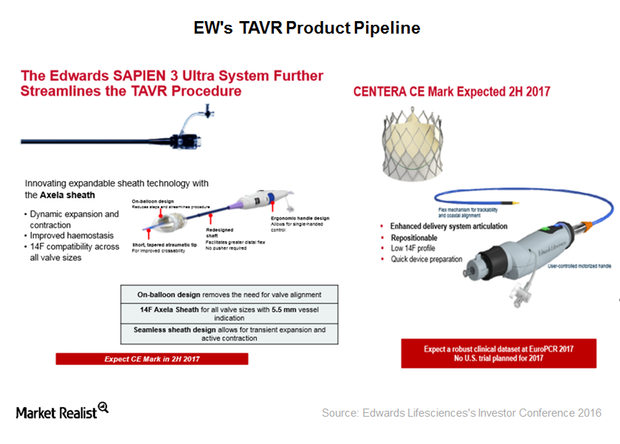

Inside Edwards Lifesciences’ THV Product Pipeline and Future Growth Estimates

Edwards Lifesciences (EW) has a robust product pipeline in its THV (transcatheter heart valve) segment, with Sapien 3 as the segment’s leading product.

The Rationale behind Johnson & Johnson’s Acquisition of Abbott Medical Optics

On September 16, 2016, Johnson & Johnson announced the acquisition of Abbott Medical Optics, a subsidiary of Abbott Laboratories, and its stock fell ~0.3%.

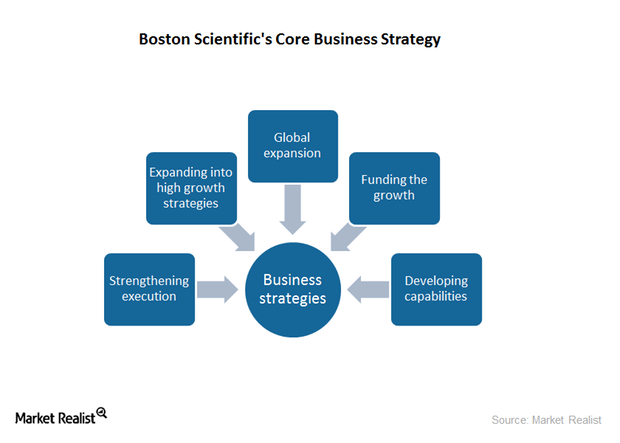

The Business Strategies Driving Boston Scientific’s Growth

Boston Scientific registered emerging market sales growth of approximately 13% in 2015, representing a steady growth in international markets.

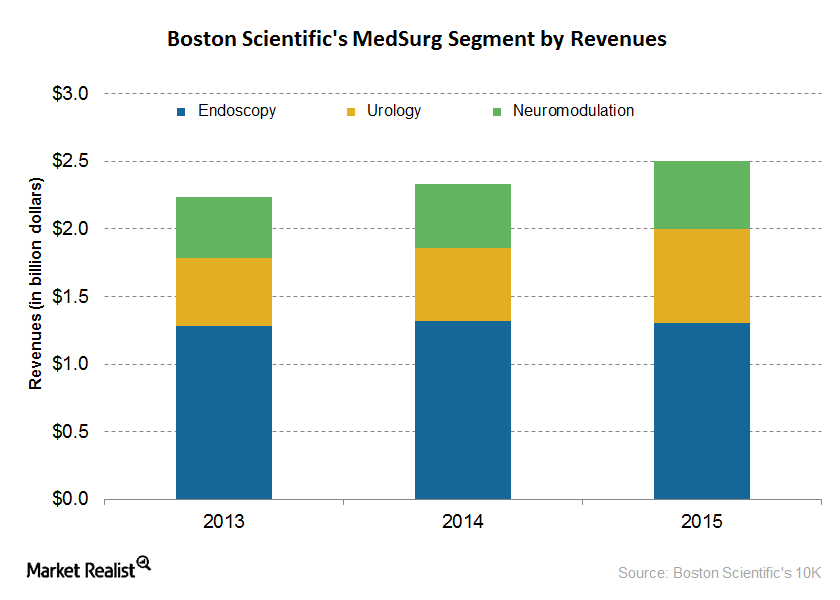

Understanding Boston Scientific’s MedSurg Segment

Boston Scientific’s (BSX) MedSurg segment contributes around 33% to the company’s total revenues and is the company’s second-largest segment.

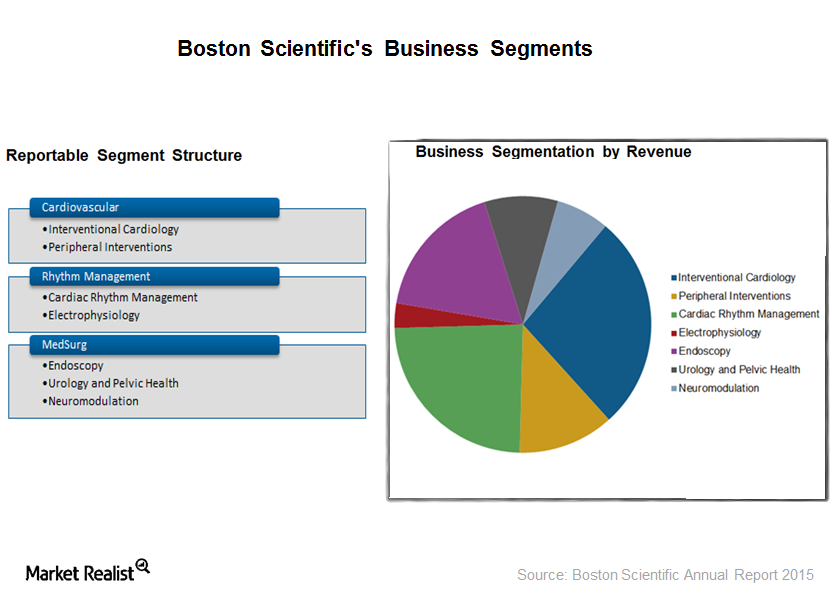

A Brief Look at Boston Scientific’s Business Model

Boston Scientific’s (BSX) Cardiovascular segment consists of minimally invasive technologies to treat patients with a wide range of heart and vascular diseases. It is BSX’s largest business segment and generated ~39% of the company’s total revenues in 2015.

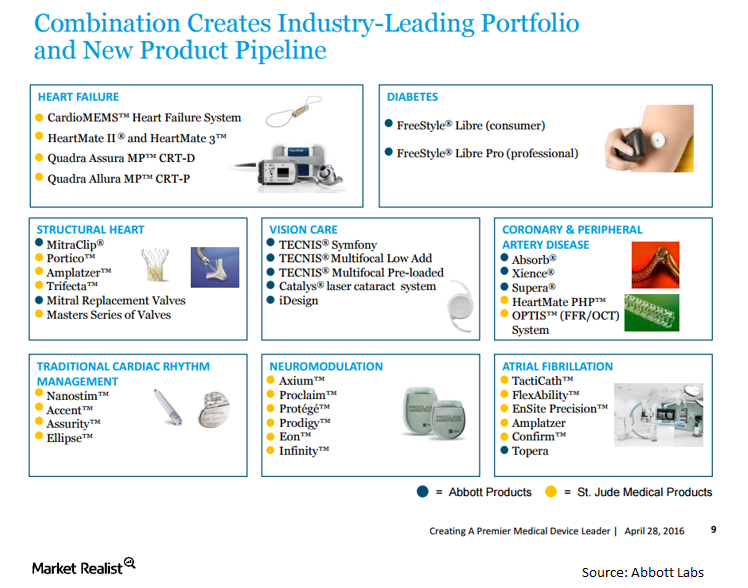

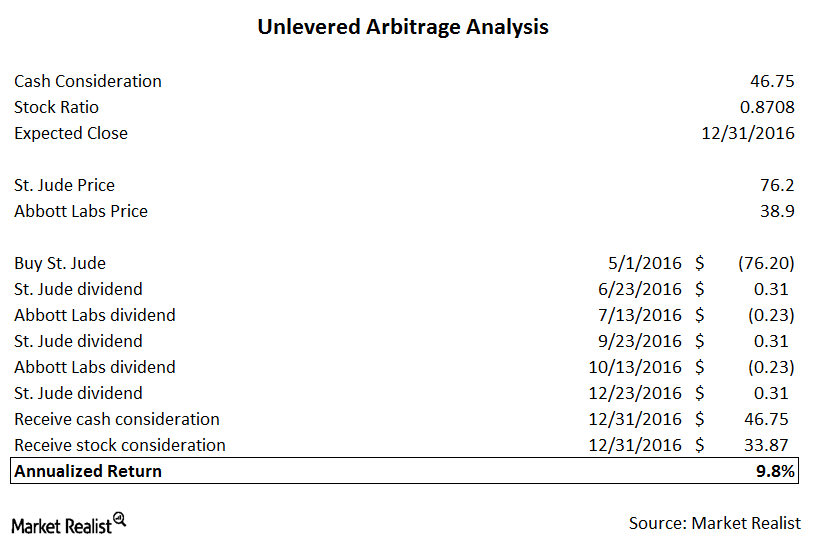

Rationale for the St. Jude Medical-Abbott Merger Transaction

Abbott Labs is buying St. Jude Medical for about $30 billion in cash, stock, and assumed debt to become a dominant player in the cardiovascular health space.

Abbott Buys St. Jude Medical for $85 per Share in Cash and Stock

On April 28, Abbott Labs and St. Jude Medical announced an agreement where Abbott will buy St. Jude for $30 billion in cash, stock, and assumed debt.

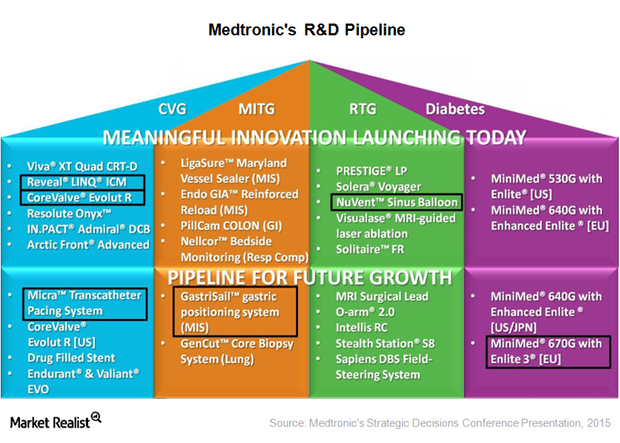

Probing Medtronic’s Research and Development Pipeline

Medtronic spent ~$1.6 billion—approximately 8.1% of its total sales—on research and development programs in fiscal 2015.

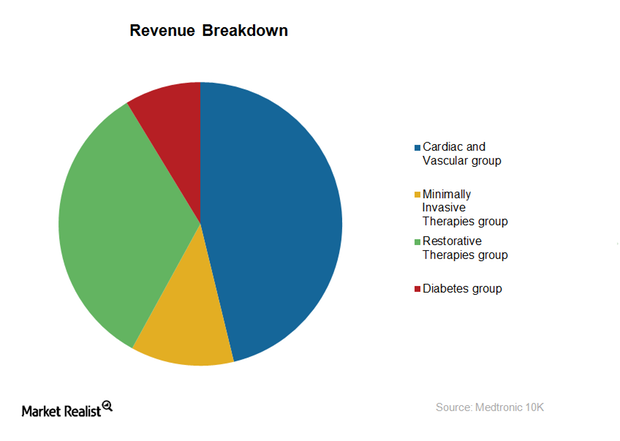

A Key Breakdown of Medtronic’s Business Model

Medtronic generates revenue through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies, Restorative Therapies, and the Diabetes Group.