ProShares Ultra S&P500

Latest ProShares Ultra S&P500 News and Updates

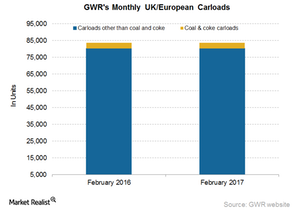

Analyzing GWR’s European Carloads in February 2017

Genesee & Wyoming’s (GWR) European carloads remained unchanged YoY (year-over-year) in February 2017.

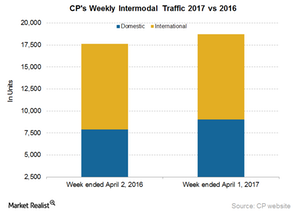

Canadian Pacific: Domestic Intermodal Growth Matters

In the week ended April 1, 2017, Canadian Pacific reported a 6.3% rise in overall intermodal traffic.

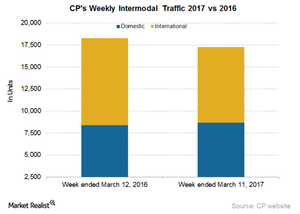

How Canadian Pacific’s Intermodal Traffic Trended

Canadian Pacific’s (CP) intermodal volumes have been rising for the past few weeks.

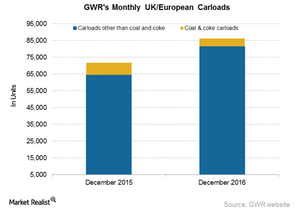

Why Did GWR’s European Carloads Rise in December?

GWR’s European carloads rose 20.3% YoY in December 2016. In the same period of 2015, GWR hauled ~72,000 railcars, as compared to ~86,000 in December 2016.

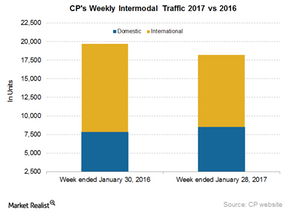

Comparing Canadian Pacific’s Intermodal Volumes

Canadian Pacific’s intermodal volumes Although Canadian Pacific’s (CP) intermodal volumes have been marching forward for the past few weeks, in the week ended January 28, 2017, CP reported a fall of 7.5% in overall intermodal traffic. Intermodal data indicates that the fall was due to a drop in its international intermodal business, where volumes fell […]

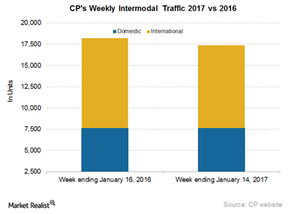

What Led to the Decline in Canadian Pacific’s Intermodal Volumes?

Canadian Pacific’s intermodal volumes Although Canadian Pacific’s (CP) intermodal volumes have been marching forward for the past few quarters, for the week ended January 14, 2017, CP reported a fall of 4.5% in overall intermodal traffic. The intermodal data indicates that the fall was led by a drop in its international intermodal business, where volumes […]

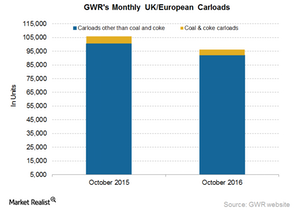

Why Genesee and Wyoming’s European Carloads Slumped in October

The decrease in the UK and European carloads in October was primarily due to the fall in coal and coke, mineral and stone, and intermodal carloads.

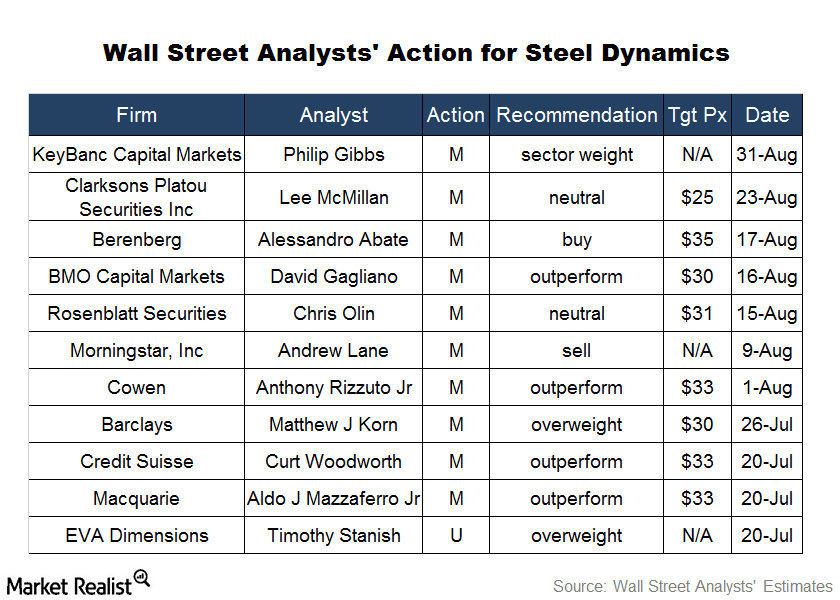

Why Most Analysts Have Rated Steel Dynamics as a ‘Buy’

Steel Dynamics has one of the most diversified end-market exposures compared to other steel companies.

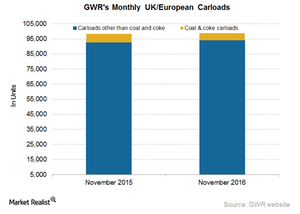

Why Genesee & Wyoming’s European Carloads Rose in November

Genesee & Wyoming’s (GWR) European carloads rose marginally 0.60% in November 2016. In the same period last year, GWR hauled 99,000 railcars.

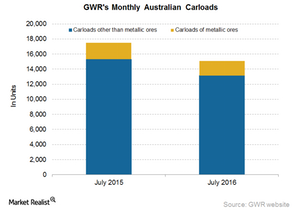

Why Did Genesee & Wyoming’s Australian Carloads Fall in July?

Genesee & Wyoming’s Australian carloads declined by 13.7% in July 2016, hauling more than 15,000 railcars, as compared to over 17,000 one year previously.

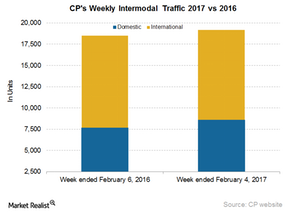

Canadian Pacific versus Canadian National: A Key Intermodal Comparison

Canadian Pacific’s (CP) intermodal volumes have been on roll for the past few weeks. It reported a 3.6% YoY rise for the week ended February 4.

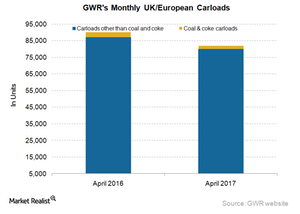

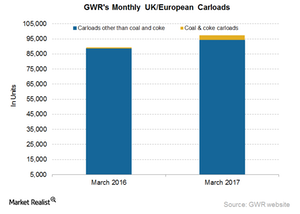

Reviewing GWR’s European Carloads in April 2017

Genesee & Wyoming’s (GWR) European carloads fell 9.1% YoY (year-over-year) in April 2017. GWR’s other-than-coal carloads fell 8.2% on a YoY basis in April 2017.

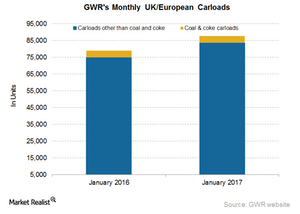

Inside GWR’s European Carload Rise in January

Genesee & Wyoming’s (GWR) European carloads rose 11.2% YoY in January 2017.

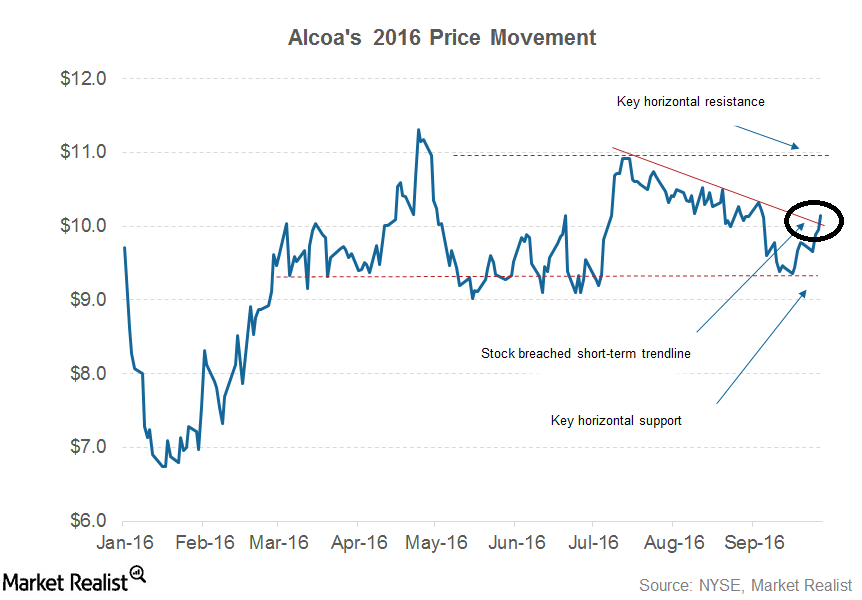

A Look at Alcoa’s Technical Indicators before Its 3Q16 Release

Alcoa’s technical indicators To make market entry and exit decisions, traders and investors analyze technical indicators. Resistance and support levels are among the most commonly used technical indicators. Resistance level Support levels typically act as a floor for stock prices. As a stock approaches its support levels, more buyers emerge while selling pressure generally subsides. […]

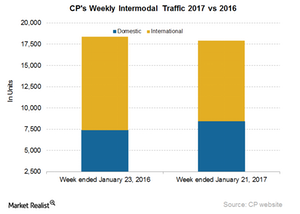

What Led to the Fall in Canadian Pacific’s Intermodal Volumes?

Canadian Pacific’s intermodal volumes Although Canadian Pacific’s (CP) intermodal volumes have been marching forward for the past few quarters, for the week ended January 21, 2017, CP reported a fall of 2.5% in overall intermodal traffic. Intermodal data indicates that the fall was due to a drop in its international intermodal business, where volumes fell […]

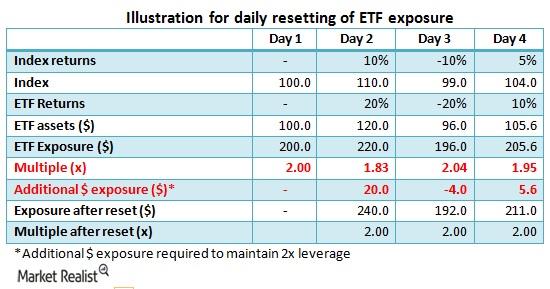

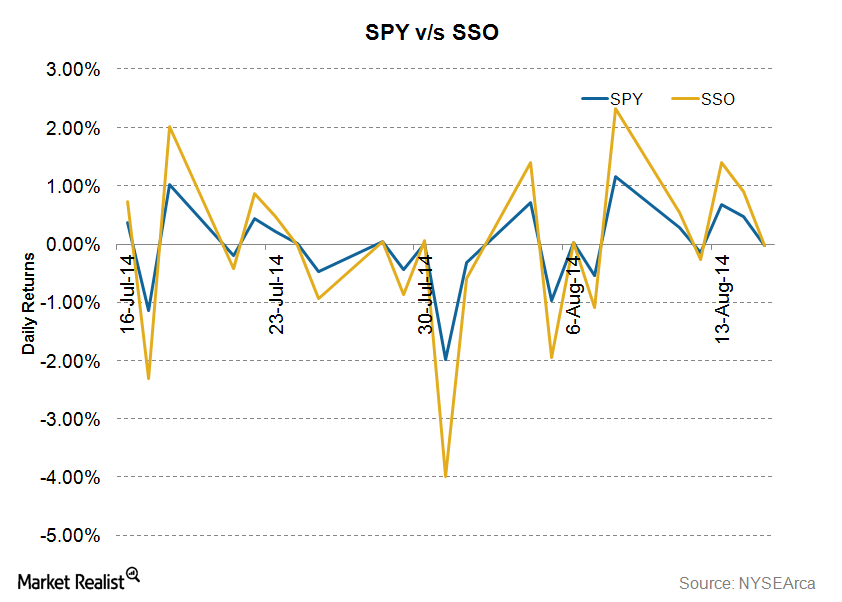

How daily re-balancing affects returns on leveraged ETFs

Leveraged ETFs seek to provide a certain multiple (generally 2x or 3x) of daily returns on the underlying index. The daily movements in the underlying index and subsequent changes in ETF exposure may mean the ETF manager needs to rebalance the portfolio daily.

How daily compounding works in case of inverse and leveraged ETFs?

If SPY rises 5% each on two consecutive days, SSO will rise 10% each day due to the 2x leverage achieved using derivative products and external borrowings. While the compounding works even for SPY, it’s magnified in SSO due to the 2x multiplier effect.

Analyzing Genesee & Wyoming’s European Carloads in March 2017

Genesee & Wyoming’s (GWR) European carloads rose to 9.0% YoY (year-over-year) in March 2017.

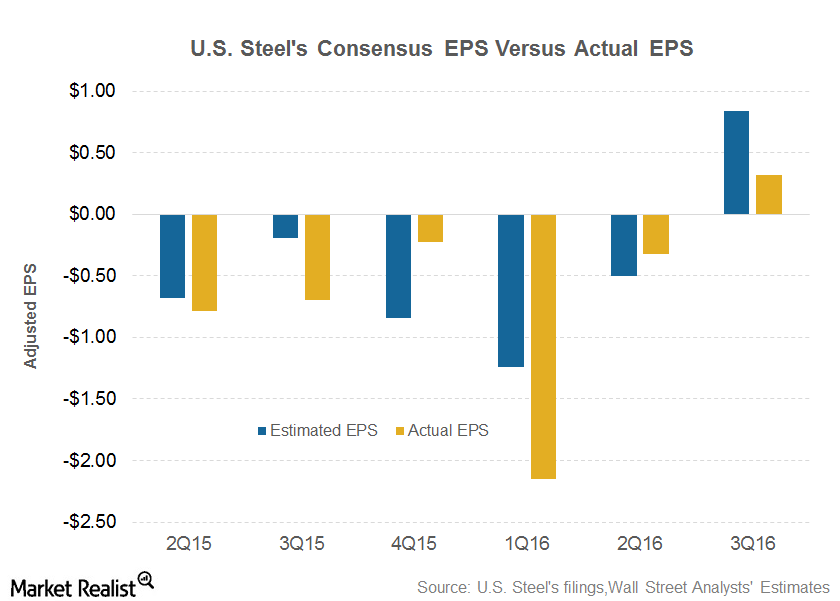

U.S. Steel Bulls Left Heartbroken After 3Q16 Earnings Miss

U.S. Steel Corporation (X) released its 3Q16 financial results on November 1 after the market closed, and it held its earnings conference call on November 2.

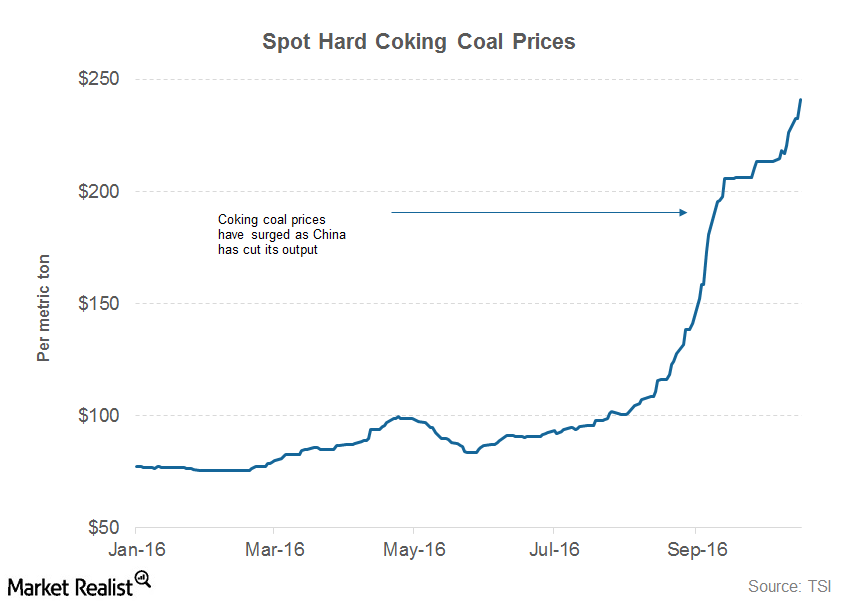

Analyzing the Bullish Argument for U.S. Steel

The bulls and bears have their own sets of arguments about U.S. Steel. U.S. Steel (X) and AK Steel (AKS) mainly use iron ore as a raw material.

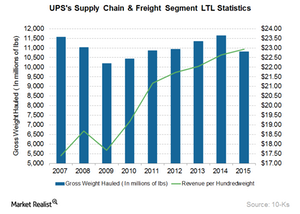

A Deep Dive into UPS’s Supply Chain and Freight Segment

United Parcel Service’s (UPS) Supply Chain and Freight segment includes forwarding and logistics services, UPS Freight, truckload freight brokerage, and financial services through UPS Capital.