Guggenheim S&P 500® Eq Wt Cons Stapl ETF

Latest Guggenheim S&P 500® Eq Wt Cons Stapl ETF News and Updates

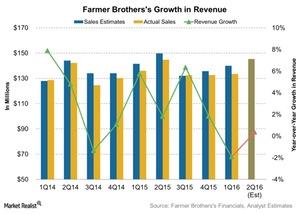

Analysts Expect Positive Revenue Growth in Fiscal 2Q16

The revenue estimate for Farmer Brothers in fiscal 2Q16 isn’t as high. However, it’s still positive. Analysts predict revenue of $145.3 million for fiscal 2Q16

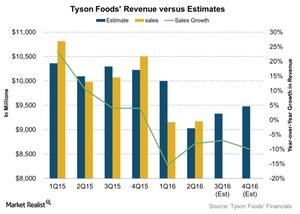

What Could Hamper Tyson Foods’ Revenue in 3Q16?

Tyson Foods is expected to report lower revenue in 3Q16. The export markets will likely be challenged moderately in 2016. This could hamper its revenue.

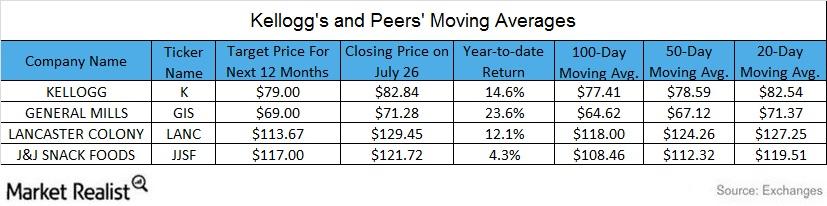

What Do Analysts Recommend for Kellogg after Fiscal 2Q16 Results?

The average broker target price for Kellogg for the next 12 months has risen to $83.93 from $79. This is 1.4% higher than the closing price of $82.71 on August 5.

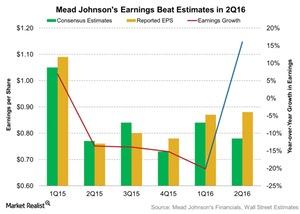

Why Did Mead Johnson Nutrition’s Earnings Rise 16% in 2Q16?

In 2Q16, Mead Johnson Nutrition’s (MJN) EPS (earnings per share) increased 16% to $0.88, compared to $0.76 in 2Q15.

Key Moving Averages: Analyzing Kellogg versus Its Peers

Kellogg closed at $82.84 on July 26. It’s trading 7.0%, 5.4%, and 0.4% above its 100-day, 50-day, and 20-day moving averages. It has appreciated ~15% in 2016.

How Hershey Benefits from the barkTHINS Acquisition

The company expects that the barkTHINS acquisition will be dilutive in 2016 and 2017, before turning accretive in 2018.

What Analysts Recommend for Mead Johnson ahead of 2Q16 Results

As of July 15, 2016, Mead Johnson (MJN) was trading at $91.38.

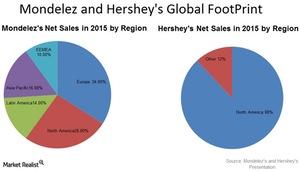

Why Was Mondelez Interested in Hershey?

Mondelez wanted a greater share in the North American market to recover from its declining revenue growth. Hershey would have benefited Mondelez’s revenue.

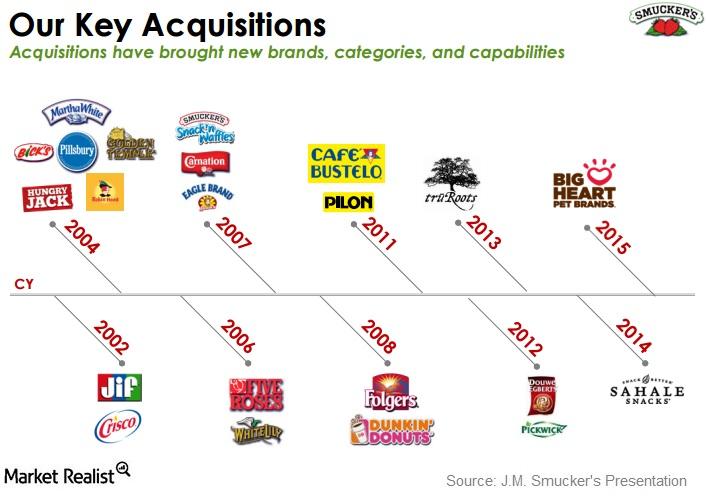

How Did Acquisitions and Innovations Lead J.M. Smucker’s Revenue?

The J.M. Smucker Company has made some key acquisitions since 2002. These acquisitions have brought in new brands, categories, and capabilities.

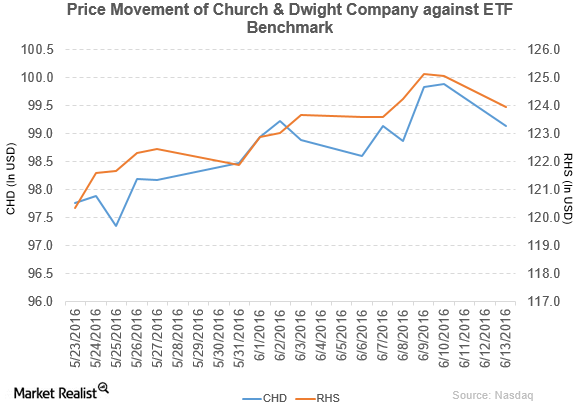

Why Church & Dwight Sold Its Brands to Armaly Brands

Church & Dwight (CHD) has a market cap of $12.7 billion. It fell by 0.74% to close at $99.14 per share on June 13, 2016.

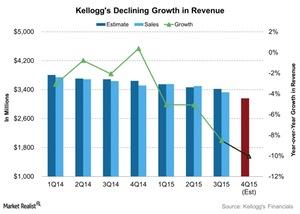

Kellogg Is Expected to Report a 10% Revenue Drop for Fiscal 4Q15

In its fiscal 4Q15 results, Kellogg is expected to report sales of $3,160 million, a fall of 10% YoY (year-over-year). For the full year, analysts expect revenue of $13.5 billion, a decline of ~7% YoY.

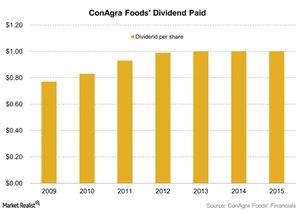

ConAgra Foods’ Dividend, Outlook, and Expectations

ConAgra Foods (CAG) has a dividend yield of 2.45% as of December 17, 2015. The company’s management raised the dividend at an average annual rate of 4.6%.