PowerShares Global Listed Private Eq ETF

Latest PowerShares Global Listed Private Eq ETF News and Updates

Blackstone and KKR Deployments Rise in 2016 on Valuations

Blackstone Group (BX), the world’s largest alternative manager, invested $2.9 billion during the September 2016 quarter.

Apollo, BlackRock Target Less Risk, Unlike Ares, Prospect

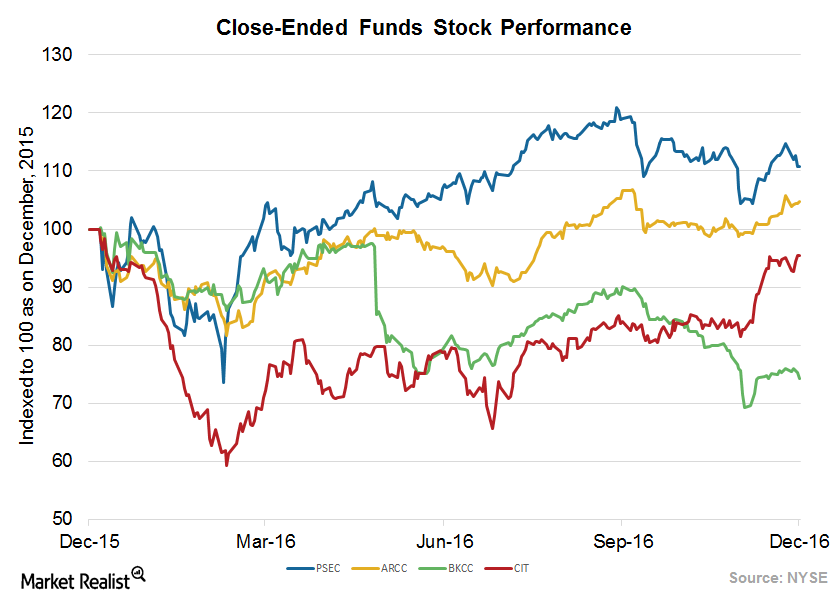

Over the past few years, closed-end funds (PSP) have deployed funds in middle market companies with better credit ratings.

Closed-End Funds Are Affected by Originations, Rates

Closed-end managers deploy money in middle market companies engaged in businesses across sectors by raising capital through share issuances.

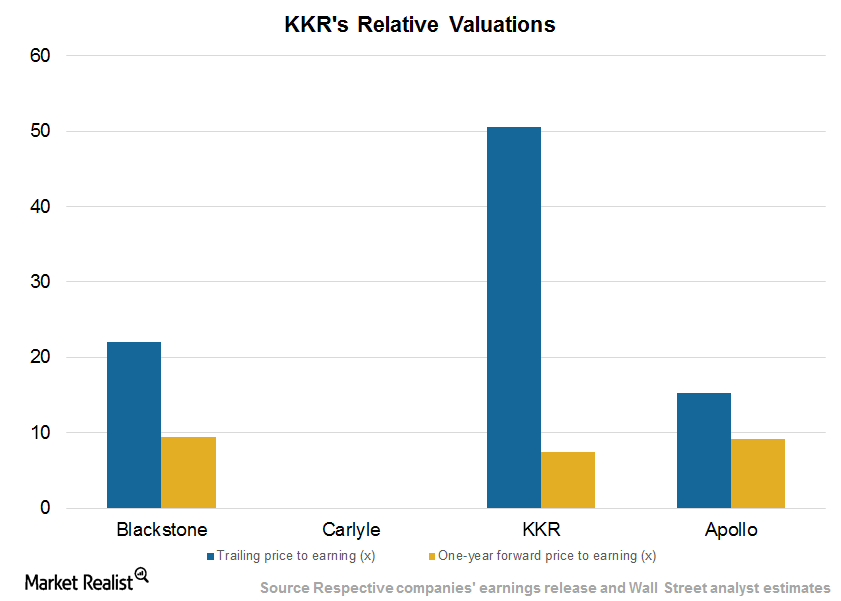

KKR Valuations Fair amid Volatile Performance and Capital Raises

KKR & Company (KKR) expects to post EPS (earnings per share) of $0.41 in 3Q16, reflecting a subdued performance compared to its 3Q15 numbers.

KKR Maintains Dividends, Continues with Repurchases in 3Q

As of October 2016, KKR has bought back 31.5 million common units for $457 million of its announced $500 million share repurchase program in December 2015.

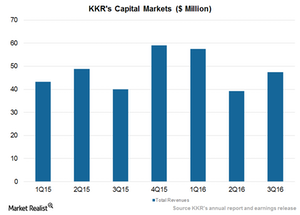

KKR Capital Markets Manages Higher Revenues on Deal Making

KKR’s Capital Markets and Principal Activities segment saw revenues of $47 million in 3Q16, as compared to $40 million in 3Q15 and $39 million in 2Q16.

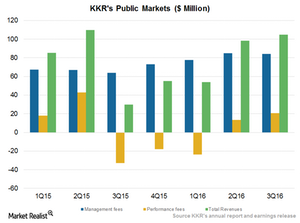

KKR Public Markets’ Performance Rises on Improved Credit Pricing

In 3Q16, KKR’s Public Markets segment reported total revenues of $84 million in 3Q16, as compared to $64 million in 3Q15.

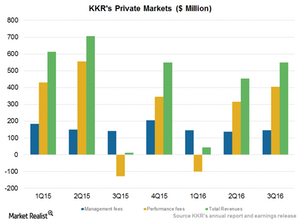

KKR Private Markets Segment Rises on Performance Fees in 3Q

In 3Q16, KKR’s Private Markets segment reported revenues of $549 million in 3Q16, as compared to $12 million in 3Q15 and $453 million in 2Q16.

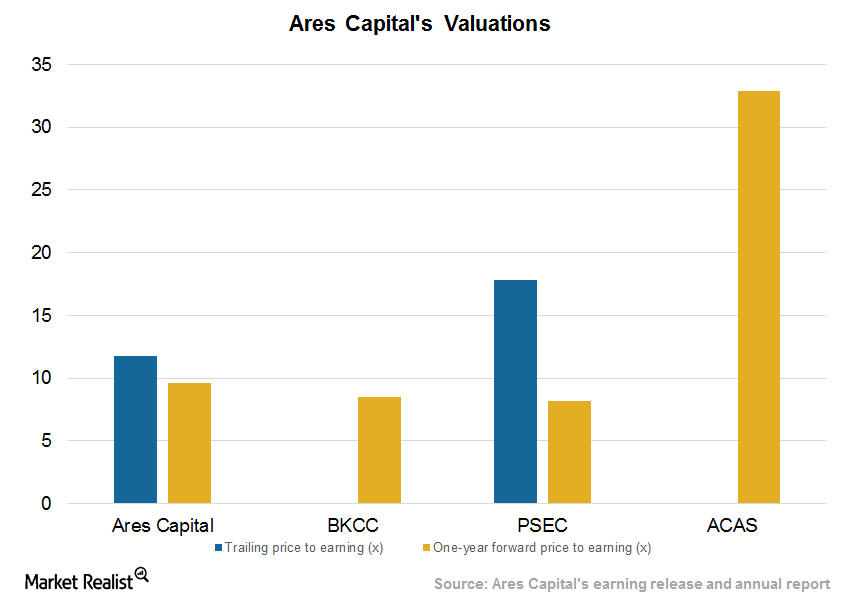

Ares Capital Stock and Valuations Rise on Strong Performance

Ares Capital (ARCC) stock has risen ~1.6% over the past six months. The company saw a strong performance in 3Q16 on higher deployment, yields, and lower expenses.

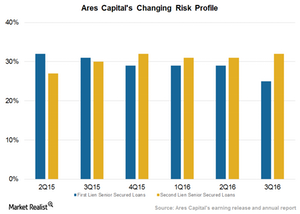

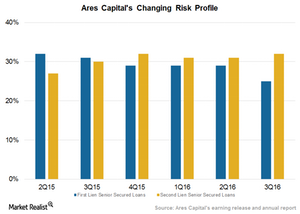

Ares Capital Second Lien Preference Evident in Portfolio Changes

Ares Capital (ARCC) has consistently enhanced its exposure to second lien debt in a bid to generate higher yields.

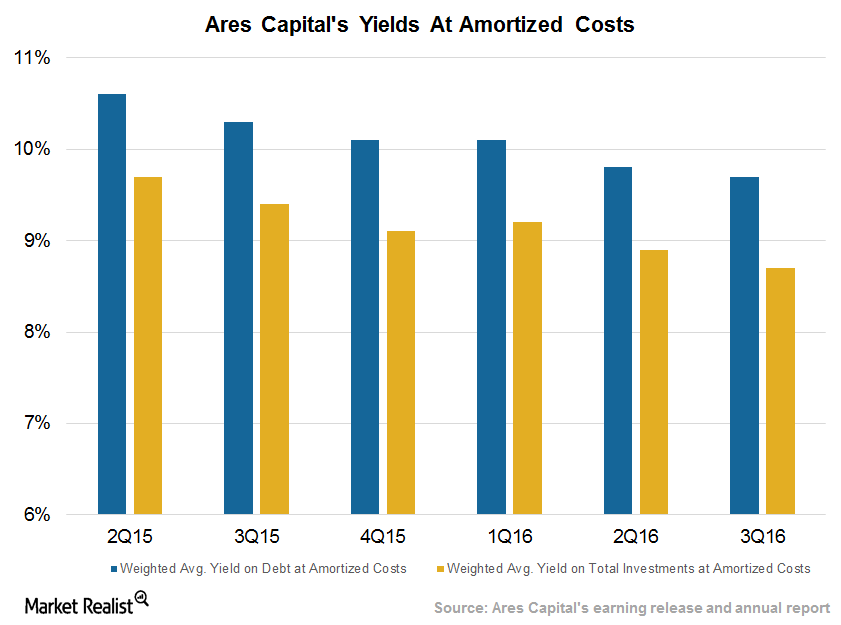

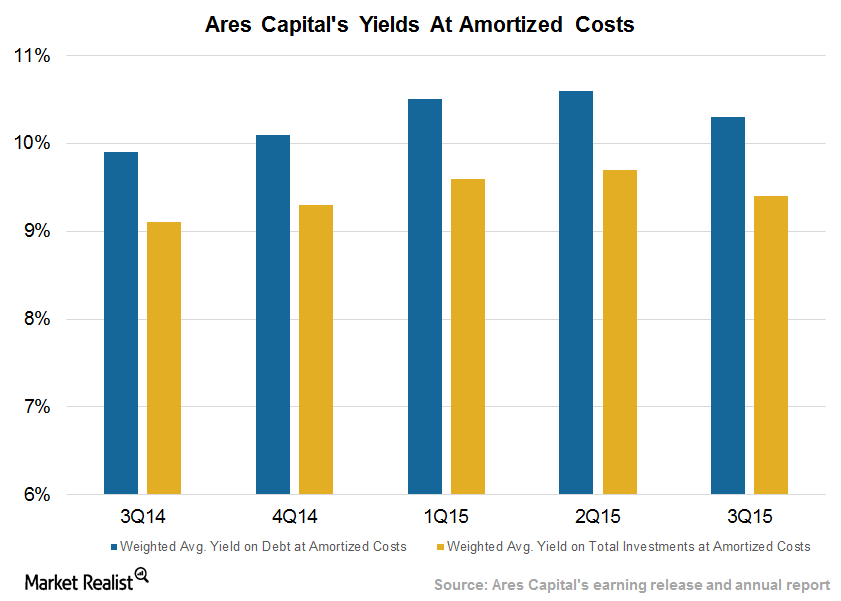

Ares Capital’s Yields and Credit Statistics Fell in 3Q16

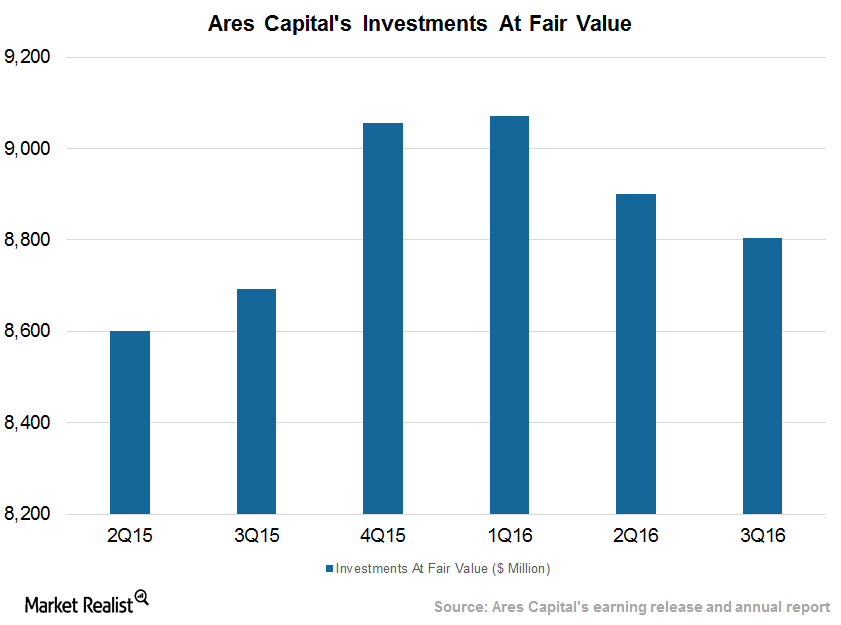

Ares Capital’s (ARCC) portfolio totaled $8.8 billion at fair value as of September 30, 2016.

Ares Capital Enhances Originations in 3Q16

By the end of September 2016, Ares Capital (ARCC) had a diversified portfolio of 215 companies totaling $8.8 billion at fair value.

Ares Capital’s Performance Improves amid ACAS Acquisition News

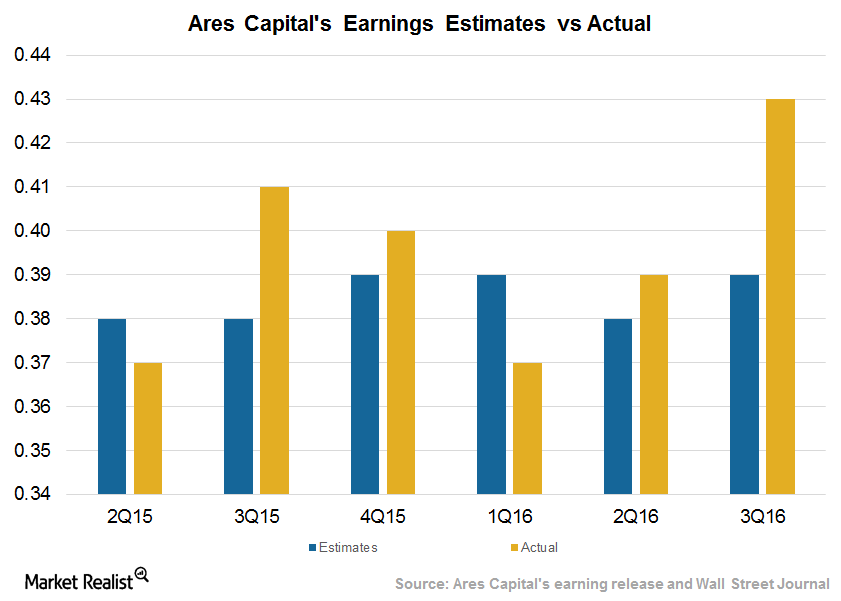

Ares Capital (ARCC) posted EPS (earnings per share) of $0.43, beating Wall Street analysts’ estimate of $0.39 in 3Q16.

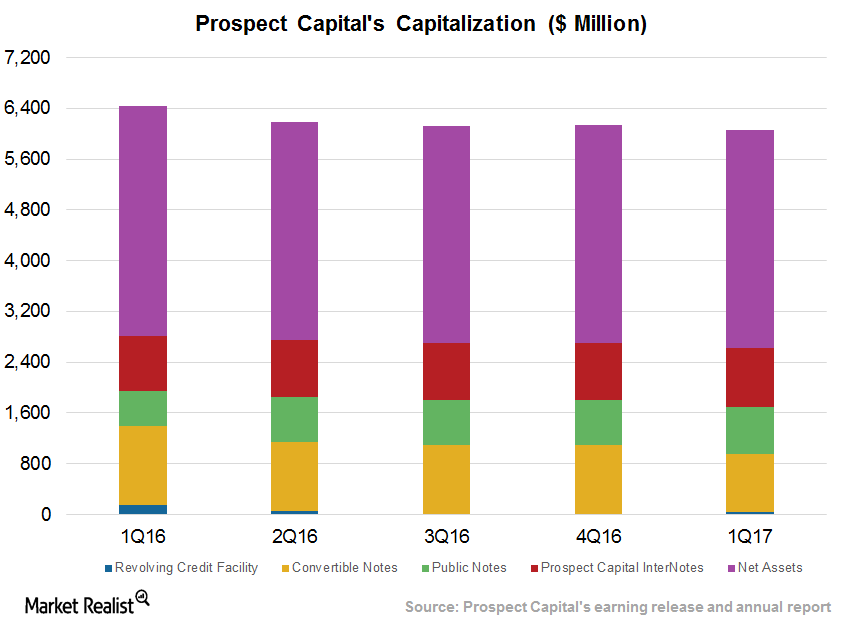

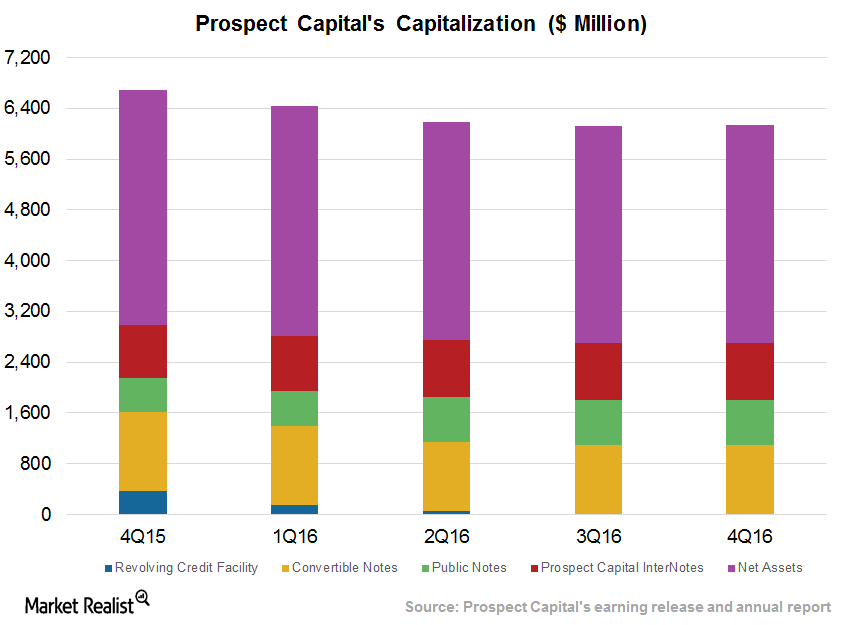

Prospect’s Leverage Rises on Higher Origination in Fiscal 1Q17

Prospect Capital has been operating at higher leverage to take advantage of low rates. But the Fed is expected to raise interest rates in calendar 4Q16.

PSEC Reduces Leverage amid Low Originations, Potential Rate Hike

Prospect Capital (PSEC) has used the low interest rate environment to its advantage by deploying higher leverage over the past couple of years.

Prospect Could See Higher Originations in Fiscal 1Q17

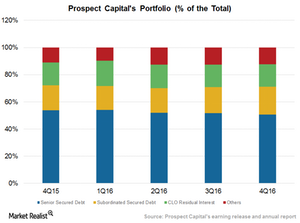

In fiscal 4Q16, Prospect Capital (PSEC) made $294 million in investments, a substantial rise compared to its investments of $23 million in fiscal 3Q16.

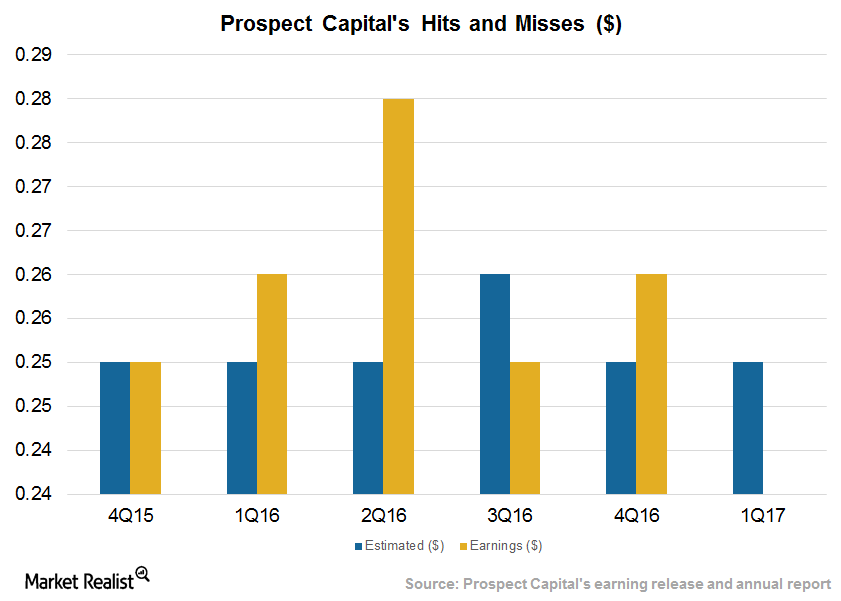

What to Expect of Prospect Capital’s Earnings in Fiscal 1Q17

Prospect Capital (PSEC) is expected to post earnings per share (or EPS) of $0.24 in fiscal 1Q17, a fall of $0.01 compared to estimates.

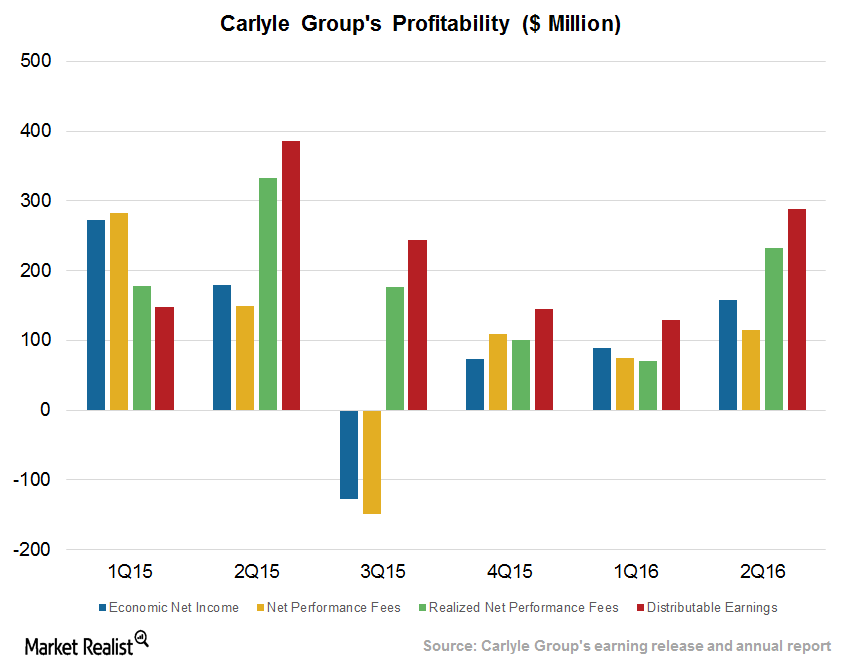

Alternatives Are Sitting on Record Capital, Making Investments

In 2015, fund managers took advantage of lower valuations and the availability of a record dry powder in order to make fresh investments at lower valuations.

Ares Capital’s 3Q15 Investment Performance, Senior Secured Loans

Ares Capital’s (ARCC) portfolio totaled $8.7 billion at fair value as of September 30, 2015. Its total assets stood at $9.2 billion.