Pinnacle Foods Inc

Latest Pinnacle Foods Inc News and Updates

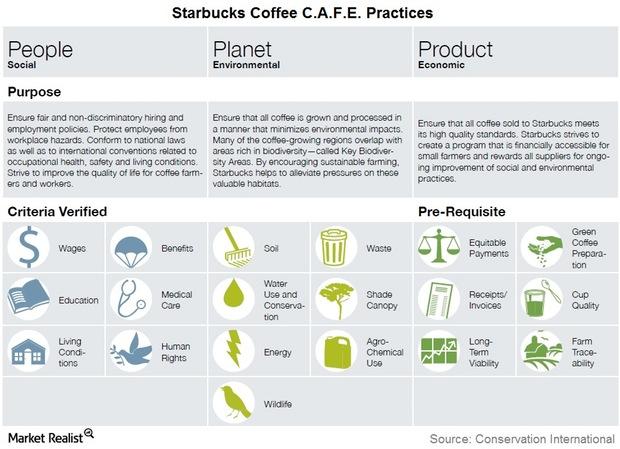

How Starbucks Brews Up Sustainable Products

A sustainable coffee effort In the previous article, we looked at industry-level and investment-level examples of how things have been on the sustainable investment front and the developments that are helping certain industries. In this article, we’ll look at a company-level example by way of Starbucks (SBUX). Starbucks employs sustainability standards called C.A.F.E. (Coffee and […]

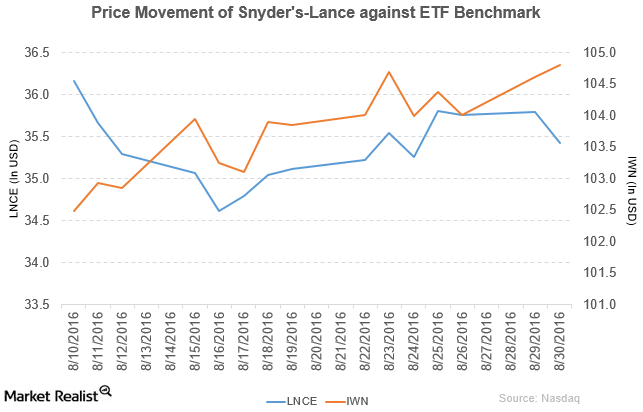

Why Did Snyder’s-Lance Recall Some of Its Products?

Snyder’s-Lance (LNCE) has a market cap of $3.4 billion. It fell by 1.0% to close at $35.42 per share on August 30, 2016.

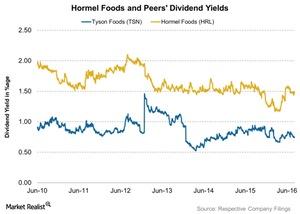

Why Did Hormel Foods Increase Its Fiscal 2016 Guidance?

Hormel Foods (HRL) increased its fiscal 2016 EPS (earnings per share) guidance to $1.60–$1.64. The earlier EPS guidance range was $1.56–$1.60.

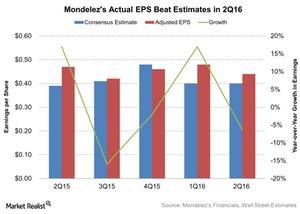

Did Mondelez’s Earnings Manage to Beat Estimates in 2Q16?

Mondelez exceeded analysts’ earnings estimates of $0.40 by 10% for 2Q16. The adjusted EPS (earnings per share) was ~$0.44 for the quarter.

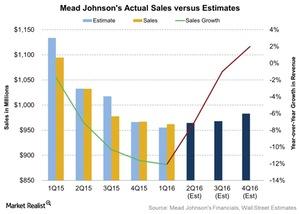

What Will Hurt Mead Johnson’s 2Q16 Revenue?

Analysts are expecting Mead Johnson’s revenue to be $964 million for 2Q16. That’s a fall of 7% compared to 2Q15 revenues of $1.0 billion.

Why Are So Many Analysts Rating B&G Foods a ‘Hold’?

Approximately 78% of analysts rate B&G Foods a “hold,” and 22% rate it a “buy.” None of the analysts rate it a “sell.”

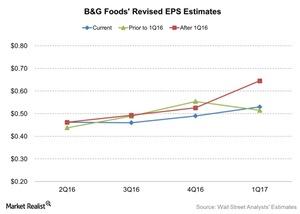

Analysts Have Revised EPS Estimates for B&G Foods: Why?

B&G Foods’ (BGS) earnings estimates have been on an upward trend since its fiscal 1Q16 impressive results. The Green Giant acquisition contributed to the results.

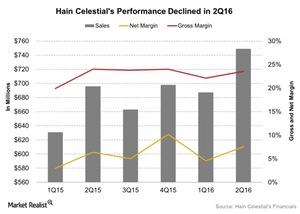

How Did Hain Celestial Perform in Fiscal 2Q16?

Hain Celestial Group’s (HAIN) fiscal 2Q16 had the strongest revenue performance in its history. The net sales for 2Q16 were $752.6 million.

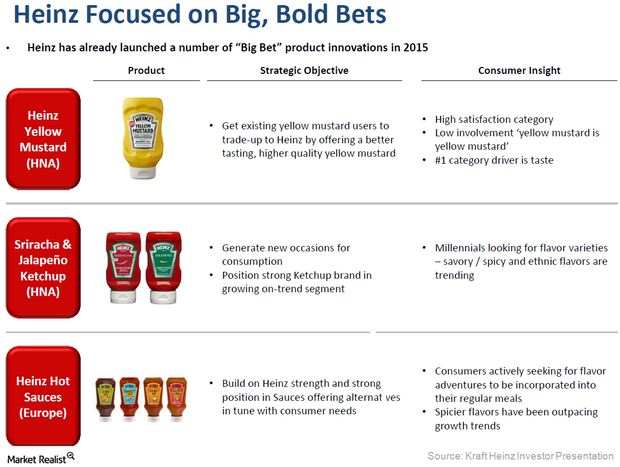

Analyzing Kraft Heinz’s Great Brands Strategy

Kraft Heinz is shifting its focus on advertising spending from non-working media to working media.

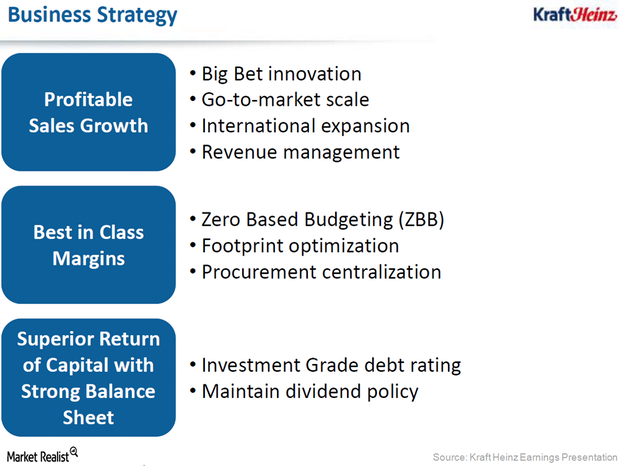

Analyzing Kraft Heinz’s Objective of Profitable Sales Growth

Kraft Heinz plans to reinvest savings from cost initiatives into its brands and to refocus its strategic vision on innovation.

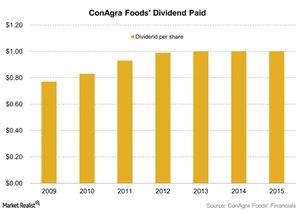

ConAgra Foods’ Dividend, Outlook, and Expectations

ConAgra Foods (CAG) has a dividend yield of 2.45% as of December 17, 2015. The company’s management raised the dividend at an average annual rate of 4.6%.

Kraft Heinz: What Happened after the Merger?

The Pittsburgh-based, privately owned ketchup maker H.J. Heinz Holding Corporation acquired Kraft Foods last month.