PowerShares DWA Momentum ETF

Latest PowerShares DWA Momentum ETF News and Updates

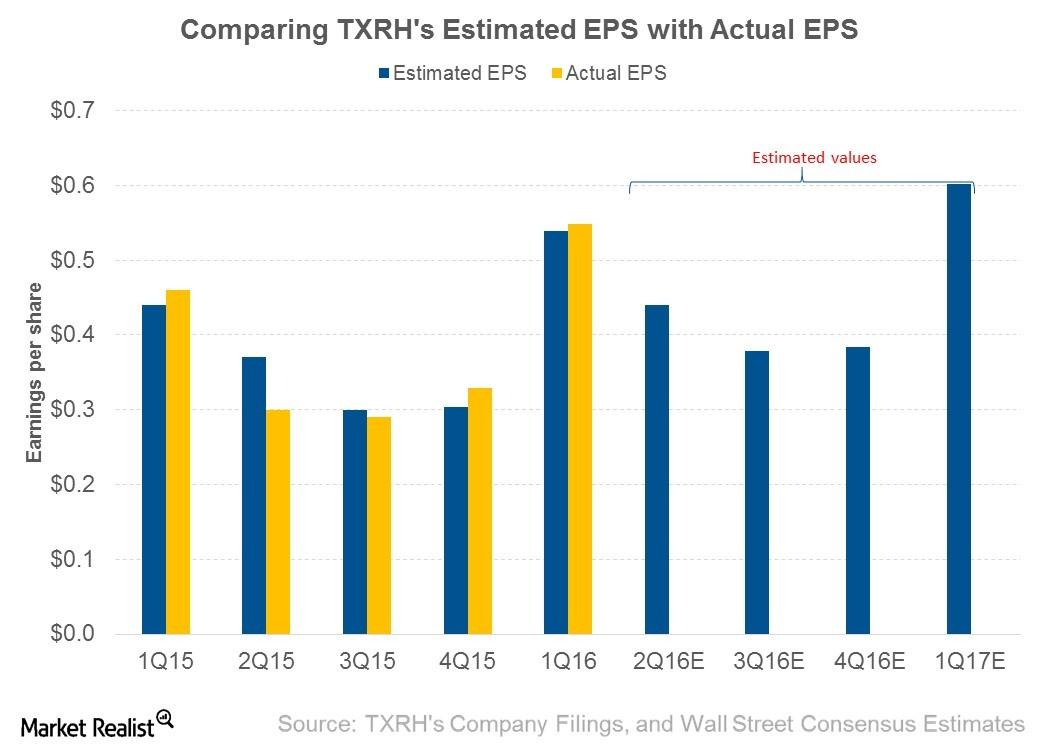

Texas Roadhouse’s 1Q16 EPS Was below Analyst’s Expectations?

In 1Q16, Texas Roadhouse posted EPS of $0.5. This was lower than analysts’ estimate of $0.54. The adjusted EPS was above analysts’ estimate at $0.55.

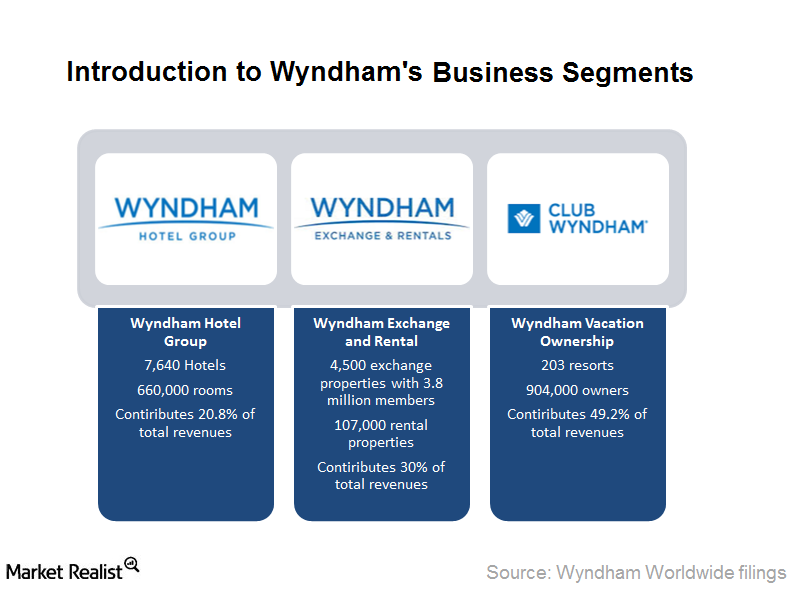

Big Hotels on the Block: Sizing up Wyndham Worldwide’s Competitors

Since 2010, Wyndham’s stock has outperformed all its peers, growing by over 270%. In that time, Marriot grew by ~176%, Starwood by 102%, and Hyatt by 67%.

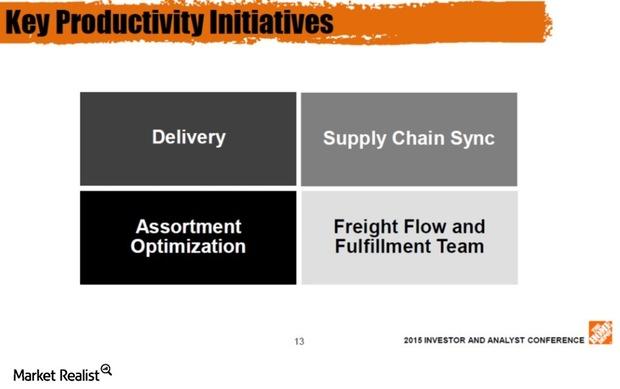

Productivity Enhancements: How Home Depot Is Trimming the Fat

Productivity enhancements resulted in improved profitability margins for the world’s number one retailer.

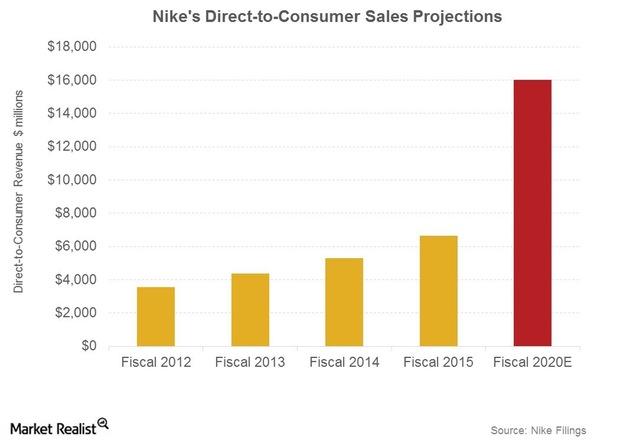

Why Is Nike Focusing on the Direct-To-Consumer Channel?

Nike’s (NKE) DTC (direct-to-consumer) (XLY) (FXD) channel includes sales made online on Nike.com and through its own retail stores.

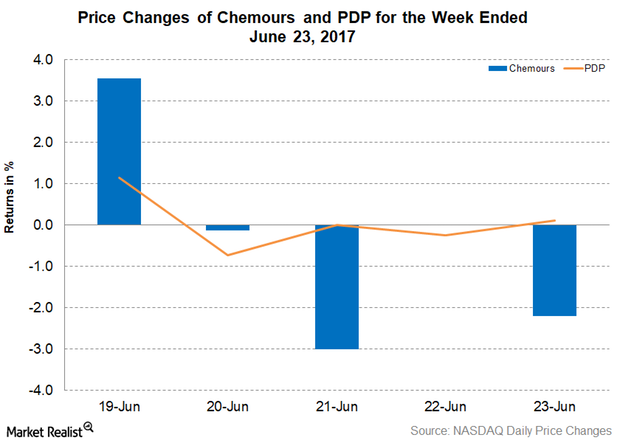

Chemours to Take New Measures to Eliminate Waste in Fayetteville

Chemours stock fell 1.9% for the week and closed at $36.0. CC stock has been in a downward trend since May.

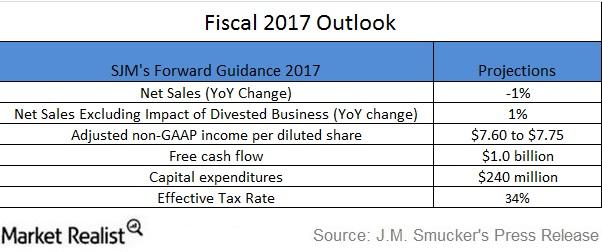

What Are J.M. Smucker’s Expectations for Fiscal 2017?

During its fiscal 4Q16 earnings release and in its investor presentation last week, the J.M. Smucker Company (SJM) discussed its outlook for fiscal 2017.

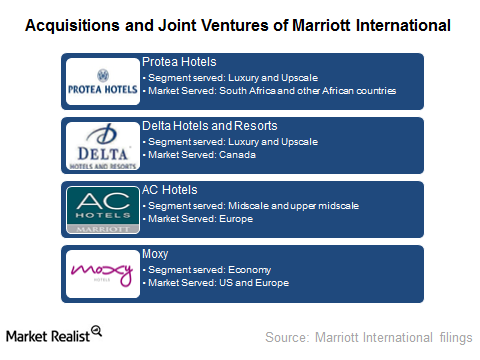

Acquisitions and Joint Ventures Drive Marriott’s International Expansions

Marriott has been able to expand its international business by both acquiring and creating brands that enable it to enter new markets and market segments.

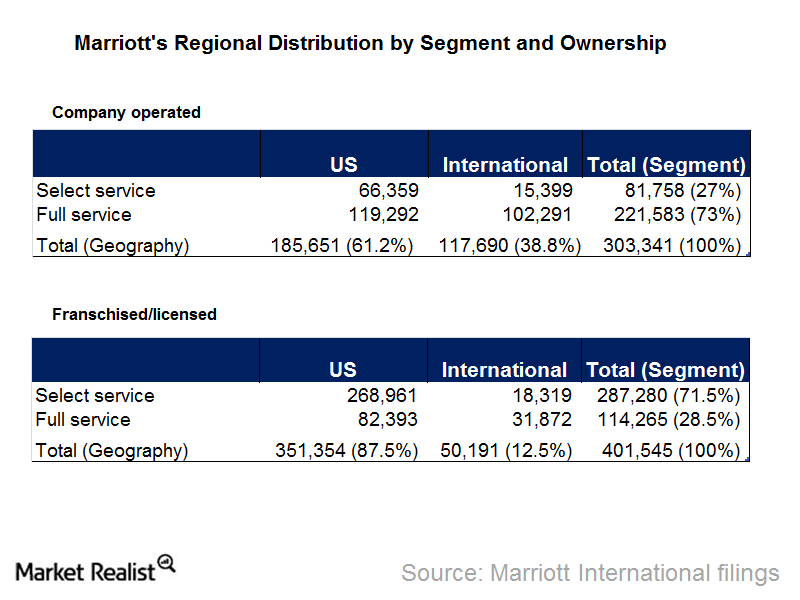

Marriott International’s Business Model by Service Category: Key Investor Takeaways

At the end of 2014, Marriott had around 2,882 franchised hotel properties, with 388,670 rooms under the franchise model.

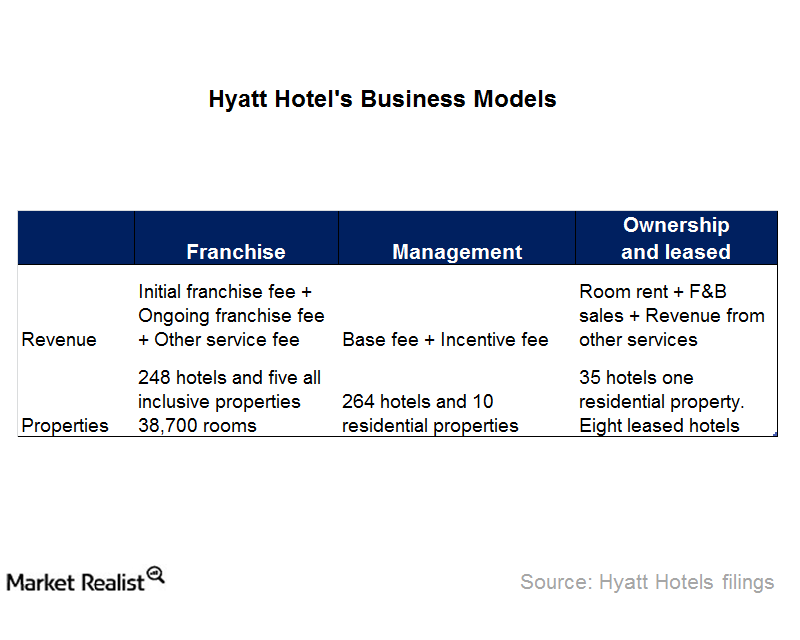

How Does Hyatt Make Money from Its Hotels?

Hyatt (H) operates its hotels and other business segments under three models: franchise, management, and ownership models.

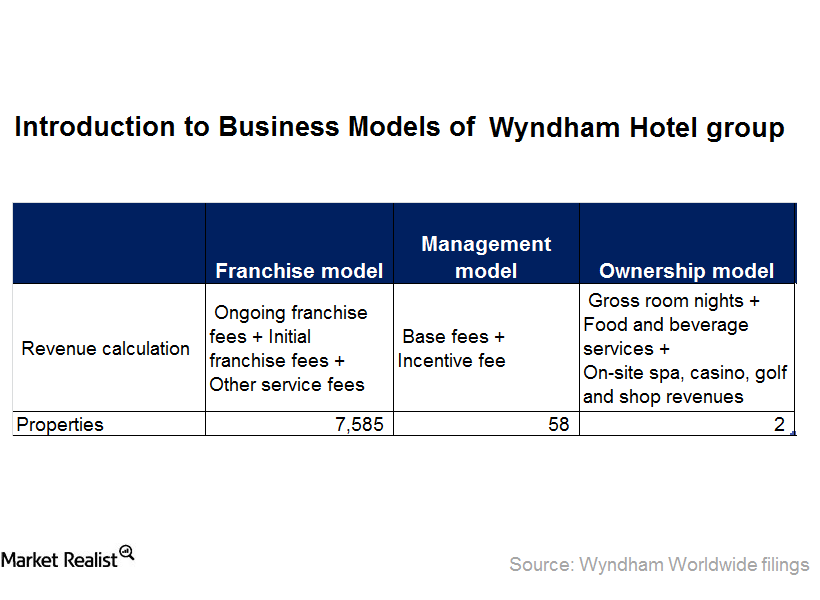

A Rundown of Wyndham Worldwide’s Wyndham Hotel Group Segment

Wyndham Hotel Group provides services under a franchise model but also offers professional oversight and operations support under a management model.