NetApp Inc

Latest NetApp Inc News and Updates

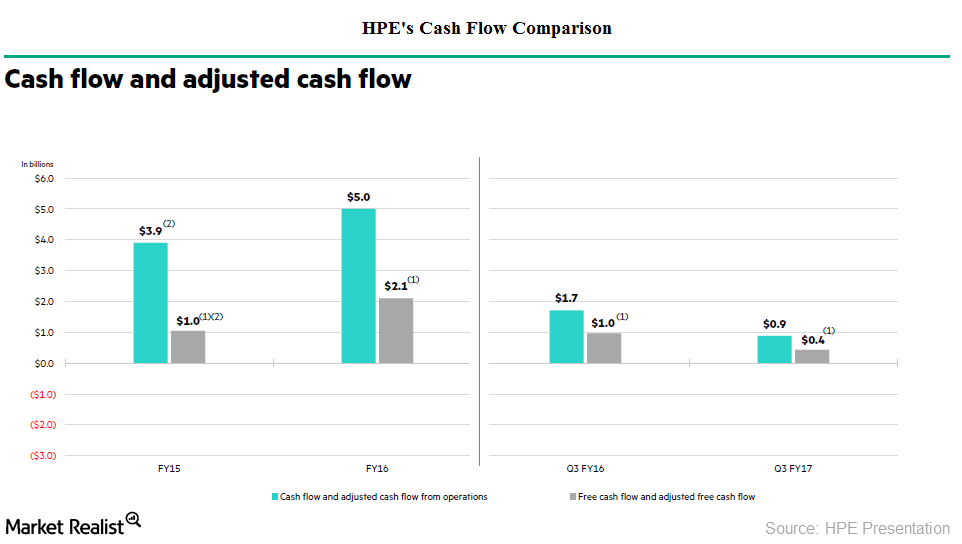

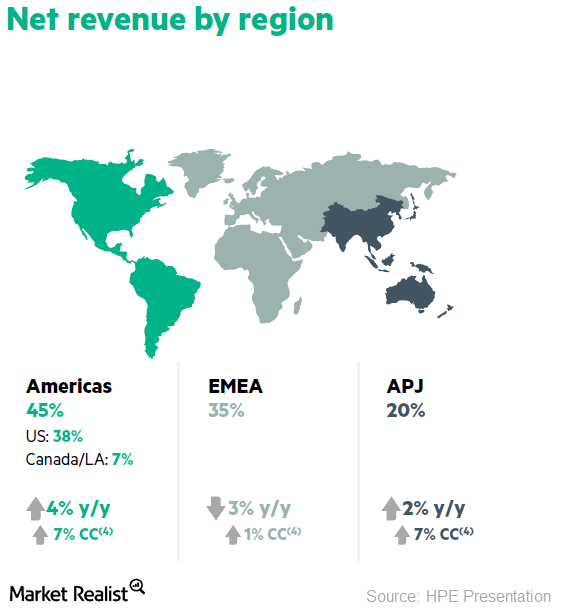

How Hewlett Packard Enterprise Is Increasing Shareholder Value

By the end of fiscal 3Q17, HPE had returned $107 million to shareholders in the form of dividends and $625 million through share repurchases.

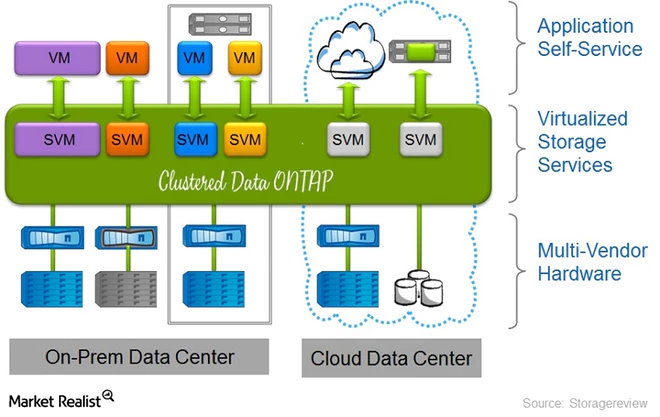

NetApp’s Key Driver: Clustered Data ONTAP

In 2013, NetApp (NTAP) introduced its own scale-out storage solution, Clustered Data ONTAP.

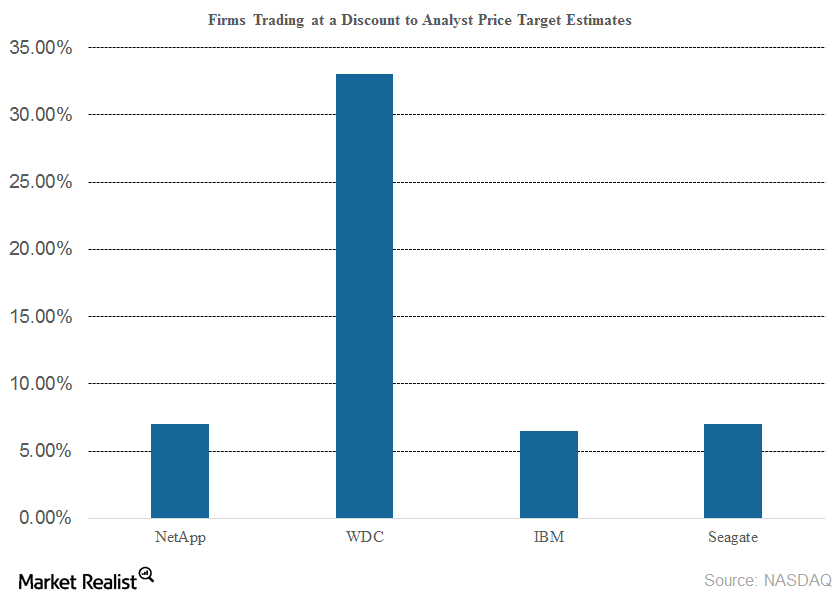

What Analysts Recommend for NetApp

Of the 27 analysts covering storage technology (QQQ) company NetApp (NTAP), 13 gave it a “buy” recommendation, two recommended a “sell,” and 12 recommended a “hold.”

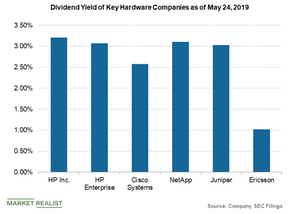

Tech Stocks with High Dividend Yields for a Rough Market

When the 10-year Treasury yield dips to 1.6%, where do investors park their funds? You can look at stocks with a high dividend yield as an alternative.

How HP’s Dividend Yield Stacks Up with Peers

HP (HPQ) generated free cash flow of $747 million in the second quarter of fiscal 2019, while cash flow from operations was $861 million.

Why IBM Considers the z14 Its Most Successful Mainframe Launch

Mainframes, large computers that can process billions of transactions daily, are mostly used by banks, retailers, and airlines.

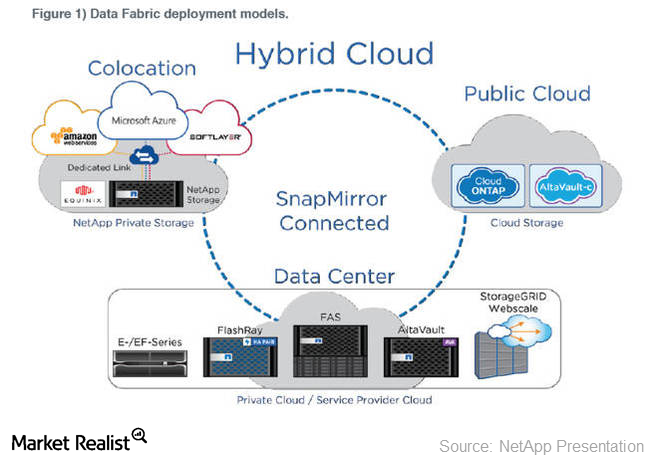

The Importance of NetApp’s Data Fabric Solution

Introduced in 2014, NetApp’s (NTAP) Data Fabric solution was primarily based on ONTAP, which is the company’s flagship operating system.

Western Digital’s Brand Named in Gartner’s Magic Quadrant

In September 2017, Western Digital’s (WDC) brand HGST was named in Gartner’s Magic Quadrant for Distributed File Systems and Object Storage as a niche player.

Why Hewlett-Packard Enterprise Fell on Brexit News

On Friday, Hewlett-Packard Enterprise (HPE) shares fell 7.6% on news of the United Kingdom deciding to leave the European (FEP)(EFA) Union—the Brexit.

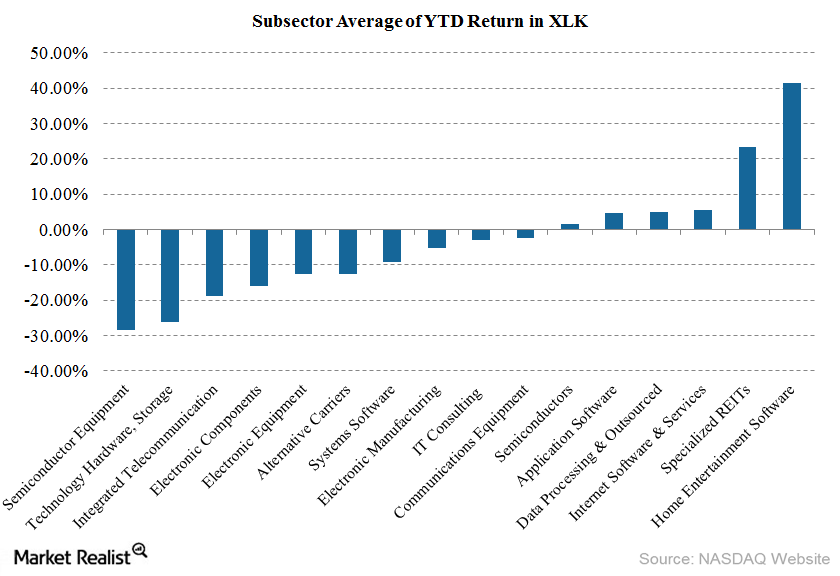

Macroeconomic Factors Affecting Technology Stock Performance in 2015

Macroeconomic factors like the Greek debt crisis, the declining Chinese stock market, and global growth issues have made tech stocks not so attractive.