Leucadia National Corp

Latest Leucadia National Corp News and Updates

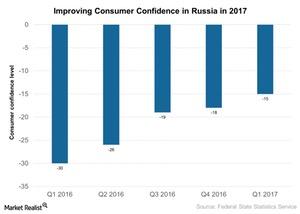

Russian Consumer Confidence Is on the Rise

Several macroeconomic indicators are suggesting that the Russian (RSX) economy is improving.

How Has the Russian Stock Market Changed?

The Russian stock market is upbeat, which adds to the ruble’s strength.

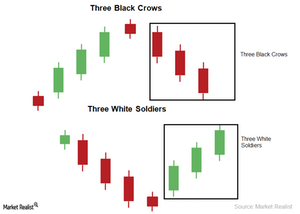

Three Black Crows And Three White Soldiers Candlestick Pattern

The Three White Soldiers candlestick pattern is also a reversal pattern. It forms at the bottom of a downtrend. The pattern has three candles. All three of the candles are long and bullish.

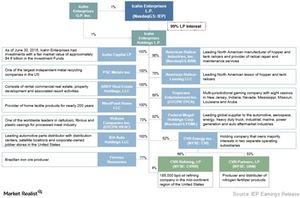

A Look at Icahn Enterprises’ Business Model

Icahn Enterprises’ investment strategy involves identifying and purchasing undervalued businesses and assets at distressed prices.

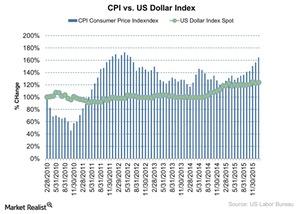

Why Inflation Is a Double-Edged Sword for the Financial Market

Core inflation could impact the market positively as well as negatively. Higher core inflation data will depreciate the US dollar (UUP).

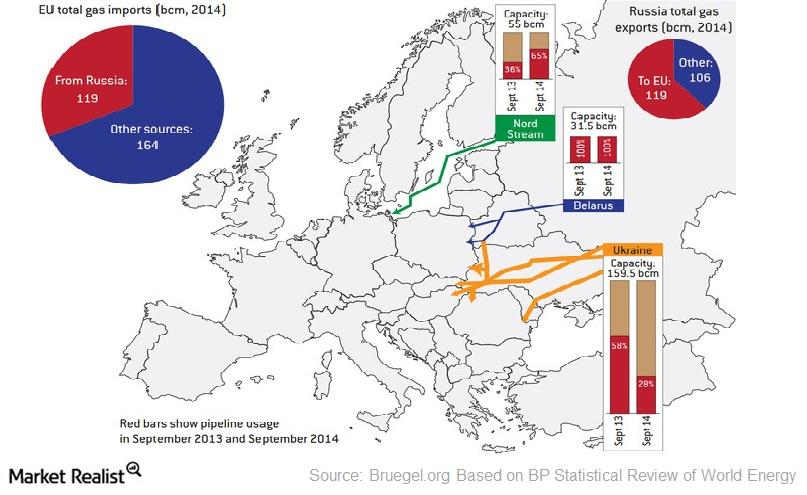

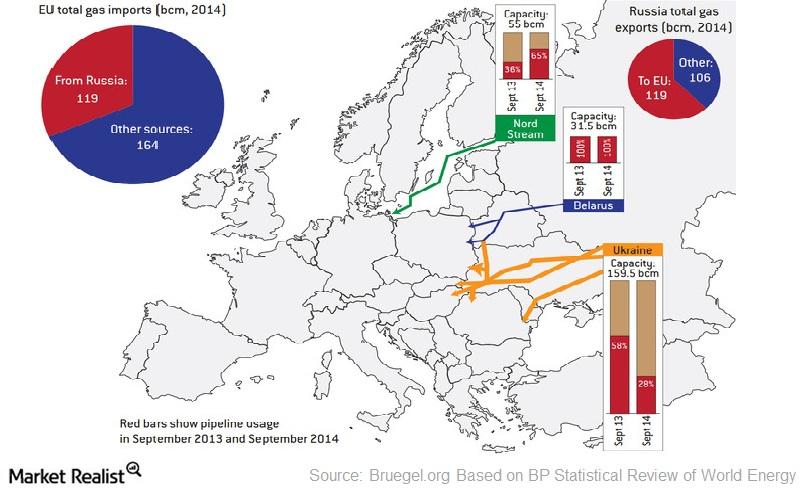

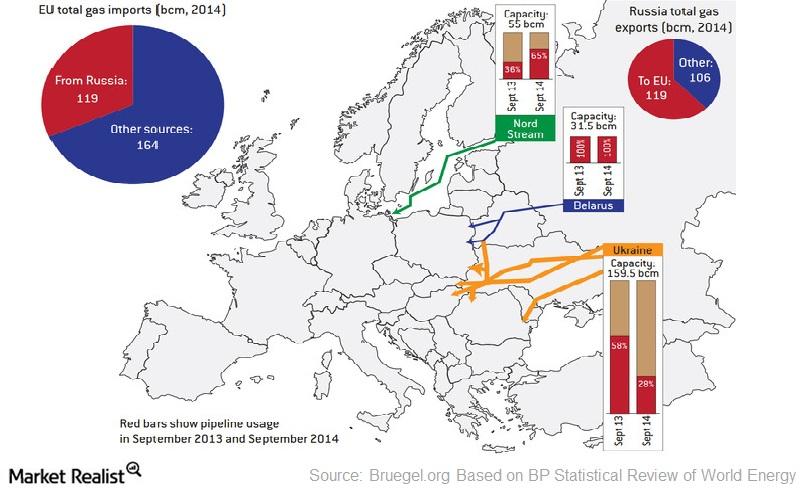

Russia’s Gas Pipeline Network in Europe

The European Union (FEZ) depends mostly on imports to meet its gas needs. Europe accounts for a significant portion of Russia’s gas exports.

Russia Could Eye Yemen in 2016, Might Spur Oil

The price war made life difficult for Russian energy companies and Russia’s economy at large. Asia and Europe are two important markets for Russia.

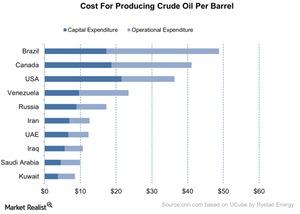

The Break-Even Costs of the World’s Top Oil Producers

Venezuela accounted for 17.5% of the world’s total proven crude oil reserve in 2014. According to a study by BP, Venezuela’s break-even cost is ~$23.5.

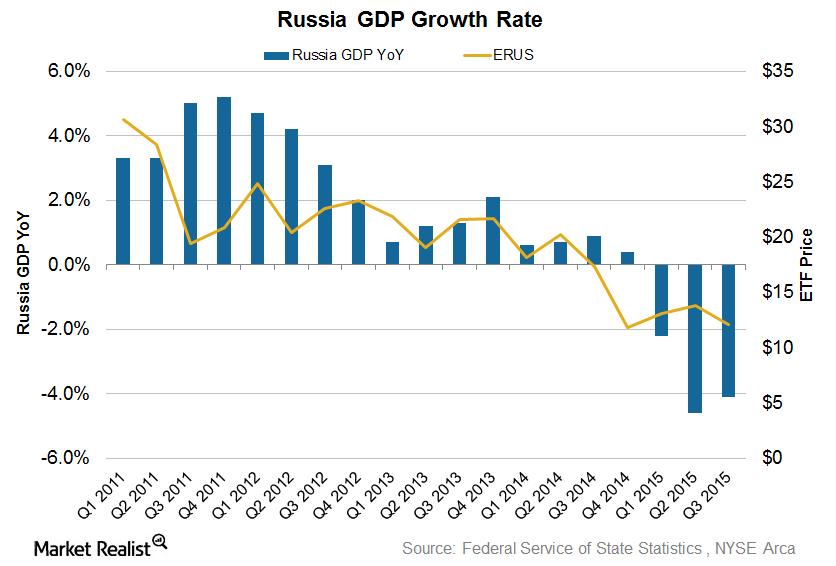

How Rising Inflation Is Affecting the Russian Economy

Like Brazil (EWZ), Russia (RUSL) (ERUS) is also struggling with high inflationary pressure. For the September quarter, Russian GDP (gross domestic product) fell 0.57%.

How Long Can the Price War Continue in Crude Oil?

According to data compiled by Rystad Energy, the cost of production per barrel of crude oil is $17.20 in Russia—compared to $9.90 in Saudi Arabia.

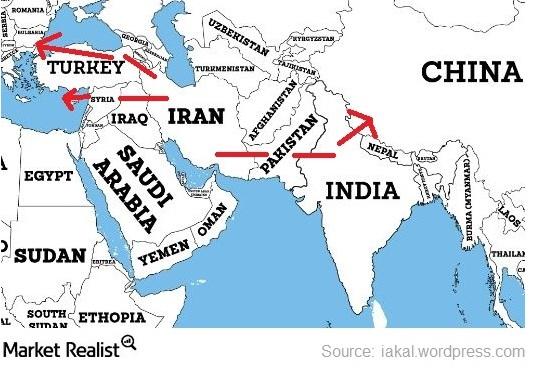

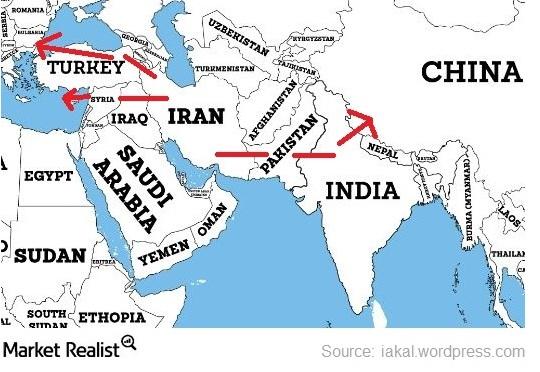

Could Iran Become a Big Gas Supplier to Europe and Asia?

Geographically, Iran is between the Europe and Asia’s gas markets. Iran could be a potential supplier to China (FXI) through Pakistan and India (INDY).

Nord Stream Pipeline: A Russian Gas Pipeline to Europe

The EU (European Union) mainly depends on imports to meet its need for gas. Europe imports a significant amount of gas from Russia.

Iran Could Supply Natural Gas to Europe and Asia

Geographically, Iran is between the European and Asian gas markets. Iran could be a potential supplier to China through Pakistan and India (INDY).

Understanding the Gas Pipeline from Russia to Europe

Europe is a lucrative market for Russian gas manufacturer Gazprom Pao, as it derives more than 50% of its revenue from overseas.

Why Is Indonesia Important as a Net Importer of Oil for OPEC?

Indonesia is looking for a long-term strategic alliance to support the demand of crude oil for its economy. Since 2003, Indonesia has been a net importer of oil.

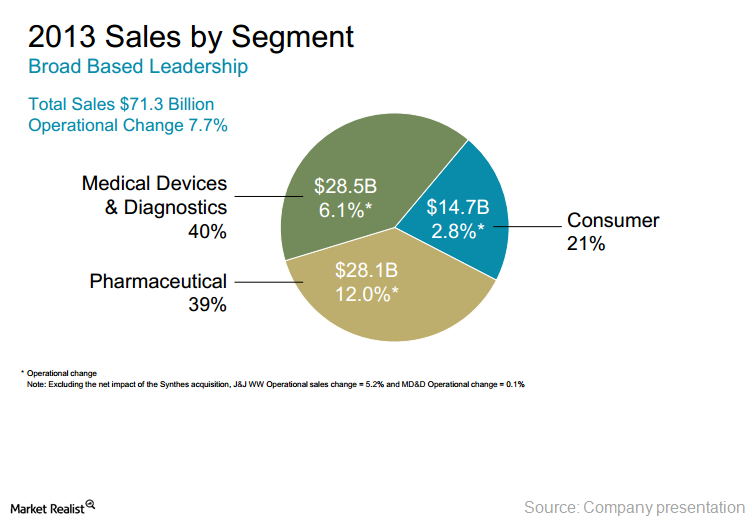

Why George Soros sold his fund’s position in Johnson & Johnson

Soros sold its 1.20% position in Johnson & Johnson (JNJ) last quarter. Johnson & Johnson’s reported 37% increase in adjusted net earnings in 4Q was mainly driven by its pharmaceutical segment.