J&J Snack Foods Corp

Latest J&J Snack Foods Corp News and Updates

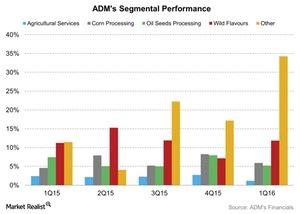

How’s ADM Advancing with Its Portfolio Management Strategy?

As part of its portfolio management strategy, Archer Daniels Midland (ADM) sold its Brazilian sugar cane ethanol operations.

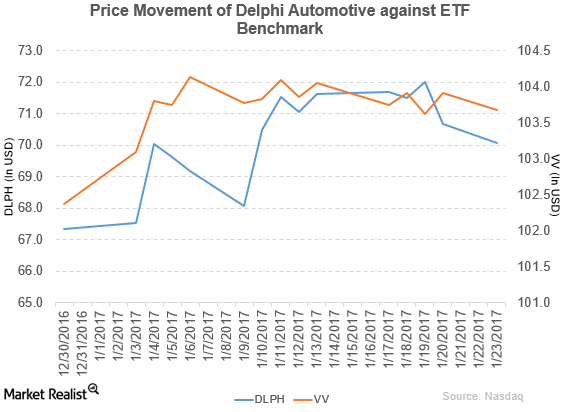

Delphi Automotive Announces New Addition to Its Management Team

Price movement Delphi Automotive (DLPH) has a market cap of $19.3 billion. It fell 0.83% to close at $70.07 per share on January 23, 2017. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -2.2%, 4.2%, and 4.0%, respectively, on the same day. DLPH is trading 0.87% above its 20-day moving average, 2.8% […]

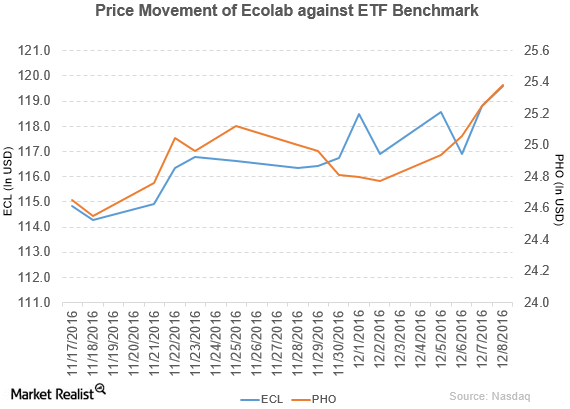

Ecolab Declares a Dividend of $0.37 per Share

Price movement Ecolab (ECL) has a market cap of $35.4 billion. It rose 0.67% to close at $119.61 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.95%, 5.3%, and 5.5%, respectively, on the same day. ECL is trading 3.0% above its 20-day moving average, 2.7% above […]

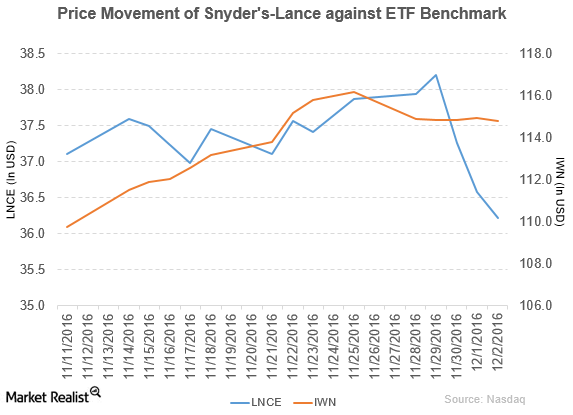

Snyder’s-Lance Plans to Sell Diamond of California

Snyder’s-Lance (LNCE) fell 4.4% to close at $36.22 per share during the fifth week of November 2016.

How Did Snyder’s-Lance Perform in 3Q16?

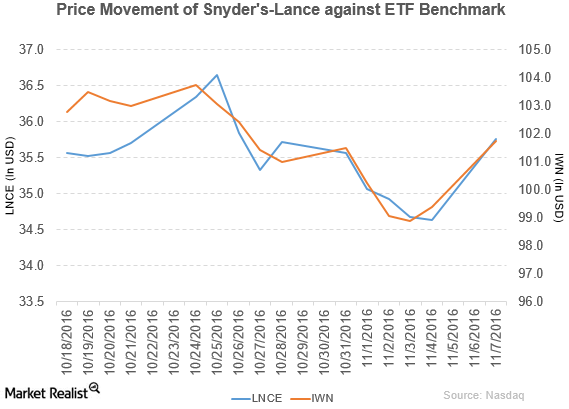

Price movement Snyder’s-Lance (LNCE) has a market cap of $3.5 billion. It rose 3.2% to close at $35.76 per share on November 7, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.53%, 4.4%, and 5.8%, respectively, on the same day. LNCE is trading 1.2% above its 20-day moving average, 3.1% above […]

Snyder’s-Lance Declares Dividend of $0.16 per Share

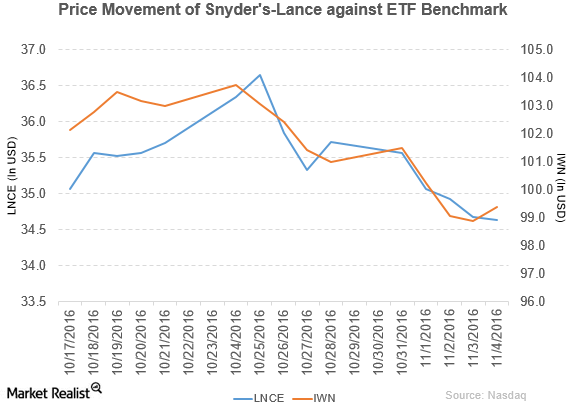

Snyder’s-Lance (LNCE) has a market cap of $3.4 billion. It fell 0.12% to close at $34.64 per share on November 4, 2016.

Snyder’s-Lance Appoints Pease as Executive Vice President

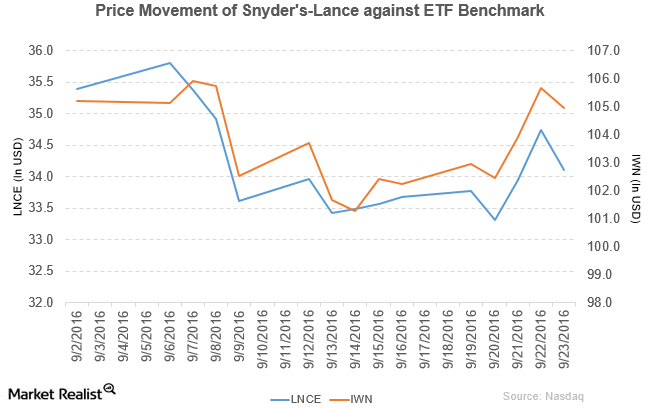

Price movement Snyder’s-Lance (LNCE) has a market cap of $3.3 billion. It fell 1.8% to close at $34.10 per share on September 23, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.3%, -3.3%, and 0.92%, respectively, on the same day. LNCE is trading 1.5% below its 20-day moving average, 1.8% below […]

Snyder’s-Lance Acquired Metcalfe’s Skinny to Expand Its Business

Snyder’s-Lance fell by 1.1% to close at $34.95 per share on September 1, 2016. Its weekly, monthly, and YTD price movements were -2.4%, 2.2%, and 3.4%.

Why Did Snyder’s-Lance Recall Some of Its Products?

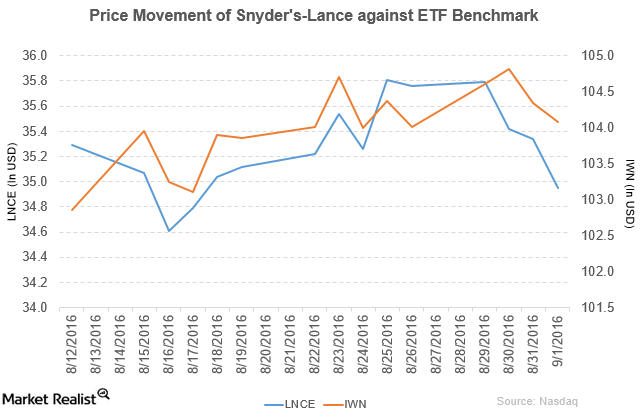

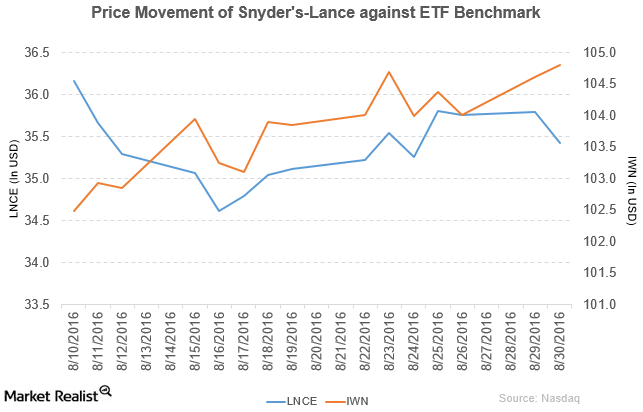

Snyder’s-Lance (LNCE) has a market cap of $3.4 billion. It fell by 1.0% to close at $35.42 per share on August 30, 2016.

Analyzing Snyder’s-Lance Performance in 2Q16

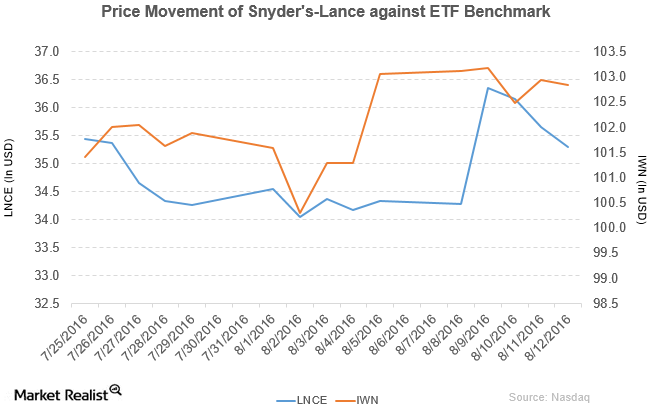

Snyder’s-Lance rose by 2.8% and closed at $35.29 per share during the second week of August 2016. It reported fiscal 2Q16 net revenue of $609.5 million.

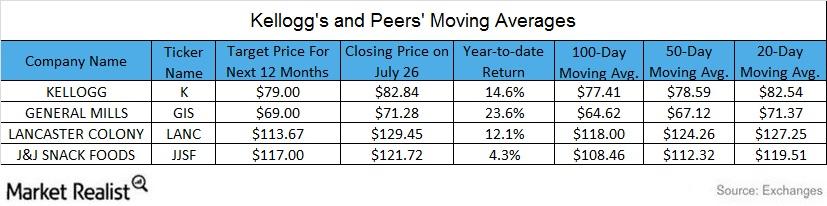

Key Moving Averages: Analyzing Kellogg versus Its Peers

Kellogg closed at $82.84 on July 26. It’s trading 7.0%, 5.4%, and 0.4% above its 100-day, 50-day, and 20-day moving averages. It has appreciated ~15% in 2016.

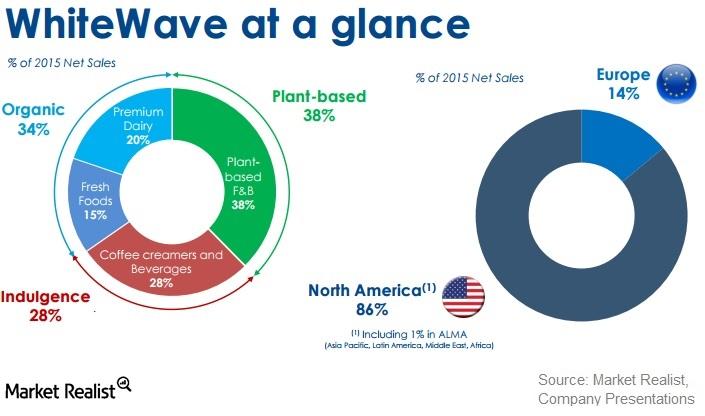

How Can WhiteWave Foods Add to Danone’s Business?

WhiteWave Foods (WWAV) currently generates around 80%–85% of its total revenue and operating profit from North America alone.

Why Did JPMorgan Chase Downgrade WhiteWave Foods?

On July 8, 2016, JPMorgan Chase (JPM) downgraded WhiteWave Foods’ (WWAV) stock to a “neutral” rating from an “overweight” rating.

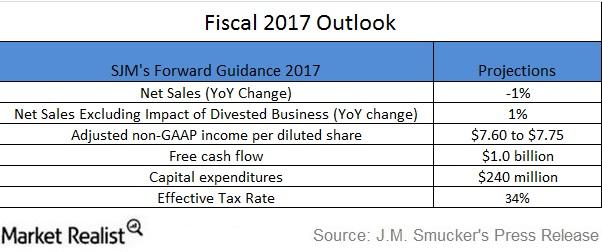

What Are J.M. Smucker’s Expectations for Fiscal 2017?

During its fiscal 4Q16 earnings release and in its investor presentation last week, the J.M. Smucker Company (SJM) discussed its outlook for fiscal 2017.

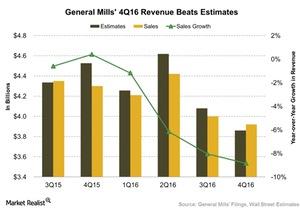

What Drove Down General Mills’ Revenue Growth for Fiscal 4Q16?

General Mills’ (GIS) net sales for fiscal 4Q16 fell 9% year-over-year. However, they beat analysts’ estimates by 2%.

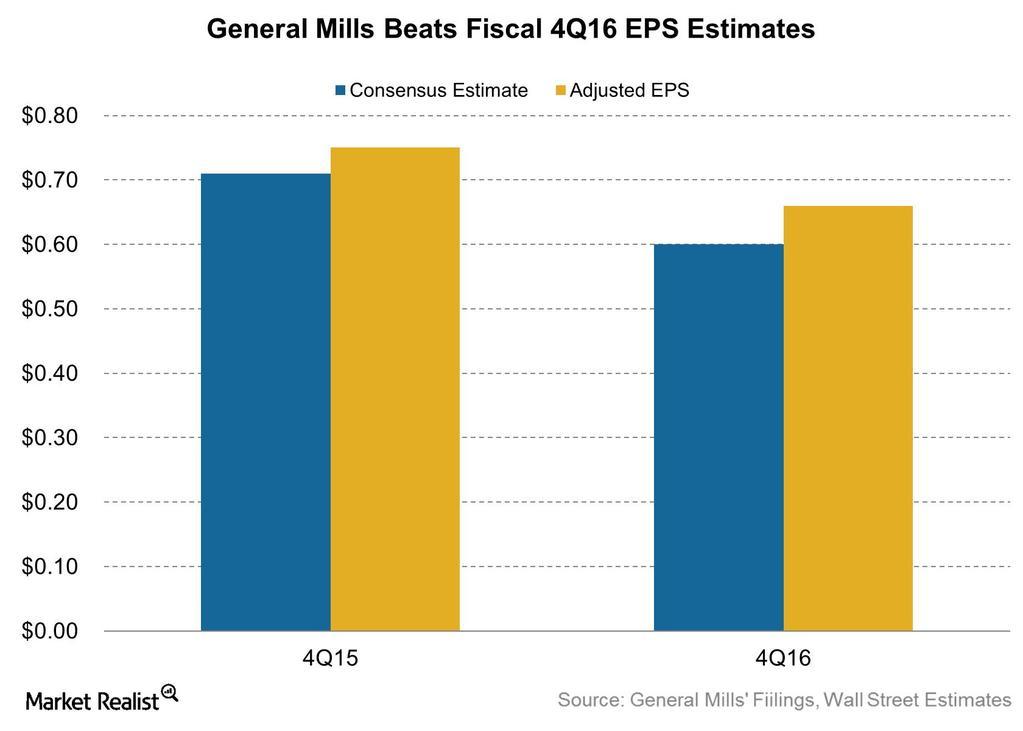

Why Did General Mills’ Earnings Fall in Fiscal 4Q16?

General Mills’ (GIS) fiscal 4Q16 earnings beat estimates by 10%. Adjusted EPS, however, declined 12% compared to fiscal 4Q15.