JA Solar Holdings Co ADR

Latest JA Solar Holdings Co ADR News and Updates

Canadian Solar’s Competitive Advantage

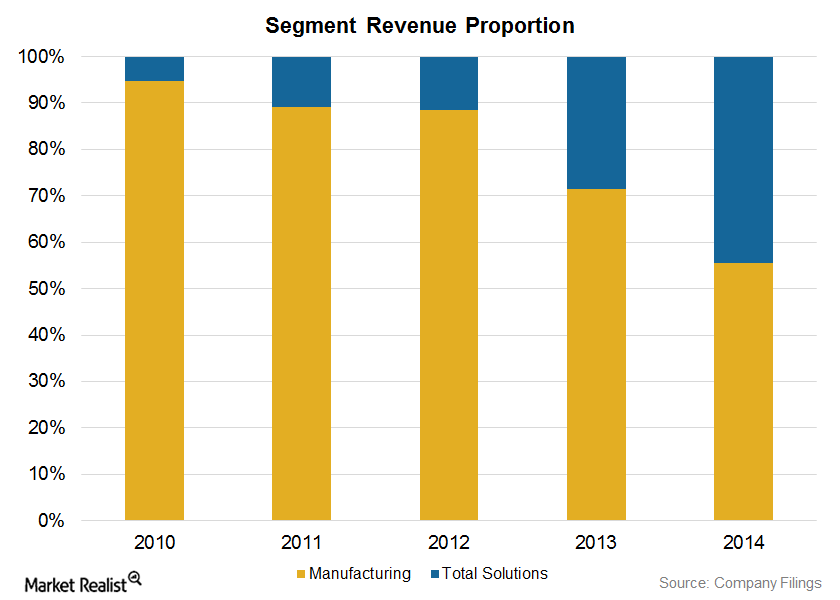

Canadian Solar (CSIQ) derives its competitive advantage from its strategic positioning in the downstream market, its broad range of crystalline silicon solar power products, and its technology.

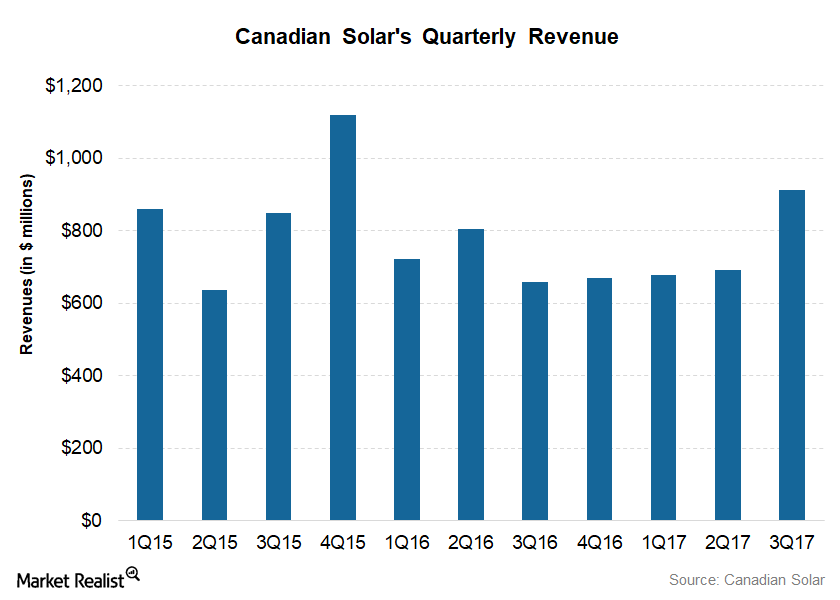

Canadian Solar Beat Analysts’ 3Q17 Revenue Estimates

Canadian Solar’s revenues from the sale of electricity in 3Q17 totaled $9.6 million, which was marginally lower than $9.8 million in 2Q17.

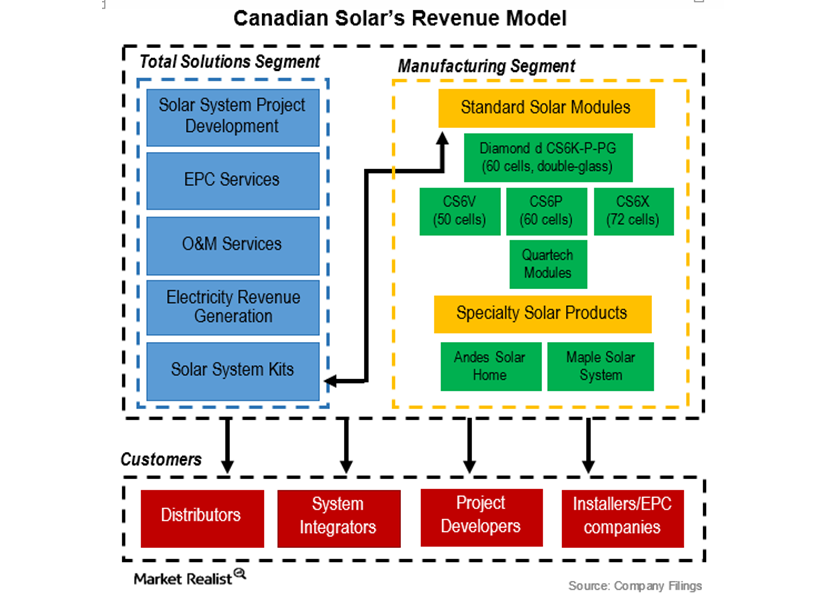

Understanding Canadian Solar’s Business Model

A significant proportion of Canadian Solar’s revenue comes from its top five customers, a structure that’s not uncommon in the industry.

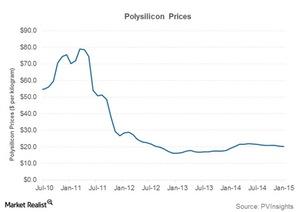

First Solar faces some must-know challenges

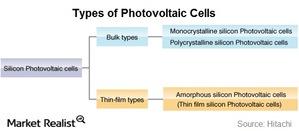

While First Solar has traditionally been manufacturing thin-film CdTe modules, which don’t require polysilicon, their prices have fallen in recent years.

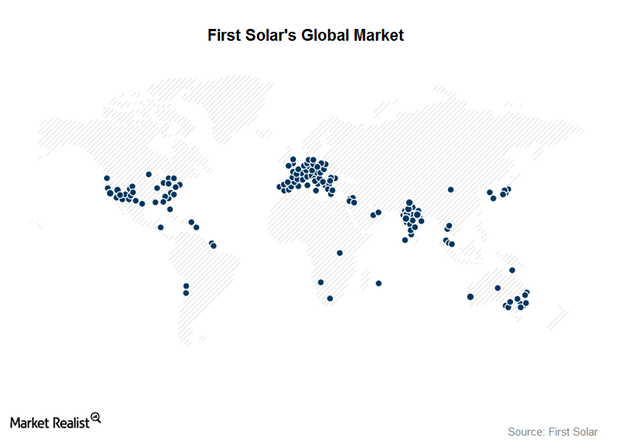

First Solar’s Global Market Strategy

The Americas The US PV (photovoltaic) market made up ~83% ($2.9 billion) of First Solar’s (FSLR) revenue. The United States has typically been First Solar’s largest market, and where many of its prominent projects and customers are located. First Solar has completed the construction of Del Sur, a 26 MW (megawatt) solar project in Honduras. It commenced […]

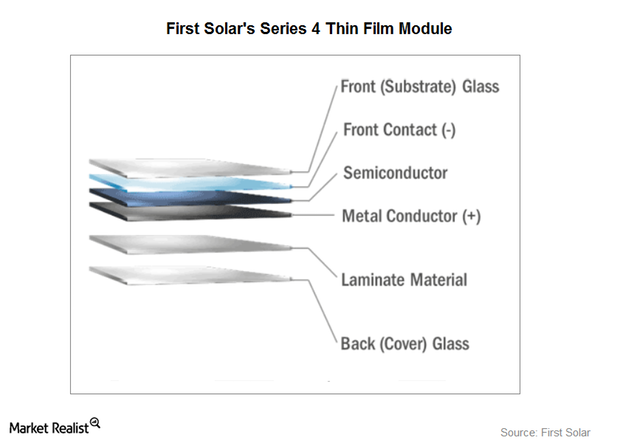

Behind First Solar’s Operations

Operating segments Previously, we looked at First Solar’s (FSLR) history. The photovoltaic module manufacturer operates two business segments: Components and Systems. The Components segment First Solar is a manufacturer of solar (TAN) photovoltaic (or PV) modules. First Solar also designs and sells these modules. They manufacture thin-film PVs, in which the semiconductor material used is […]

SunPower’s Solar Components Business Model: How Does It Work?

SunPower uses solar cells to produce solar panels at its facilities in the Philippines, Mexico, and France. It has a total solar panel capacity of 1.7 GW.