Intuit Inc

Latest Intuit Inc News and Updates

Checks Are in the Mail for $141 Million TurboTax Settlement — Who Qualifies?

Checks are being mailed to taxpayers eligible to receive restitution in a $141 million TurboTax settlement. Are you a possible recipient? Find out!

4.4 Million TurboTax Customers Will Get $141 Million Intuit Settlement

Wronged TurboTax customers across the U.S. may be eligible for a slice of the $141 million Intuit settlement. Intuit will contact eligible customers.

How to Join the Fight Against TurboTax Amid 2022 Lawsuit

The FTC is suing Intuit’s TurboTax. If you were misled by deceptive advertising, you may be able to join the TurboTax lawsuit one way or another.

Intuit Acquires Mailchimp for $12 Billion, Makes Waves in the Industry

The Quickbooks maker Intuit has officially announced that it's acquiring email software Mailchimp. Why is the deal making waves in the industry?

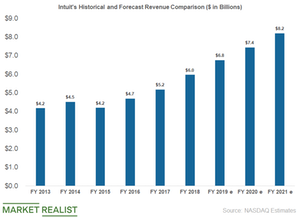

Here Are Intuit’s Key Revenue Drivers

Intuit (INTU) provides several tax-based solutions to enterprises and individuals.

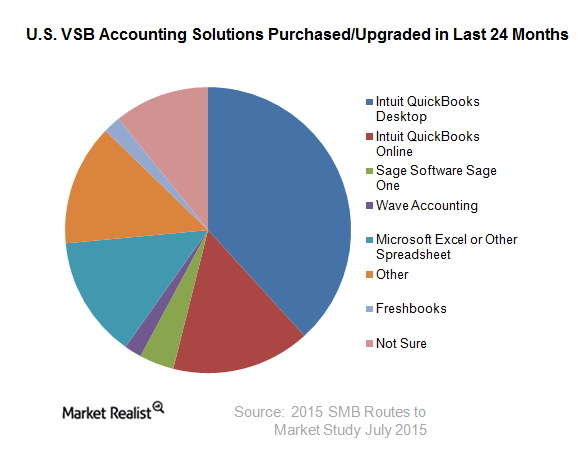

Intuit’s Persistent Focus on Small Business Benefits Investors

Intuit’s tax and accounting software and offerings dominate the very small business (or VSB) accounting market in the United States.

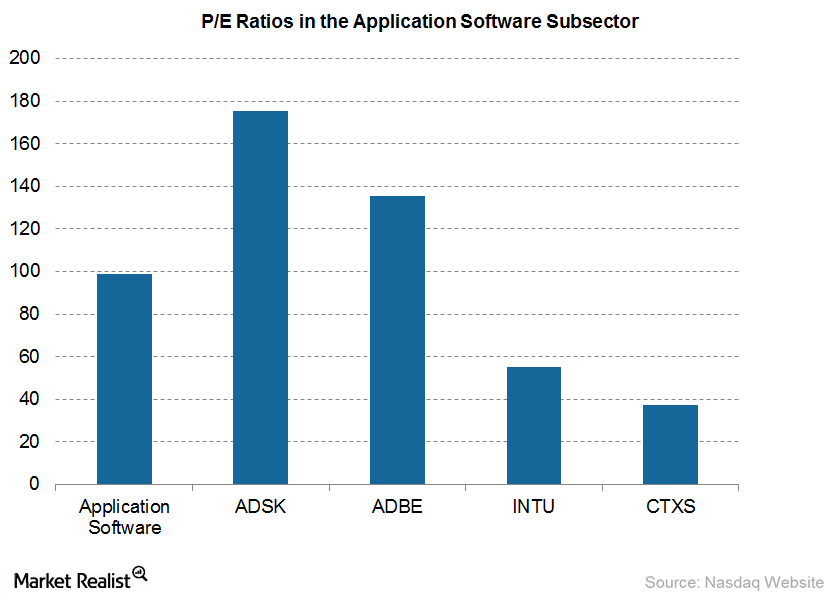

What Does Autodesk’s High Price-to-Earnings Ratio Mean in 2015?

In 4Q15, Autodesk’s subscription business grew 17% to $300 million, beating analysts’ estimates. ADSK’s cloud-based products, Fusion 360 and PLM 360, increased its customer base.

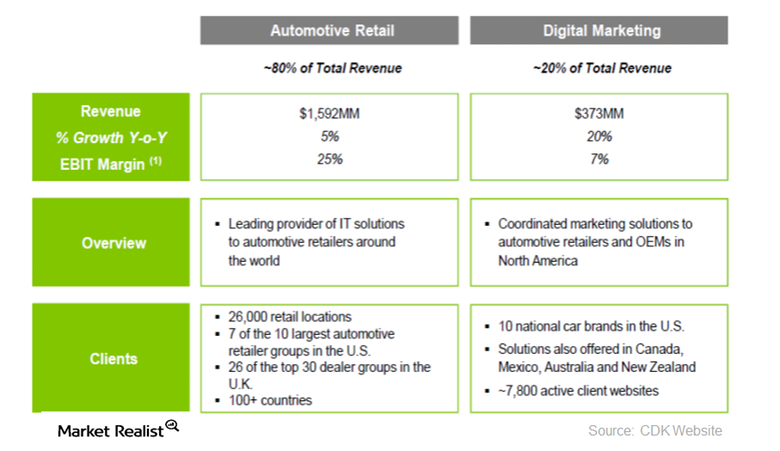

OZ Management Opens New Position in CDK Global

OZ Management commenced a stake in CDK Global Inc. (CDK) by purchasing 4,521,952 shares of the company, representing 0.5% of the fund’s 4Q14 portfolio.