iShares S&P Small-Cap 600 Growth

Latest iShares S&P Small-Cap 600 Growth News and Updates

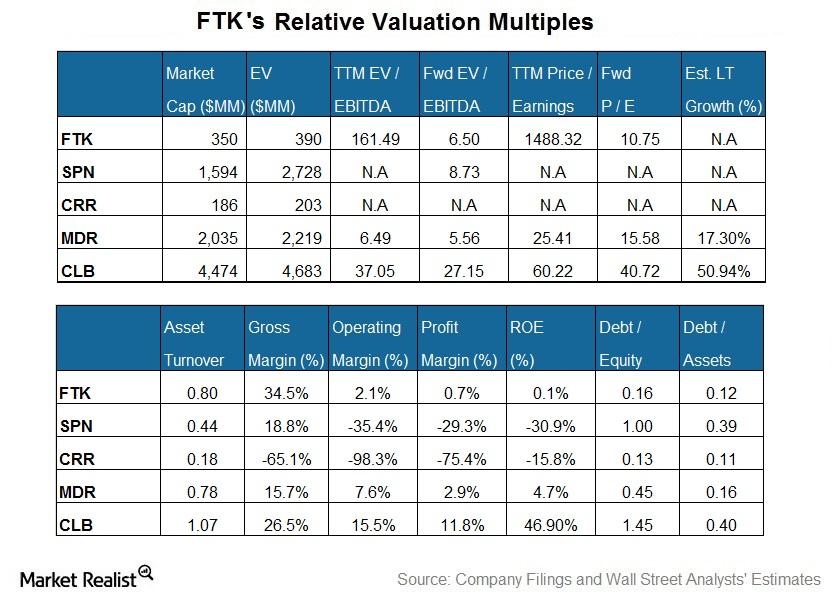

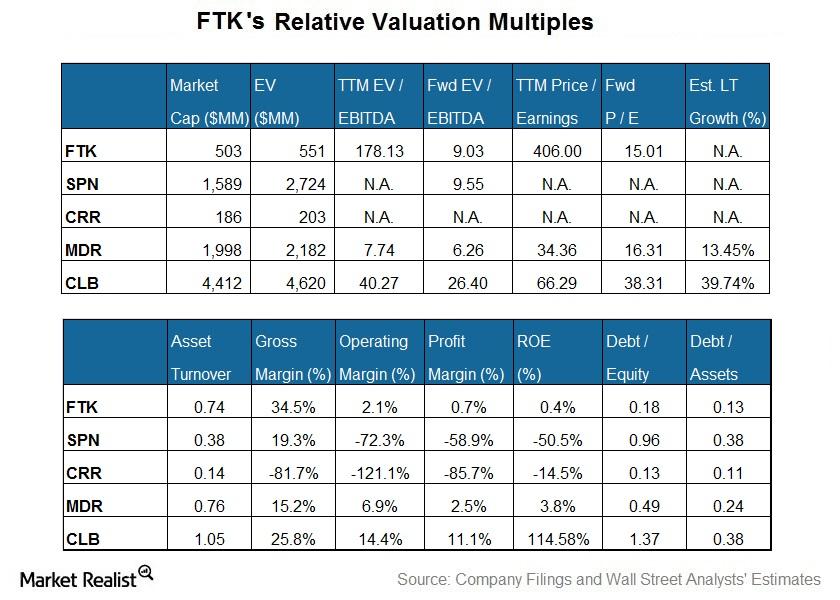

Flotek Industries’ Current Valuation versus Its Peers

Sell-side analysts expect Flotek’s adjusted EBITDA to rise sharper in the next four quarters compared to its peers.

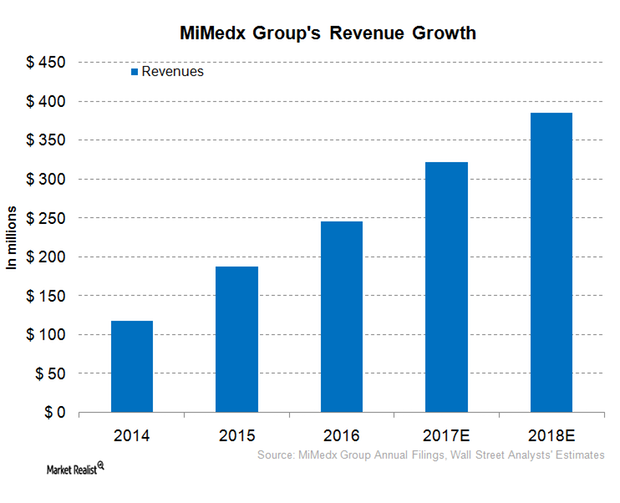

Understanding MiMedx Group’s Zealous Focus on Sales

MiMedx focuses on marketing efforts to increase revenues. The company has at its disposal a sales force of 320 professionals.

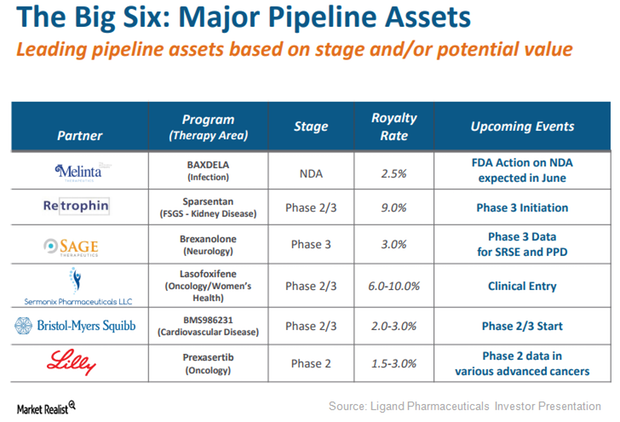

Captisol-Enabled Prexasertib May Be Major Growth Driver for Ligand

Eli Lilly’s (LLY) Captisol-enabled drug Prexasertib is currently being evaluated in multiple oncology indications such as head and neck cancer, small-cell lung cancer (or SCLC), and advanced metastatic cancer.

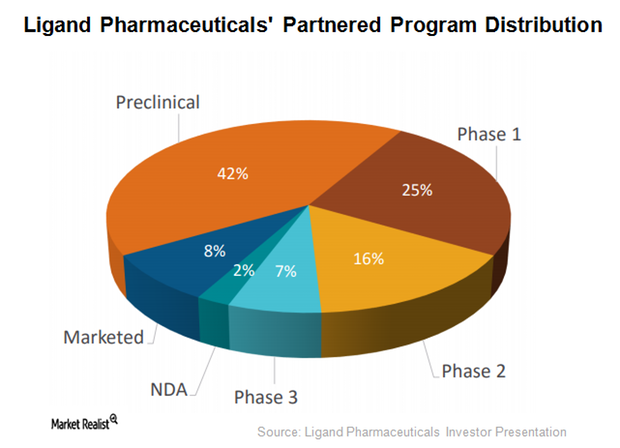

Fully Funded Partnerships May Drive Growth for Ligand Pharmaceuticals

Ligand Pharmaceuticals (LGND) expects its licensees to invest ~$2.0 billion for advancing more than 155 partnered research and development programs in 2017.

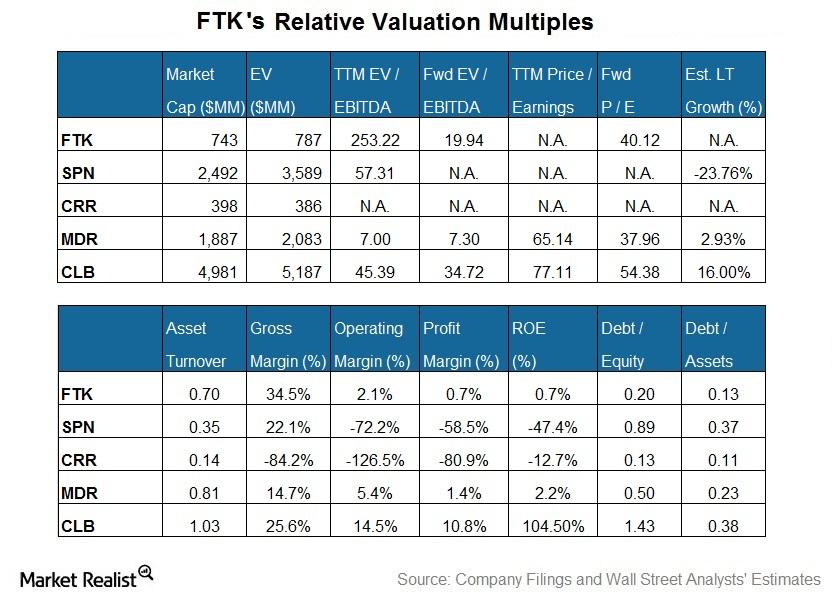

Weighing Flotek’s Current Valuation against Peers

Sell-side analysts expect FTK’s adjusted EBITDA to rise more sharply over the next four quarters than those of its peers.

How Flotek Industries Is Valued versus Peer Stocks

Core Laboratories (CLB) is the largest company by market capitalization among our set of select oilfield services and equipment (or OFS) companies…

Why Are So Many Analysts Rating B&G Foods a ‘Hold’?

Approximately 78% of analysts rate B&G Foods a “hold,” and 22% rate it a “buy.” None of the analysts rate it a “sell.”

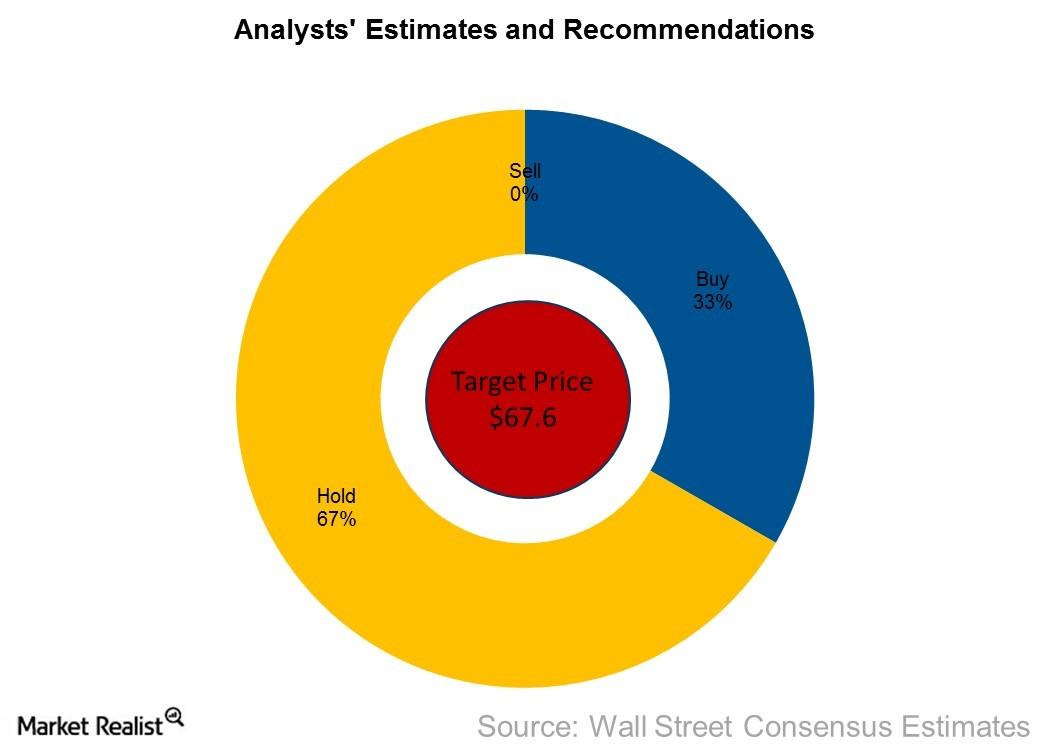

The Word on the Street: How Analysts See Papa John’s

Analysts are maintaining a price target of $67.6 for Papa John’s for the next 12-months, which represents a return potential of 2.5% for the company.

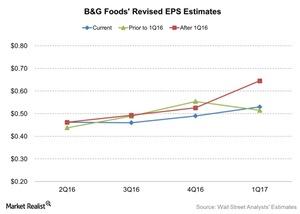

Analysts Have Revised EPS Estimates for B&G Foods: Why?

B&G Foods’ (BGS) earnings estimates have been on an upward trend since its fiscal 1Q16 impressive results. The Green Giant acquisition contributed to the results.

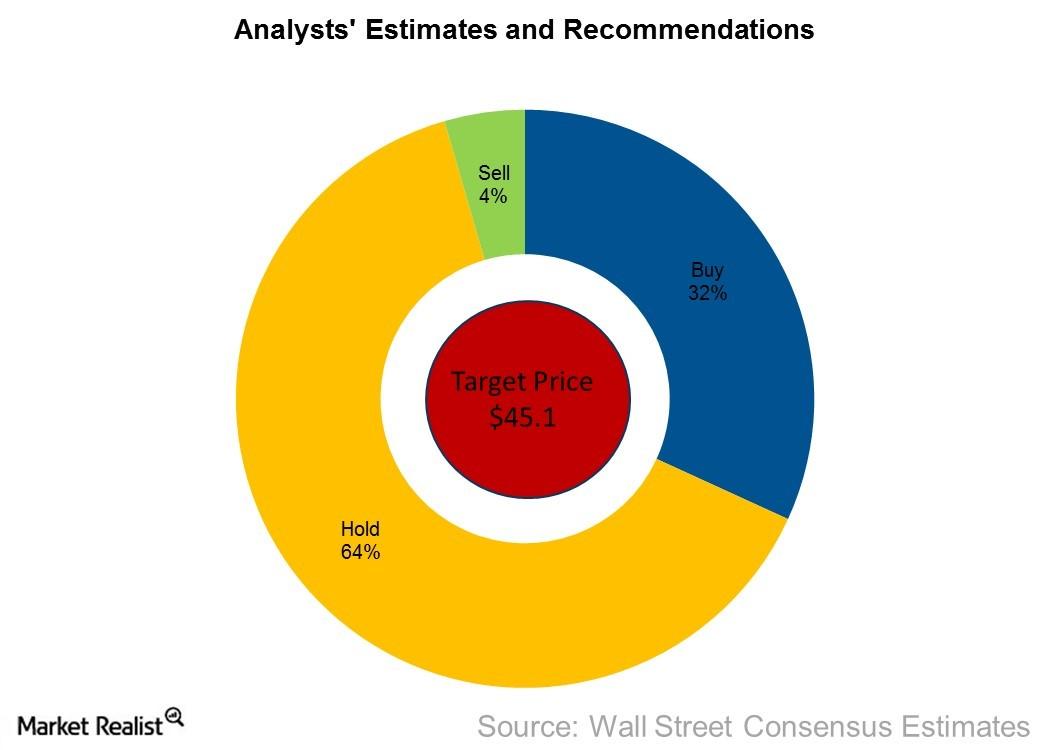

What Do Analysts Recommend for Texas Roadhouse?

The rise in EPS estimates for the next four quarters has prompted analysts to increase their price target for TXRH for the next 12 months to $45.1 from their earlier estimate of $44.8.