Hecla Mining Co

Latest Hecla Mining Co News and Updates

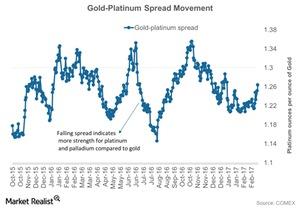

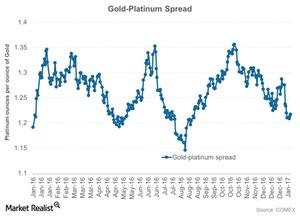

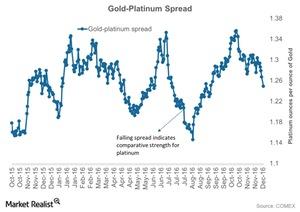

Where’s the Platinum Spread Headed in 2017?

Among the four precious metals, platinum has been the worst-performing precious metal and has seen a year-to-date rise of only 5.8%.

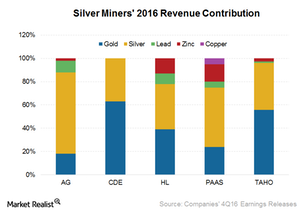

A Look at Silver Miners’ 2016 Commodity Exposure

Commodity exposure In the previous part of this series, we looked at miners’ geographic exposure, which is important to consider due to the geopolitical risks some jurisdictions face. It’s equally important to consider their revenue compositions in terms of commodity exposure. Contribution from silver Silver companies are rarely pure-play miners. For investors considering silver […]

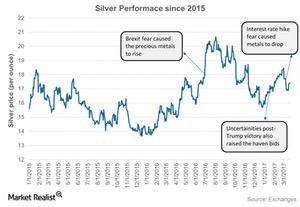

These Factors Have Been Driving Silver Prices

Silver has performed slightly better than gold and platinum on a year-to-date basis.

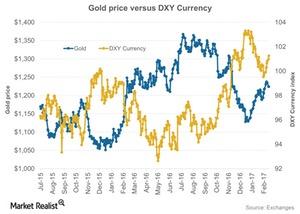

Understanding the Fall in the US Dollar and How Precious Metal Reacted

All four precious metals witnessed a rise in price on Monday, March 20, as the US dollar slipped to its six-week low.

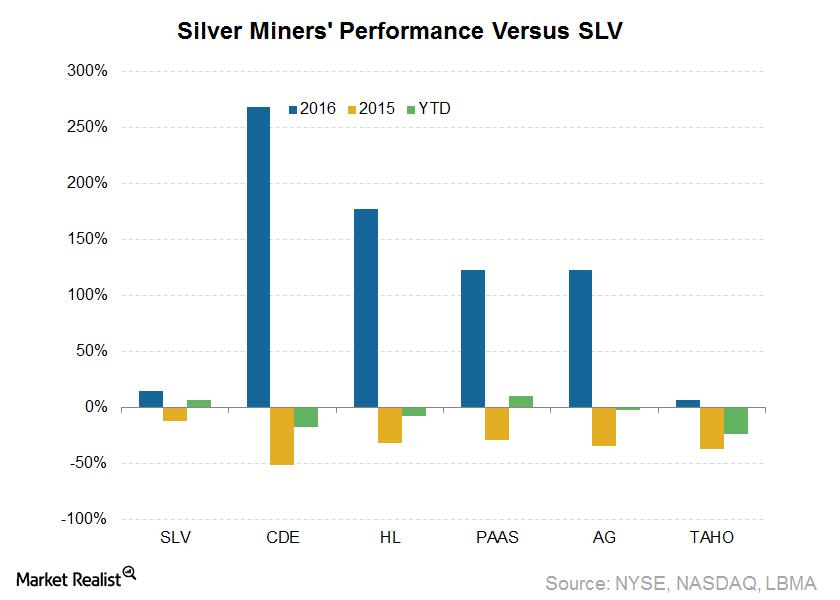

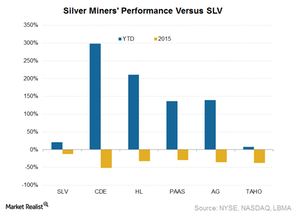

Looking at Silver Miners after the Federal Reserve’s Rate Hike

Silver miners (SIL) are usually a levered play on gold. Notably, silver has outperformed gold year-to-date.

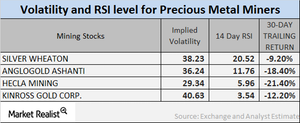

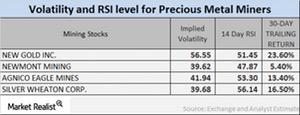

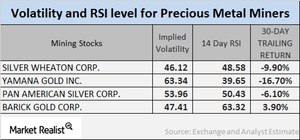

Analyzing Mining Stocks’ Volatility

As of March 15, the volatilities of Silver Wheaton, AngloGold Ashanti, Hecla Mining, and Kinross Gold were 38.2%, 36.2%, 29.3%, and 40.6%, respectively.

Where the Gold-Platinum Spread Is Headed

Platinum is known for its use in jewelry and as an autocatalyst for diesel-based automobile engines. The demand has been very fragile over the past few years.

How the Gold-Platinum Spread Could Move More

The demand for platinum has been very fragile over the past few years, affected by the reduced market forecast for sales of diesel-based vehicles.

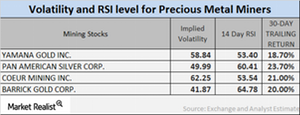

Analyzing the Volatility of Miners in February 2017

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option.

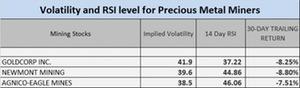

Reading the Volatility Numbers for Mining Stocks

It’s important to monitor the implied volatilities and RSI levels of large mining stocks, particularly in the wake of the changes in precious metal prices.

Analyzing the Gold-Platinum Ratio in 2017

The gold-platinum spread was ~1.2 on January 11, 2017. Platinum’s RSI (relative strength index) was 38.

Analyzing Silver’s January Technicals

Among the other precious metals trading on the COMEX, silver shares for March expiration maintained an almost flat end to the day on January 11, 2017.

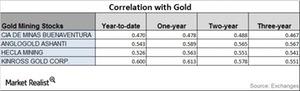

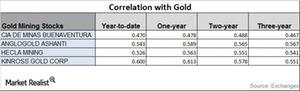

Analyzing Mining Stocks’ Correlation in 2016

Mining companies that have high correlations with gold include Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Reading the Correlation of the Mining Stocks

Mining stocks and gold Although precious metals were doing well at the beginning of 2016, it’s important to know which mining stocks overperformed and underperformed precious metals. Precious metal prices have been falling since Donald Trump won the US presidential election on November 8, 2016. As a result, mining stocks have also been falling. Mining […]

What’s in Store for Silver Miners after the Fed’s Rate Hike?

Silver miners have shown a significant correlation to gold prices, at 0.84 from the start of 2013 to December 14, 2016.

Which Mining Stocks Have Highest Correlation to Gold?

Mining companies that have high correlations with gold include Cia de Minas Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

What Do Mining Stocks’ Technicals Indicate?

Many of the fluctuations in precious metals have been a result of speculation about the Federal Reserve’s interest rate stance.

Rising Volatility Continues to Affect Miners’ Stocks

The precious metals price correction that happened on September 2, 2016, extended to September 6. How did equities and funds respond?

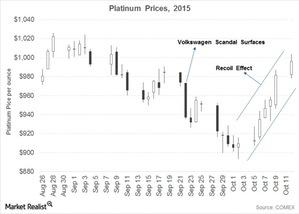

Analyzing the Coiled Spring Effect in Platinum Prices

After the VW scandal, platinum prices jumped to an almost two-week high, again entering the $1,000 territory after hitting a low of $893.4 on October 2.

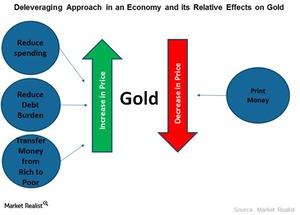

Reviewing an Economy and Its Effect on Gold Prices

Deleveraging can affect gold and other bullion prices, as well as exchange-traded funds such as the iShares Gold Trust ETF (IAU) and the iShares Silver Trust ETF (SLV).

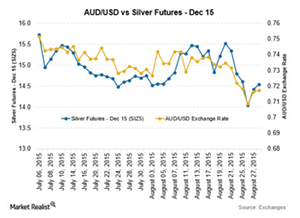

Silver Prices Show Positive Correlation with the Australian Dollar

Drop in silver prices among other precious metals With global commodity and metal prices falling in the volatile month of August, silver has been no exception. The economic slowdown in China has been slowing the demand across various commodities. Precious metals like gold and silver have been under pressure. The strength in the US dollar […]

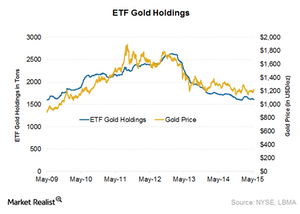

Gold ETF Holdings Fall to 4-Month Low Led by the SPDR Gold Trust

Gold ETF holdings reached a peak of 1,679.8 tons on February 24. In January and early February, gold holdings surged because of the Swiss National Bank’s decision to remove the euro cap.