SSgA SPDR S&P Global Natural Resources ETF

Latest SSgA SPDR S&P Global Natural Resources ETF News and Updates

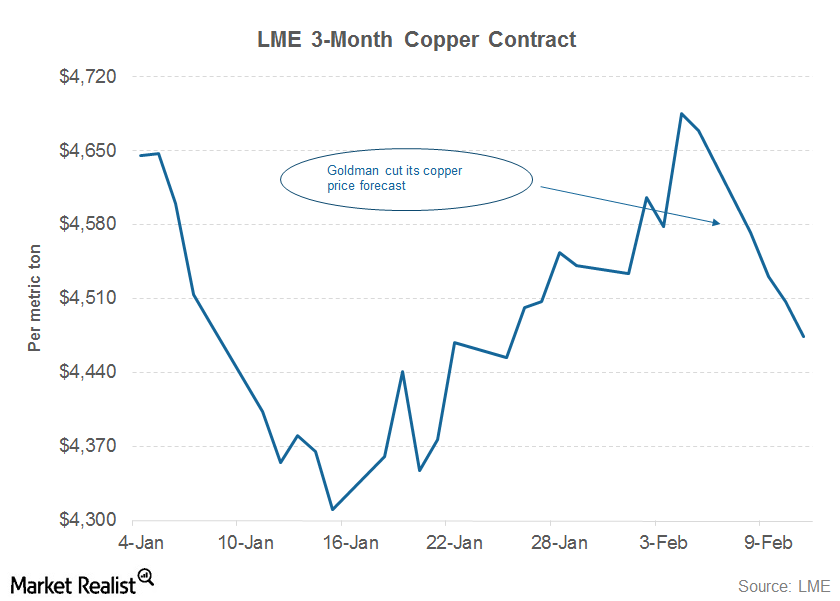

Must Know: Goldman Provided Fodder to Copper Bears

Goldman Sachs (GS) now expects copper prices to fall to $4,000 per metric ton this year. In its previous guidance, Goldman had expected copper to fall to $4,500 per metric ton in 2016.

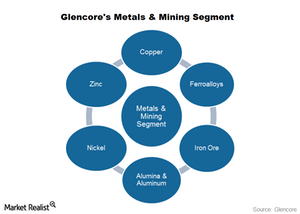

Understanding Glencore’s Metals and Mining Business

Glencore’s metals and mining segment was the second-biggest contributor to its 1H15 revenues.

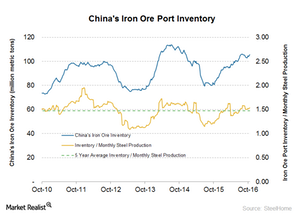

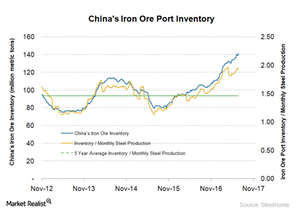

How Price Impacts Iron Ore Inventory

China’s (MCHI) iron ore port inventory is a key indicator that reflects the commodity’s supply-and-demand balance.

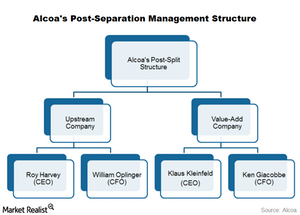

Will Elliott Management Start Taking an Active Interest in Alcoa?

Elliott Management plans to engage in a “constructive dialogue” with Alcoa’s board about Alcoa’s split transaction and “additional available opportunities to maximize shareholder value.”

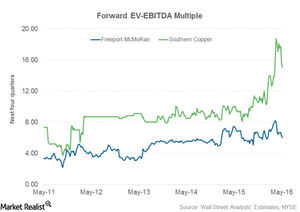

Why Southern Copper Is Trading at a Premium to Freeport-McMoRan

Southern Copper has historically traded at a premium to Freeport.

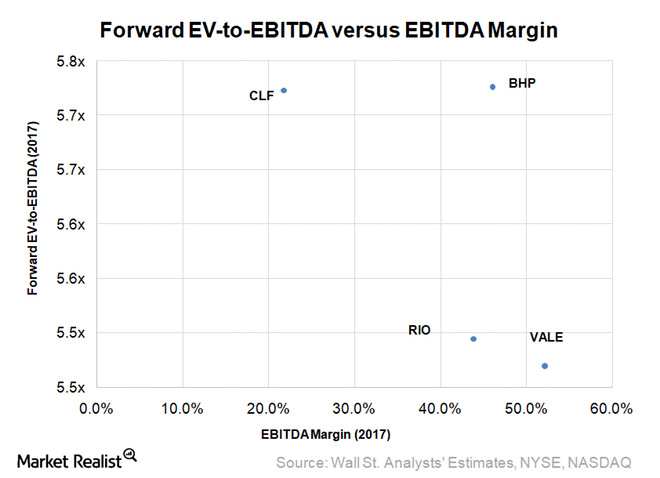

Does Vale Deserve a Rerating of Its Valuation Multiple?

Vale’s CFO (chief financial officer) Luciano Siani Pires said during Vale Day on December 6, 2017, that the company deserves a rerating of its valuation.

China’s Ever-Rising Iron Ore Port Inventory

It’s important for investors to keep tabs on iron ore port inventories in China. Inventory levels show the balance between demand and supply for iron ore.

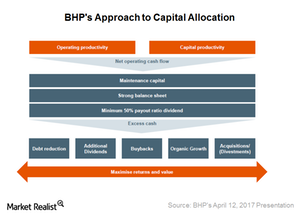

Cyclical Nature of BHP’s Business and Mechanistic Share Buybacks

The third element of Elliott Funds’ “value unlock” plan for BHP Billiton (BHP) (BBL) is the adoption of a policy of consistent and optimized capital returns to shareholders.

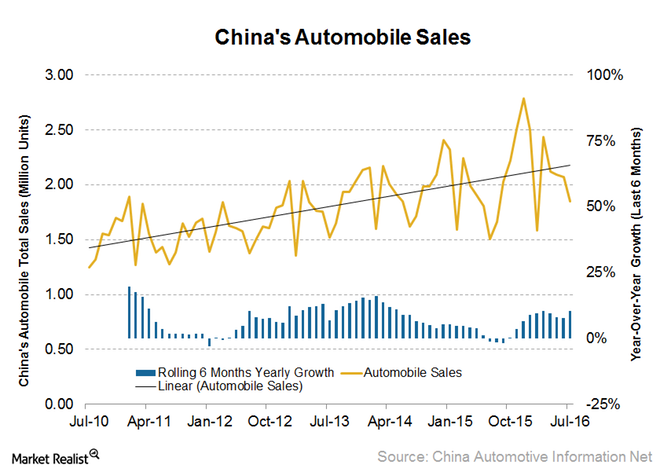

The Outlook for China’s Automobile Sales and Why It Matters

China’s passenger car sales rose 26% year-over-year in August. This is the fourth consecutive month that car sales have risen in the double digits.

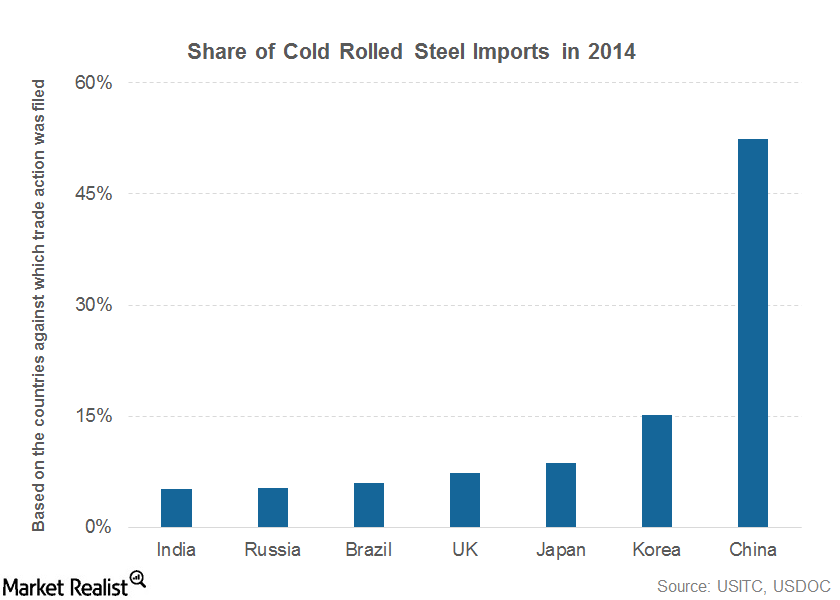

What’s Driving the Record Spread Between HRC and CRC Prices?

US Spot hot rolled coil prices have risen in the ballpark of $200 per short ton in 2016. Spot cold rolled coil prices have risen by ~$300 per short ton.

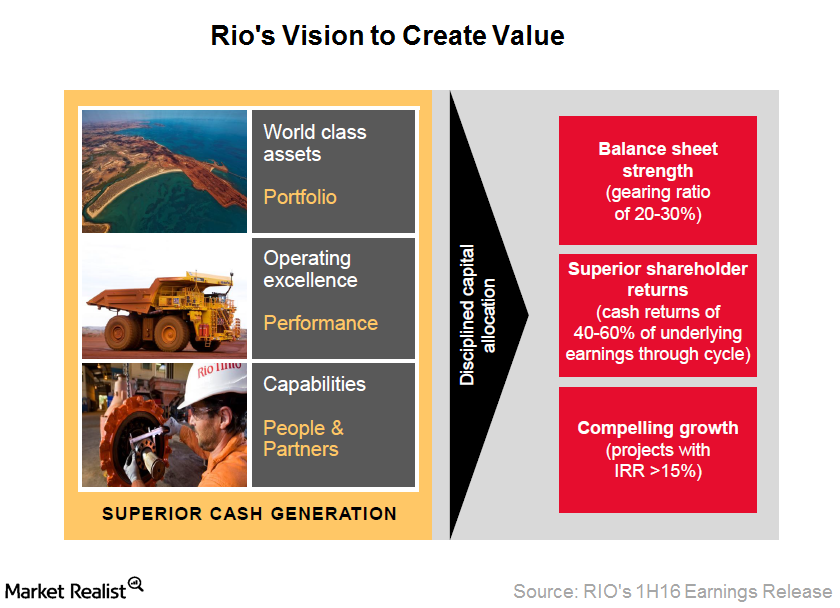

Rio Tinto’s Earnings during 1H16 Were Driven by This

Rio Tinto reported its 1H16 results on August 3, 2016. Its underlying earnings came in at $1.6 billion, 7% ahead of consensus expectations of $1.5 billion.

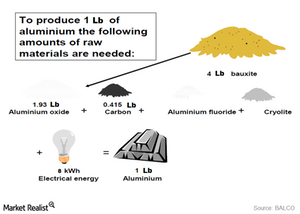

Why Are Alumina Prices a Key Driver for Aluminum Companies?

It can take almost two pounds of alumina to produce one pound of aluminum. Naturally, changes in alumina prices would impact aluminum’s production cost.

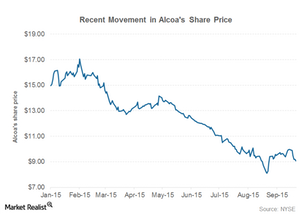

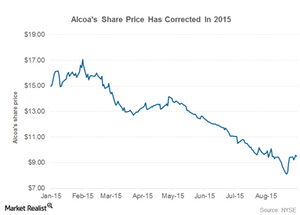

Why Alcoa Did the Obvious and Is Splitting Its Value-Add Business

On September 28, Alcoa (AA) announced that it would split into two independent companies. The transaction is expected to be completed in the second half of 2016.

A Comparative Analysis of the Aluminum Industry

Aluminum is the second most widely used metal after steel. Investors have a special liking for aluminum. There are several ways to play the industry.